Click Here for Printable Version

Whilst it is not apparent from the indices, the Trump Rally is starting to come under pressure.

Budget tax cuts have yet to arrive and are unlikely to be the blockbuster promised in the Presidential Election campaign. In the meantime higher US interest rates are impacting on the US housing market albeit in a relatively small way so far.

Trump remains lucky that US company profits continue to grow nicely.

In the UK the snap General Election campaign does not appearto be going as planned.

The Conservatives seem to have forgotten that voters vote with their wallets and promising to take your house away to pay for care was never likely to be a vote winning policy.

Labour meanwhile is offering everything to everyone, to be paid for later. For apolitical markets a Labour win or coalition would mean significantly higher market interest rates.

One Belt One Road

Whilst the media’s attention has been on Trump, they missed the beginnings of a major shift in global power.

As the US steps back from the global stage and Europe is beset with in-fighting and punishing the UK for wanting to leave the party early, China quietly launched the “One Belt One Road” project with 29 other countries.

One Belt, One Road has two parts to it, the belt and the road, and it’s a little confusing.

The belt is a physical tarmac road, which starts in China and ends in Scandinavia.

What the Chinese are calling the road is actually the maritime Silk Road, in other words, shipping lanes, essentially from Shanghai to symbolically Marco Polo’s Venice.

Therefore it is a very ambitious integrated trade route covering about 65 percent of the world’s population, about one-third of the world’s GDP, and about a quarter of all the goods and services the world moves.

China is also backing this initiative with hard cash.

PwC predicts that the One Belt One Road initiative will receive up to US$1 trillion of overseas state financing from China over the next 10 years.

The Chinese have created several vehicles to help allocate this money to appropriate projects and initiatives.

These include the establishment of a New Silk Road Fund, and the Asian Infrastructure Investment Bank as well as direct investment from its foreign exchange reserves and several of its largest state-owned banks.

China always takes the long view and sees America’s Trump-inspired retrenchment as an opportunity to continue its progress to being the Global Superpower.

The world order continues to change.

Oil

All have benefitted from the recovery in the price of crude oil as the Saudis have reversed their “chasing market share” policy and cut production.

They persuaded OPEC and Russia to follow suit and the price has held around the $50 per barrel level.

But with the US shale oil producers seemingly able to raise and cut production at will OPEC’s ability to control the markets is diminishing.

Their hope is that when existing wells run dry the current lack of exploration and development will restrict supply and boost the price. The danger for OPEC is that reduced supply merely matches reduced demand as purchases of hybrid and electric vehicles accelerate.

Car Loans

The consumer in both the UK and USA is not back to full spending power except where cars are concerned.

Cheap Auto Loans in the US and Contract Hire/PCP schemes in the UK have enabled car owners to get new vehicles and yet magically, in some circumstances, reduce their monthly outgoings.

Loans to 107million US citizens now total $1.2trillion.

No-one is quite sure how all these loans will be paid back, particularly if a glut of second hand cars leads to a fall in residual values? As interest rates rise US banks are starting to pull back from this enormous market.

Ford / Tesla

The Ford Motor Company under Henry Ford was the initiator of the mass adoption of petrol cars. Has Bill Ford, Henry’s great-grandson, just rung the bell that the days of the private motor vehicle are coming to an end?

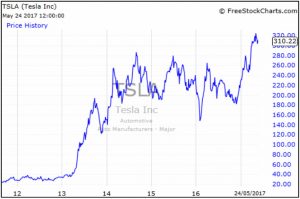

Despite being very profitable, Ford’s share price has struggled when loss-making Tesla’s has surged ahead.

The Ford family has taken steps to address this and Chief Exec Mark Fields has been “retired” and replaced by Jim Hacket who tellingly ran the new technology based Smart Mobility division. Ford seems to have looked into the future and seen that the market may be about to change radically for car manufacturers.

As think-tank RethinkX highlighted in a recent report, they project a dramatic drop in the cost of transportation, coming from on-demand autonomous electric vehicles owned by large fleets and not individuals.

“As vehicles in this new model are driven continuously and are owned by fleets, cost savings will become paramount. the private ownership model, you don’t really care about the lifetime miles of a vehicle, you’re not going to own it for it’s lifetime. You’re more concerned about it’s residual value, but when we move to a transport-as-a-service model, the service life of a vehicle becomes critical. This is where electric vehicles will begin to take over.”

Electric cars have fewer moving parts, will be cheaper to operate and are likely to have a service life of around 500,000 miles.

This has huge financial implications for the global economy. Car brands will die, manufacturing plants will close and the consumer infrastructure that surrounds the car from dealers to the RAC/AA and insurance industry will suffer, all rely on consumers buying and running cars.

Then again, on what will consumers spend the huge financial savings they will make?

Markets

June normally sees the start of the summer market doldrums, however there is still lots going on.

The Trump saga continues and markets in particular want to see tax cuts and soon. In the meantime, if US economic data deteriorates then the market’s patience will soon wear thin.

Here in the UK what was supposed to be an easy Conservative general election campaign is proving to be far more difficult than expected.

A weak Conservative Manifesto has been challenged by a very left-wing Labour one.

As ever, the international biased FTSE 100 will be impacted only by currency moves, it will be the Gilt market where any election shocks will be seen.

Essentially, greater government debt means higher interest rates and the greater the size of the debt the higher the rates must be. That will have a knock-on effect on the currency and the economy.

A possible Labour victory or SNP coalition would make the markets nervous.

Conversely, an increased May majority would be well received by markets that are only concerned with economics and corporate profits.

Globally, company profits continue to be healthy and that means valuations remain reasonable. Also the probability is still high that US tax cuts will eventually happen and overseas corporate cash will be repatriated and reinvested.

So there remains the potential for a big uplift in these already growing company profits.

But politics can get in the way; Trump’s enemies, including those in his own party, may place a higher priority on getting rid of him than on an economy boosting Budget.

Market fundamentals remain healthy, but the political risks just seem to be getting greater as each month passes.

May 2017

Click Here for Printable Version