Click Here for Printable Version

We are all being held hostage by the deadly virus Covid 19, it is difficult for individuals to work and also to spend and this has slammed the brakes on the global economy. The lock-down is clearly a necessary event and our thoughts are with anyone who is being touched by this dreadful virus. In the mercenary world of global finance as investors we have seen valuations of investments rapidly reprice to take this extraordinary event into account.

As ever in these market crashes prices are false, buyers disappear and there are forced sellers as the complex interaction between bonds, equities and derivatives lead to margin calls and thus billions of dollars’ worth of trades have to be unwound into a falling market in a very short space of time.

Such events cause huge financial dislocations that threaten the whole banking and financial systems.

Central Banks have though swung into action to stabilise markets and ensure that liquidity in the banking system does not dry up and we don’t get a repeat of 2008/09.

In 2008 there was debate over “moral hazard “ i.e. should banks be allowed to go bust, but when Lehman Brothers went under in September 2008 the penny finally dropped and financial support from the Central Banks for the markets finally arrived.

This time it has been clear from the outset of this crisis that Central banks will do “whatever it takes”, and they have.

This will save the global financial system, but what about the global economy? In those countries that are in lock down there is a gigantic cash flow crisis underway and, no as yet, obvious end date. Without direct government support many companies and individuals will go bankrupt and to their credit some programmes have been announced.

But at present, it isn’t enough, many smaller businesses simply won’t reopen, the available funding is too little, too late and with too many strings attached.

The amounts have been calculated based on a quick return to normal.

Concepts that we have mentioned before in these Newsletters such as “Helicopter Money” and “Universal Income” will probably have to be rolled out.

The lack of an end date is because economies are “quite rightly” being run by Chief Medical officers, market participants therefore remain focussed on the new infection rate, especially in Italy.

From this we can extrapolate a possible end date and thus calculate the size of the extra fiscal and economic stimulus that might be needed (the first number is never the “right” number).

As we write the rate of infection in Italy does seem to be slowing. We also need to monitor the development of new virus tests and possible vaccines, it is the latter that will be the game changer.

Vaccine

In excess of 30 companies and academic institutions (that we know of) are developing a vaccine, of these at least four are currently lab testing and one is about to enter human trials.

There are several reasons to be optimistic. Firstly, the Chinese did the scientific groundwork early and then released it for everyone to use.

This has saved time. Secondly, coronaviruses have caused two other recent epidemics – SARS in China in 2002-04, and Middle East respiratory syndrome MERS in Saudi Arabia in 2012. In both cases, work began on vaccines that were later shelved when the outbreaks were contained. Vaccine developers have taken these prototype vaccines off the shelf and repurposed them.

Another being repurposed is an Ebola vaccine. Vaccines can take time to develop but in this case they have had a head start.

If any of these prototypes do prove themselves to be effective and soon, markets will take off.

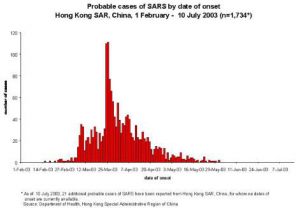

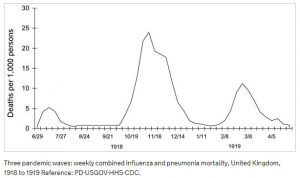

Daily New Infections: SARS in Hong Kong 2003 and Spanish Flu in UK 1918/19

As mentioned in our most recent newsletter markets are fixated on the daily infection rate, they are working on the basis that this pandemic is temporary but when will it pass?

Looking back at history does give us a few clues. Using more reliable Hong Kong data for SARS we can see that the epidemic peaked about one month after it started.

Going back even further to the Spanish Flu of 1918 this again peaked just over a month after it started. But worryingly, as has been talked about this time, there was a second peak as de-mobbed soldiers returned from the front.

Italy seems to have finally peaked as well, again a month after it started. Now the markets are not medical professionals but these dates are pretty consistent and do seem to match various government’s pronouncements around the world.

What does this mean? Altogether we might lose a minimum of 3 months economic activity which would be split over two quarters. How would this be reflected in markets?

Experience Last time 2008/09

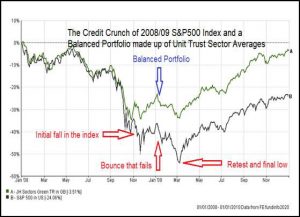

Stock markets by their very nature are not predictable but patterns do seem to repeat themselves. This gives us a guideline to aid decision making. This chart shows how the main index, the US S&P 500 and a theoretical Balanced unit trust portfolio, behaved during the critical final period of the 08/09 Credit Crunch.

This period was a typical “bottoming process” that is necessary before a new Bull market can begin. It took six months for the initial bounce to fade, the low to be retested and then for the new uptrend to be established.

Will this pattern repeat itself?

No one knows, we do have a completely different set of circumstances. Central Banks have been very quick to respond this time, normally politics gets in the way of a speedy crisis response. Nevertheless, six months would take us to September which in investment terms is not that long to wait.

Oil

Another factor in this crisis is the collapse in the oil price. The Saudis have taken the opportunity to grab market share and squeeze competitors by flooding the market.

Speculators have hired tankers and space in storage facilities to take advantage of “sale” prices. At some point the spare tanker and storage capacity will run out. This will be the critical point, will the Saudi’s then cut production to match demand? This is important to UK investors as two of the largest holdings in the FTSE100 are BP and Royal Dutch Shell.

The FTSE100 will struggle to rally unless oil demand picks up significantly.

Europe

The EU, already under pressure from the UK’s departure and the political weakness of Angela Merkel, is now at a very critical point.

France, Italy and Spain have been hit hardest by this virus and have limited financial room. They need fiscal help from Germany, Merkel may not be in a position to provide it.

Europe does tend to need a crisis to reform, but this will be a severe test over the coming months.

Markets

We are truly in unprecedented times, no-one has ever experienced a total economic shut-down of this magnitude before.

Global stock and bond markets have rapidly priced-in a short, very sharp recession and are looking through to a strong recovery in the second half of this year. Portfolio values are now below their long term average but experience suggests this will be temporary and valuations will return to trend.

History also tells us to be wary of the first bounce following a market crash, therefore we could expect a further period of weakness before a base is formed and a new Bull market starts.

Again history tells us this should happen sometime before the end of this year. However, if a successful vaccine is developed before then or the virus burn out, markets will take off.

Clearly, these are very difficult times, but our view is that we were in the danger zone for a market collapse anyway and this virus is actually doing us an investment favour.

The overdue recession is now here and governments, for once, have not wasted any time with fiscal and monetary stimulus. Whilst this is painful it should, hopefully, soon pass. March 2020

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.