As May passes, the market’s attention turns to the impending Brexit Referendum. Clearly it would not be right for us to express a view on either course of action but given the importance of this vote we thought we should devote this edition of Market View to the consequences or otherwise if the UK voters answers yes to the following question?

“Should the United Kingdom remain a member of the European Union or leave the European Union?”

According to the remain camp a failure to say yes would reportedly lead to a long term recession, permanent austerity, a collapse of trade, an ending of foreign investment into the UK, another Scottish independence vote, and a collapse of the NHS as well as allegedly Russian tanks thundering through the Channel tunnel.

Clearly there has to be a grain of truth in some of these various statements (collectively dubbed “Project Fear”) but you don’t need to be a Nobel Prize winner to realise that some of these pronouncements might just be a bit farfetched!

On top of all these statements we seem to have the great and the good around the world including Obama, the IMF, OECD, various business leaders, actors even the Pope all seeming to support the UK staying in the EU.

How likely is a Yes Vote?

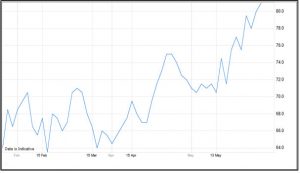

Source: IG Index

This chart from Financial Bookie IG Index shows that it would cost, for a £1 stake, £82.50 in order to win £100 assuming a Yes vote wins.

This has moved up from a low of £64.

The odds are heavily in favour of a Remain win. This is important as it reflects the view of the financial markets; it is what is priced in. So the markets remain sanguine. Conversely, a sudden late surge to the Out camp would be a shock and have a heavy impact on global markets

What would be the economic consequences of a Brexit?

If we just concentrate on the financial impact then we know what the initial saving would be i.e. about £8.4bn per annum, (cost less rebate) or just over 1% of total government spending.

But what financial benefit do we currently get for this cost?

Should be a simple answer to this question but there isn’t.

Why? It’s a free market, who knows what a component’s cost is and where it comes from within the EU, no borders means no records.

Likewise a Chinese import arrives in Rotterdam pays import duty on arrival, gets put on a truck to the UK, is it still Chinese or is it now Dutch?

The recent furor over the tax paid by Starbucks and Google also showed how clever companies are in defining in what country the profit is actually made.

There are many more examples of the complexity of calculating what the true benefit to the UK membership of the EU brings, but the real answer is no-one actually knows. What are the forecasts?

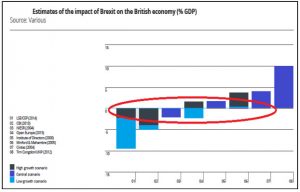

Source: Woodford/Capital Economics

There are and will be more, all will be guesswork and will be ultimately dependent on what happens not in Europe but in the USA and China.

If we discount the extreme numbers and take the central scenarios, as highlighted by the red ring, the collective impact could be summed up as negative, but not by much.

It all depends on what form an exit takes place.

Whilst there is a simple Yes/No vote, a No vote actually has potentially two outcomes.

Either leave the EU but stay as part of either the EFTA/EEA like Norway and Switzerland or alternatively leave completely.

If we vote to leave, but manage within the 2 year exit timeframe (as provided for by EU articles) to negotiate a Swiss or Norwegian style deal what would be the benefit compared to staying in? Anatole Kaletsky, the highly regarded former FT journalist and economist now at Gavekal of Hong Kong, makes the point that “Norway and Switzerland must abide by all EU single markets standards and regulations without any say to their formulation.

They agree to translate all relevant laws into their domestic legislation without consulting domestic voters.

They contribute substantially to the EU budget, and they must accept unlimited EU immigration, resulting in a higher share of EU immigrants that in the UK.”

So to leave the government structure of the EU and get a ratified (if possible) trade agreement as part of the EEA or EFTA appears to offer no economic or political gain to the UK.

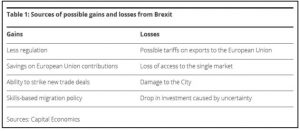

Meanwhile, Roger Bootle of Capital Economics argues that leaving altogether and paying the EU import duties might be better.

On average these are only 3% to 4%, (though for cars 10%, nearly 30% for confectionary and over 50% for dairy products!).

Such costs would be similar to normal currency moves and the UK could drop tariffs altogether for non EU imports, thus generating a huge boost in trade.

Such a boom would not happen overnight but he argues would lead to greater long term growth and wealth, than if we stayed in.

Banks

The one sector, just like in the Scottish referendum, that would lose is the banks. London is home to a large international banks benefitting from “passporting rights” into the EU, the Swiss notably.

Many would leave overnight, probably to Dublin.

Ireland would be a major beneficiary of a Brexit, many companies, not just banks, would transfer HQs to benefit from EU status as well as lower Corporation Tax rates.

The loss of tax revenue to the UK could be significant. But the City will cope, it always does, the Euro was supposed to kill London, it didn’t; light touch regulation would help, especially as the EU moves towards a Banking Union.

What would happen to the EU if Britain Left?

As the Greek crisis continues to show, unraveling the Euro is very difficult, if nearly impossible. It has also shown that “ever closer union” is the most realistic way forward for Europe.

A Federal style single currency and Central Bank but without tax raising or bond issuing powers makes no long term sense. Britain would never be likely to sign up for such an arrangement and so would always be skulking at the edge of the party.

Only Sweden and Denmark are current non-Euro, net payers-in that might have an issue with “every closer union”. For the key Eurogroup members the exit of the UK would be the removal of a significant impediment to greater integration.

Summary

Before the vote all anyone can say is that there are currently significant financial benefits to the UK for being in the EU as it is structured now.

What these amount to and whether they will remain in the future, no-one honestly knows.

So as Mohamed El-Erian, of Allianz, argues, because the consequences of leaving are highly uncertain, Britons’ “most pragmatic choice would be to remain in the EU, at least for now, thereby preserving the option of changing their collective mind later, should new information warrant it.”

That is certainly a logical conclusion, the UK is very unlikely to agree to any form of European Super State and it is at this point a negotiation to leave (i.e. with some leverage) might be more financial productive?

Ultimately though, there is a significant risk this referendum may end up as nothing to do with either Brexit or even

the EU.

For some years the biggest concern for the UK electorate, according to the polls, has been immigration regardless of political bias.

Politicians regard the topic as toxic and avoid it. This is the first opportunity for the UK to voice its collective opinion on immigration without party or constituency constraints. If that happens, and we get an OUT result, then we get the dreaded uncertainty. The key test, again as always, is what impact will Brexit have on the profits of the multinational companies we invest in?

May 2016

Click Here for Printable Version