As May passes and we enter a period of difficult seasonality for markets, they appear to be becalmed.

They are waiting for the U.S Federal Reserve to begin normalising interest rates; for the Greeks to either commit to austerity or short term financial

suicide and now for the UK to decide whether it wishes to be European or not.

In addition markets are trying to work out exactly what is going on in China?

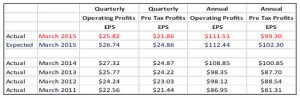

We need to keep talking about US Corporate earnings, and we make no apologies for this as company profits are the ultimate key to markets, recent updated numbers are a bit disconcerting. But as ever in investment nothing is clear, faced with all this uncertainty markets in May decided to do nothing.

Greece

After years of prevarication the Greek debt crisis seems to be finally getting close to some sort of conclusion. During June there are repayments due to the IMF in a series of tranches totalling about e2.5bn and then in July a sizeable payment needs to be made to

ECB of approx. a further e4.0bn.

The government of Greece does not have enough cash and tax revenue to make both these payments and pay government salaries, pensions and social security.

The Greeks are saying they will pay their public first and default on the debt, unless of course there are changes in the lending terms imposed on them by the ECB/IMF or more accurately the Germans.

The Greek Prime Minister is playing the ultimate game of poker. His hand is though very weak as the markets seem to have worked out that the majority of Greek debt is held by Greek Banks, the IMF and the ECB.

So if they do default it shouldn’t cause a systemic risk to the European banking system. This is because apparently European banks have and should have been shedding any Greek government assets whilst they could during this saga.

So if the Greeks do default will it cause a “Lehman moment” (when the Fed allowed Lehman Brothers Investment Bank to collapse triggering a domino effect in financial institutions around the world)? It probably won’t and given the length of time the Greek crisis has been taking it would be unforgivable on the global financial regulators if it did. But we do need to be aware that the market might have it wrong.

Corporate Results

We have updated the numbers shown in the last newsletter, these showed that with 3/4 of the results in profits were better than expected, however, with all the numbers now in, the picture has turned out to be quite different. Far from being better than expected the actual numbers have been worse and show a quarter on quarter decline, which is not good news.

Drilling down into the numbers there were a number of macro factors, firstly the extreme weather conditions in the US have clearly impacted on consumer spending as well as construction.

The strength of the dollar hit overseas earnings upon translation and the collapse of the oil price hurt energy companies’ profits which together affected the overall average. The positive is that despite the weather there were signs of the US consumer starting to spend a bit more.

As the unemployment rate drops and average earnings pick up the medium term background for US earnings does seem to be positive. This means that despite these disappointing numbers the markets are looking through them and anticipating good times ahead. But much will depend upon the oil price, and thus US fracking activity, as well as the dollar.

Remember the rough rule of thumb is that as the world’s “reserve currency”, if the global economy is healthy, the dollar should be weak.

Oil and the Dollar

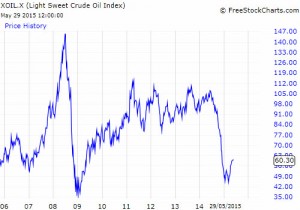

As the below chart shows the dollar had a big run upwards during the first part of this year. This was boosted by the ECB’s Quantative Easing programme which weakened the euro.

Just recently we have seen the dollar pull back, which should be good for US earnings, this has also coincided with a small recovery in the oil price.

So far this does not count as a change in trend but is a step in the right direction for US corporate profits. This is important as we are starting to hear some chatter from commentators that the market’s valuation is getting stretched. Our own work suggests that the S&P 500 Price Earnings ratio remains at an average valuation, but, if earnings don’t start growing again then this number will soon move to an expensive level.

This market is somewhat artificial as it is often “managed” by central government as part of economic policy. One of China’s steady drip feed of reforms has created links between the mainland stock exchanges and Hong Kong. This has given a boost to the purely capitalist, mature Hong Kong market.

There have been some spectacular moves as short term speculators trade stocks with limited

liquidity.

There is lots going on in China, the restructuring from an export led to a local consumer based economy is progressing. But growth has slowed and there have been some signs of deflation. This has prompted the Peoples Bank of China to embark on interest rate cuts and a debt swap programme (a form of QE).

China is important as this is where the long term growth of the global economy comes from. The reforms are critical; the issue is the Chinese think in terms of decades when the markets think in terms of weeks, can the global economy be patient enough to wait for the undoubted long term benefits of China’s transformation?

Markets

The Bull market is getting mature and some investors are starting to get twitchy. Growth should be accelerating and if anything seems to be stalling. Logically with European, Japanese and Chinese QE there is plenty of stimulus around, those investors of a more nervous disposition have been quick to cry that it’s not working; unfortunately economies do not move in straight lines and policies often take years to work through to have an impact.

For some investors the fact that we are in year six of the cycle and that growth is slowing will be enough to take their foot off the accelerator. Our own view is that whilst the slowdown in corporate earnings is disconcerting the same thing happened this time last year and in theory should be transitory.

As such we are prepared to give markets the benefit of the doubt for now. As, whilst it is not yet probable, it is certainly possible, that we may yet finally get the long awaited “lift-off” in the global economy. Markets can be very good at tricking investors and sending then the wrong way at the

wrong time.

May 2015

Click Here for Printable Version