Click Here for Printable Version

The first quarter of 2019 has passed with solid gains for markets after the difficult period before Christmas.For most equity sectors we saw increases of between 7% to 8% with bonds around 2%.

But this did not reflect the main theme that developed during March.

US Treasury Bonds (the key indicator for the future direction of interest rates) yields fell and longer dated bonds now yield less than shorter dated bonds i.e. the dreaded inversion.

Historically, an inversion in yields has been 100% accurate in predicting a recession.

But as ever nothing is clear in the world of investment, as we shall see later.

No agreement has been made, as yet, in the China/USA trade war during March, though expectations are high that something will be signed this month. The other high profile issue, at least for Europe and the UK,is Brexit.

In essence there is currently a Parliamentary stalemate. Theresa May failed to get a satisfactory change to the Irish backstop text which meant there was no support from the DUP and thus her deal couldn’t pass.

She is now trying to agree a deal with the opposition. It is still technically possible we could leave with “No Deal”,which rational economic analysis would suggest would be bad,but not that bad.

Brexit is fascinating and infuriating, but economically is just a sideshow, the big event is happening in the US Bond markets.

Yield Curve Inversion

It is hard to see from the above chart but the US 3 month interest rate has moved to be higher than the 10 year one.

We have shown a version of this chart before, but using the 2 year Treasury Yield, this is the 3 month/10 year spread. This is significant as it can be an early warning indicator that the classic 2 year/10 year spread is about to invert.

The grey lines are US (thus global recessions). In the past when this has occurred,a few years later,the US enters recession.

This is somewhat surprising at this point of the cycle but does tie in with our working thesis that the first year of a new US Presidency i.e. 2021 is normally a recessionary year (get the bad news out of the way early), but it is worrisome.

We need to understand what is going on in the US economy, is it just the trade war and the Fed?

Some clues can be discovered in the US car sales figures.

According to a report by Automotive News US car sales in March could be down by as much as 6.7%.

Reasons include a lack of US consumer confidence, prices increasing by c2.8%(due to the trade war), rising auto finance interest rates (due to the Fed) and significantly a decline in annual tax refunds post the Trump tax changes.

So the message is,the US economy has picked up,but is very fragile and susceptible to policy mistakes.

Purchasing Managers Index

Most economic indicators are historic, we can however use economic surveys which are forward looking, making them valuable as a predictive tool.

The Purchasing Managers index (PMI) surveys actual businesses, the most common PMI surveys are the manufacturing PMI and the services PMI.

Investors use these surveys as leading indicators of economic health, as they give us an insight into projected sales, employment, inventory, and pricing.

Manufacturing PMIs in particular tend to react quickly to any slowdown in consumer demand.

They are amongst the most highly watched economic indicators,especially as they are not collated by government statistical departments. The latest set of surveys has been particularly interesting. Above 50 is good, below 50 suggests that an economy is heading for a contraction.

What conclusions can we draw from the latest data?

Crucially China and the USA are reporting numbers over 50 which is indicative of future growth.

What is particularly shocking is the collapse in German manufacturing expectations.

In comparison the numbers from the UK are spectacularly good, not what you would expect with all the Brexit nonsense going on.German manufacturing is very dependent on China, the trade war is not helping. But why should the UK be doing so well? It is all down to currency, a weak pound (against the dollar) stimulates UK manufacturing, hence any No Deal Brexit would ultimately have a silver lining.

Brexit

As we write, the Conservatives lack of a majority and the failure of Theresa May’s negotiated deal to satisfy the DUP are coming home to roost.

She is now proposing a further Brexit delay in an attempt to agree a cross-party deal with Jeremy Corbyn’s Labour Party.

What do we know about Labour’s Brexit policy?

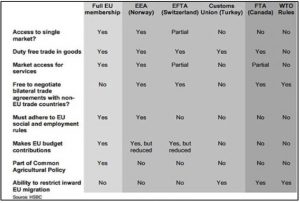

Firstly, Corbyn wants a Brexit, he can’t nationalise anything if we are in the EU. Their stated policy is a Customs Union, what does this mean? We have shown this table from HSBC before and it is the Turkey option we have to focus on. The key issue is that a Customs Union prevents the UK from signing trade deals with other countries.

The EU also seems to be suggesting that a Customs Union would be an amendment to Theresa May’s deal, thus negating the Irish backstop issue.

If that occurs then the Customs Union will be enshrined in International Law and thus virtually impossible to escape from.

If a deal can be agreed and pass Parliament,then this move will not go down well with either Brexit supporters nor Tory rank and file members.

The consequences of Theresa May seeking a deal at all costs could be very significant over the long term for UK politics. However, Jeremy Corbyn may yet force a crisis in order to get a General Election, a Custom Union does suit him,but an election suits him more.

Markets

For the markets it’s still all about the China/USA trade talks, expectations are high and the markets are hopeful are solution will be agreed in April.

China’s latest manufacturing PMI data indicated a return to growth and if a reasonable (for both sides) deal can be signed then the global growth trend should resume.

This cannot come too soon for Germany, which also needs a resolution of Brexit.

Remember,the UK is the single most important export market for German vehicles.

The US Federal Reserve Bank is with China the key to the future market trend. Since January the Fed has been explicit that further interest rate increases are not on the agenda and neither is Quantitative Tightening.

This is significant as traditionally, the Fed does not move interest rates during the Presidential Election process. As long as inflation remains subdued, which given the lack of US consumer confidence seems likely, then so will US interest rates. April may see a resolution to the Brexit political crisis,but the risk is it might just precipitate another one, with more severe consequences.April2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.