The global equity markets continue to fret over “the taper” and whether growth is robust enough for the US and thus the global economy to cope without QE. The big test starts now with the post-Thanksgiving US consumer spending spree. With new iPads, iPhones and Xboxes to tempt the public out of their self-imposed frugality, central bankers are hoping that this Christmas will be a good one and generate enough growth for them to safely “taper”.

The major news of the month came out of China where the ruling Communist party finished its Third Plenum. Since then information has slowly been released of the important changes that were agreed. The most significant is the intention to float the Yuan rather than peg it to the Dollar. This simple statement made without a timeframe has major implications for the future of the global economy, the direction of bond prices, currencies and thus interest rates.

This has not been widely reported as nothing will happen in the short term. In the long term though, this could be the beginning of a process that sees China assume its long planned position as the number one global economy.

China

investors. For UK funds the majority of Chinese share deals pass through the Hong Kong stock exchange into various special

classes of shares structured for western investment.

This means that the indices are often not truly representative of what is happening in the economy. These charts show the Blue Line, the Shanghai Composite (mainly local investment only) and the Hang Seng index from pure capitalist Hong Kong. Whilst the Hong Kong market has shown steady growth since the crash of 2008/9 the Shanghai index has fallen back from its initial recovery as Chinese authorities deliberately slowed the economy down.

Why is China important? It is because this is where the majority of the world’s current and future growth is coming from. The enormous potential of this country can be seen when we compare it’s GDP per head of population to the USA. America generates $49,794 per person each year; China despite all of its recent growth produces only $6,078. What is staggering is that this level is a third of Greece’s at $22,035. Future growth is though dependent on the State rolling back its control.

The new leadership has just finished the 3rd Plenum of the Communist Party, although the communiqué released right away was vague, the decision set new courses and proposed fairly specific changes for a number of big reform areas. The following are a number of points on economic reform that are encouragingly specific.

State-owned enterprises will pay 30% of their dividend to a Social Security Fund by 2020. All investors will be allowed to enter any industry other than those on the “negative list”. This is being tested in the (radical for China) Shanghai free trade zone. If this zone proves to be successful it will be rolled out across the country and would be true Chinese capitalism. Additionally, state price controls are to be further liberalised and extended to include transportation and telecommunication.

Rural land for non-agriculture uses that is owned by farmers will be allowed to enter the land market at same prices as state-owned land. This move will undermine the local governments’ monopoly over land markets and boost farmers’ income. Private investors will be able set up banks. Appraisal of local governments’ performance will focus more on aspects other than GDP, such as pollution, excess capacity and debt. Fiscal spending will decouple from fiscal revenue or GDP, and fiscal deficit will be assessed over economic cycles.

In addition, the one-child policy will be relaxed. The Plenum did not provide any time frame other than “achieving major breakthroughs in all major reform areas by 2020”. But the announcement with the greatest significance came after the Plenum. The intention is now to free float the Yuan on the currency markets, thus ending the artificial peg against the US Dollar.

The long term implications of this statement could be very significant. China has had to buy record amounts of US Treasury Bonds to keep the peg

in place; will they now sell, thus forcing up US interest rates? Will Chinese capital be free to invest around the world and if so, will they snap up bargain western companies for their patents and intellectual property? All this is not imminent but it is a fascinating long term investment theme with unpredictable consequences for global equity and bond markets.

Funding for Lending Scheme

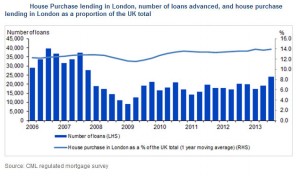

This is not the government’s Help to Buy programme which remains in place for now. One of the strange things is whilst there is much talk of

a London housing boom, the actual figures from the Council of Mortgage Lenders show that whilst lending in London has picked up it is still way below 2006 and 2007 levels.

So perhaps this is less about the housing market and more about the lack of funding for small businesses and the unsavoury bank practices identified in the Tomlinson Report for Business Secretary Vince Cable? The money under the FLS is now being redirected to small businesses.

Black Friday

Black Friday is a US term for the big shopping day after Thanksgiving; interestingly Back Friday offers now seem to have arrived on the UK High St. The next Fed meeting is on the 17th/18th December and the question is will they start the “Taper”, much will depend on the US consumer and how busy the 29th November was for the US shopping malls?

Expectations were low and it would appear that whilst the number of shoppers over the four-day Thanksgiving weekend rose, they were reluctant to buy, with total spending down nearly 3% from a year ago, according to the US National Retail Federation. This has dampened expectations that the US consumer will rescue the US economy and allow the Fed to ease back on QE. Much will now depend on November’s unemployment data. If there has not been a meaningful decline in unemployment and a pick-up in hiring then the Taper is likely to be delayed yet again.

Markets

December usually sees the Santa Claus rally, as volumes drop and derivatives contracts are closed down for the New Year; equities normally enjoy an easy ride upwards. The trigger is usually the last Options and Futures expiry day, this year it is a little later than normal on the 20th December.

Unfortunately, this virtually coincides with the last FOMC meeting of the year. It is at this meeting that markets, are at the moment, fully expecting the tapering of QE3 to be announced. Potentially this could mean we might have a particularly volatile few days but hopefully not ruin Santa’s traditional end of year market fun. The cycle continues to progress, if it follows the average exactly then June 2014 should be the turning point; however, the last 3 cycles have averaged 7 and half years which would take us beyond 2016.

The reality may lie somewhere between the two dates, as the next Presidential election comes into play in 2015. The Democrats will certainly not want a recession before then. Valuations remain supportive of markets and interest rates in the US and UK show little sign of rising as yet, indeed in Europe rates have started to fall.

The Central Banks are walking a fine line between stimulating growth and worrying about future inflation. The ending of the Funding for Lending Scheme in the UK shows how quickly Central Banks can start to panic about rising property prices and inflationary pressures. Nevertheless the lack of consumer spending in the US over Thanksgiving weekend and the number of pre-Christmas sales in the UK does suggest that neither economy is strong enough to cope without QE just yet. 30th November 2013

Click Here for Printable Version