Click Here for Printable Version

The fundamental frailties of the European structure came into focus again during May. In Italy two parties, neither of which are from mainstream Italian politics, are trying to form a government which was initially blocked by the Italian President.

This triggered a fear that Italy might be going head to head with Brussels and raised the spectre of an “Italexit”.

As a major euro member, if Italy does ultimately leave, then there will be severe consequences for the European and thus the British banking system.

Whilst this counts at present as a possibility rather than a probability markets have to price in this risk.

The major impact was seen in Italian Government Bonds, the euro and in European banking shares.

Elsewhere, Trump and trade were the dominant market news stories. There is a poker game under way and Trump is playing tough, however, he needs a deal(s) as the US mid-term elections are imminent.

Italy

Two parties in Italy, 5 Star and The League together won a majority vote in the recent General Election.

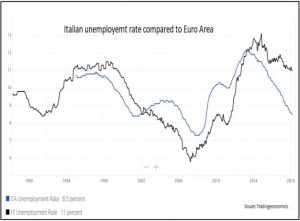

Italy has not benefited from the recent European economic recovery and is now the front line for immigration.

Surveys have shown that Italy is even more Eurosceptic than the UK was ahead of the Brexit referendum.

So the risk of a vote on EU membership, either as another General Election or a referendum is very high.

Italian politics are always complicated and difficult to read. The post Mussolini constitution has many checks and balances built in that makes a formal withdrawal much more politically difficult than say in the UK.

So a formal departure should in theory be very difficult. However, if it does happen then the financial consequences would be particularly severe.

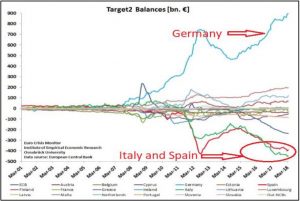

Target 2 is a Eurozone wide system that clears cross-border bank transfers.

The problem is that the system is heavily distorted with Germany massively in credit whilst Spain and worryingly Italy are each in deficit.

It could be argued that this is just “imaginary money”, but if Italy fails to pay and therefore defaults, that is 475 billion euros that will disappear from the monetary system.

Banks across Europe would run out of cash and we are into another Credit Crunch/Depression.

If we can remember back to all of the concern about “Grexit”, then in comparison Greece’s line barely shows up on this chart.

An aggressive anti-EU Italian government would have real bargaining power over Brussels at a time when Merkel has been weakened politically and Macron is trying without much success to start reforms. So far we have the beginnings of an anti-EU government but predicting Italian politics is far worse than trying to do so in the UK.

So as we have said above, this is all a possibility and not yet a probability. But markets don’t like uncertainty and if Italy does make a wrong move the consequences could be severe.

Brexit and Politics

Progress towards a post-Brexit trade deal is progressing; the issue we continue to see is political rather than economic.

There is one date that matters, 5th May 2022 the next UK General Election. The EU has perfected the fine art of “kicking the can down the road”i.e. not making a decision until you really have to and if you delay long enough the problem usually goes away.

Whilst May has lost a series of votes, especially in the House of Lords, nothing has really changed.

Her problem is the hard core Brexiteers in her own Cabinet who are itching to mount a leadership challenge but would be stupid to do it just yet. Let her do all the hard work with Brussels, wait until there is deal on the table and then make your move.

For the markets that is all just fine. But then again Theresa May could also quit after losing another vote; markets would be unprepared for that.

Oil and Inflation

This chart, which shows Texas Sweet Oil and not Brent which is about $10 higher, displays the dramatic recovery from the $30 lows.

This has been good for the oil companies’ profits. They are still a huge part of the indices, especially in the UK and this helps boost earnings and thus lower valuations.

But there will be consequences. Markets are looking for the end of the cycle, this comes when inflation accelerates.

So far the numbers show no such acceleration, but there is a time lag to the data. Oil will drive this, it is now all about by how much inflation will rise rather than whether it will come or not.

Trade Wars

Trump continues to deal with the delicate balance of international trade as if it were a Manhattan real estate deal.

He goes in hard and then gradually gives back (as he has done with Chinese phone manufacturer ZTE).

But he has a strong hand; the US has trade deficits with China, Europa and Canada/Mexico.

He doesn’t want to end trade, he just wants better terms. However, he is short of time, he needs some wins ahead of the US mid-term elections and the next Presidential vote is only 18 months away.

China’s time horizons are in decades not years and can afford to wait, it is Europe that has the real problem.

The US trade deficit to Europe is much greater than to China. The US tariffs on European steel etc. have been met with possible targeted responses on US products such as Harley Davidson motorcycles and Bourbon.

This eclectic list shows how weak the European position is. As ever with Trump the media are looking in the wrong direction, the trade dispute with China is all about China 2025 and who leads the global economyinto the 4th Industrial Revolution.

Markets

Helped by oil, markets held up reasonably well in May, US investments were boosted by a strong dollar as a 3% yield from US 10 year Treasuries was simply too good for traders to turn down.

There are few signs of “sell in May” as yet.

Valuations remain reasonable at 16.8 times earnings and profit growth exceptional at 21%. However, markets are sensing that the cycle is getting very long in the tooth and are looking for the turn.

This is always difficult to predict.

The last stage of the cycle as we have said before is often very profitable for investors and distorted by politics.

We do have a target date; the US Presidential elections ARE due in November 2020.

Trump, if he can survive that long, will want a booming US economy at all costs. The price will come in 2021 and 2022 when the Fed will have to cool it down.

It is Europe though where the short term problem may come from.

Italy and possibly Spain need to be indulged by Brussels, which neither the rules nor an increasingly insular Germany will allow.

If Italy starts to cause problems then the ECB, which still has negative interest rates and QE, has a massive problem.

It has no weapons available to deal with another European recession.

However, it is always dangerous to be overly pessimistic about the EU, they are experts in survival.

At present though it does appear to face an increasingly long list of structural issues when its true leader,

Angela Merkel has just been politically weakened.

Markets for now will be focussed not just on the soap opera of Trump’s trade poker game with China and Europe but by a new poker game between Brussels and Italy, Spain, Poland, Hungary as well as Brexit.

But as we enter the period of seasonal weakness, investors, so far at least seem happy to buy every dip.

May 2018

Click Here for Printable Version