Click Here for Printable Version

So far in 2022 markets have been hit by a triple “whammy” of the war in Ukraine, Covid in China and the US Federal Reserve Bank dramatically changing the direction of US monetary policy.

The common factor between all these major events is the impact on inflation, usually it automatically follows that if we have higher inflation then interest rates have to rise and as central banks aren’t very good at timing they raise interest rates too far and too fast and thus create a recession.

Company profits tend to fall in a recession and thus, as share prices are valued according to company earnings, if these fall then so must share prices.

So the big question for markets is whether this potentially difficult combination of rising inflation and interest rates will tip the global economy into recession?

At present it remains a possibility, not a probability, but there are just too many factors in play to make any sort of prediction. There was though some positive news in May.

Also both traders and investors looking at the percentage falls in many of the indices, knowing they will never catch the bottom, are starting to feed money in selectively.

“Triple Whammy” Update

1.)

China Covid: New infections have fallen dramatically and this has allowed the Chinese authorities to ease the lock-downs in Beijing, Shanghai and Shenzhen.

Regular testing remains compulsory, nevertheless this is a major step forward. Anecdotally, not a single new car was sold in Shanghai during May.

China is now embarking on a huge monetary stimulus programme, just as the rest of the world slams the brakes on. There were fears that these lock downs would further restrict the supply of crucial components to the western economies. However, given the continuing logjam of container ships in ports, especially on the west coast of the USA, it is difficult to judge whether these recent measures added any more delays.

What did become clear from US retailer earnings reports in May is that the likes of Walmart actually have too much stock. They have over-ordered, anticipating a strong US consumer they have been blindsided by the war in Ukraine and ensuing gasoline price rise.

US consumers seem again to have gone on strike, just as they did during Trump’s trade tariff period, if prices rise they just stop buying.

So the passing of this lockdown in China is potentially a major positive.

Investors would be happier though if this was after a mass inoculation programme using western vaccines, it does the leave the possibility open for new lock-downs. The Chinese consumer has been hit hard and the ruling party will have to spend heavily to reach its new (more realistic) growth targets.

For the rest of the world that is good news.

2.)

The Federal Reserve Bank: What the Fed says and does will be the key to the immediate direction of markets.

Here nothing has changed in the rhetoric or the strategy. This is to remove the exceptional Covid stimulus as quickly as possible and get back to “normal” i.e. interest rates and inflation around the 2.5%ish level.

In May it became clear from bond prices that markets think that this task might be priced-in, at least for now.

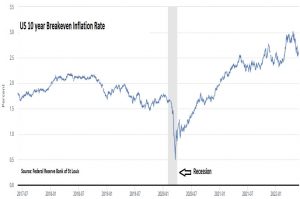

This first chart is the crucial one. It is the market’s expected rate of inflation for the next 10 years and known as the Breakeven Rate. It has recently fallen back to 2.7% which is now almost unbelievably virtually unchanged since over a year ago and before the Fed spooked markets in January.

Source: Federal Reserve Bank of St Louis Source: Freestockcharts.com

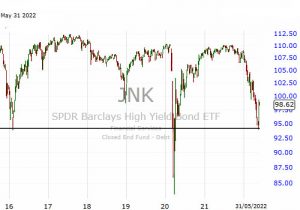

The second chart shows the Junk Bond Exchange Traded Fund (high yielding, low credit quality corporate bonds). These bonds are the highest risk as they are the most likely to default during a recession. The recent rally in response to the fall in breakeven yields is interesting.

Whilst It is very early days, the fact that investors are so far back buying is encouraging.

Whether this is a permanent change in trend will depend on the economic data and the Fed’s response.

3.)

Ukraine: As this sad conflict continues the major economic fear i.e. Germany’s gas being cut off is seeming to ease, at least for now. The EU did announce a partial, future ban on the importing of Russian oil. This in practice is little more than a PR exercise.

It still allows oil from Azerbaijan and Armenia to be pumped through Russian pipelines. The difference in grades means that this has to be mixed with some Russian oil in order to flow properly.

So when is Russian oil actually Russian?

Banking sanctions on payment for oil and gas and Russian bond coupons do seem to be legally circumvented, which does remove the immediate risk of both a Russian bond default and gas embargoes.

But it is nearly summer, demand for gas is low, there is excess supply of oil and gas, but the risk does remain of a sudden cut off as well as a Russian debt default and markets have to factor this into pricing.

Portfolio Roadmap

Given all the negative press surrounding inflation and the now usual forecast of an impending recession it is important to revisit where we are on the portfolio Roadmap. This takes a typical Balanced Asset Allocation but uses unit trust sector averages to give an indication of typical historic returns and volatility.

Over time this shows a consistent average return which has been constant since data records began.

But over the short term returns can be “bumpy”. As this chart shows over the past 20 years we have had two market crashes (Blue Circles) and a number of significant corrections (Red Circles). The Black line smooths out the volatile day to day performance.

The shaded areas show when the Roadmap dips below this moving average. Generally, when it does so, it doesn’t stay there for long before the uptrend reasserts itself.

We are below the trend now and of a magnitude and length of time that is in line with a “normal” correction. Could this deteriorate into a full blown crash?

Well of course yes it could, but based on the current news-flow and valuations the probability of that should be low.

However, we are dealing with three big unpredictable factors at present, each or any one of which could easily tip the markets one way or another.

Markets

The bond and currency markets are presently indicating that inflation has peaked. Much will now depend on the economic data, whilst inflation statistics themselves suggest the rate is elevated, the bond markets have taken support from slowing US consumer spending and disappointing sales figures from big US retailers such as Walmart, Target and even Amazon.

This suggests that consumers are reacting to higher energy prices and thus slowing down the economy, therefore the Fed might not need to push rates much higher than the 2.5-3.0% level already priced in by the bond markets.

Clearly, these markets are very susceptible to the data announcements and will move accordingly.

It will take a while yet for a complete picture to emerge but the equity markets will take their cue from the bonds for now.

Given the time of year, some in the media will quote the “sell in May” adage but given the magnitude of the falls so far, particularly in the high growth technology sectors where some stocks are down over 50% plus, (notwithstanding the carnage in cryptocurrencies) they are probably too late.

If the data does continue to suggest that the US is slowing (and thus the Fed can moderate its current very aggressive stance); if China can avoid a further Omicron outbreak and Germany keeps taking Russian gas, rightly or wrongly, then markets have a reasonable chance of avoiding further downside and can start to resume the uptrend. June 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.