Click Here for Printable Version

US President Donald Trump propelled global markets to new highs, now his actions are bringing about a healthy and much needed correction.

Stock markets do not go up in a straight line forever, they are a pricing mechanism. When prices get overvalued then they have to pull back to a point where the buyers are tempted back in. We are finally in one of these periods now.

Investors with properly constructed portfolios should not fear such periods it is just the “noise” of the markets.

What has Trump been up to this time? Unusually for a “politician” he is actually following through with his election promises.

Risking a painful trade war he has introduced tariffs on Chinese imports and this is on top of attempting to renegotiate the NAFTA trade agreement with Mexico and Canada.

At the same time the markets are concerned that Trump is sacking the “sensible” people such as Rex Tillotson, who the markets had hoped would keep Trump in check.

So, with a trade war possibly starting and Trump acting out his Apprentice Show persona the market now needs to reprice.

This is at a time when two of the market darlings, Facebook and Amazon have come under intense scrutiny.

customer provide details on every aspect of your life, for free, they then essentially sell this information to advertisers.

So it is almost money for nothing! However, it would appear that Facebook might have been inadvertently selling this information to the “wrong sort of people” and this is very bad PR.

Furthermore, politicians are worried by fake news and alleged Russian meddling in elections via social media platforms such as Facebook.

This raises the risk of regulation. How this impacts the underlying business is so far, hard to tell.

Facebook’s various platforms are embedded in modern culture and there are few signs that accounts are being deleted on any significant scale. Advertisers meanwhile might be nervous, but as one major multinational said, who else offers such targeted and accurate advertising

Trade Wars

Trump has followed through with his election promise to put America first and stop the flow of American manufacturing jobs toMexico and China.

For Mexico (and thus Canada as well) this means detailed talks about NAFTA (North American Free Trade Agreement).

In particular Trump wants the apparent bias in favour of Mexico moved back into balance. On the face of it from an American perspective it is a noble cause. However, US manufacturing is very reliant on low cost Mexican components and if Trump wants to limit immigration a wealthy Mexico would be the way to do it. He will probably end up getting his way; Mexico and Canada have a relatively weak negotiating position.

For the markets it would be a question of whether this would add to the profits of USA Inc. or actually hurt them.

Against China however he is up against a much tougher opponent. The bullying tactics that will probably work in NAFTA will not work with China.

But, we are very much earlier into the game, so far the US has announced tariffs, China has responded with “tit for tat” duties on the likes of soya beans and Boeing aircraft.

Our guess is that this is the opening play in the poker game.

Trump is not a diplomat or politician; he is a New York Real Estate developer. As such his tactics are understandable and probably quite liked by the Chinese. For the markets the worry will be how long the poker game lasts, a quick agreement would be very well received; a drawn-out affair could well act as a drag on global equities for some time.

But actually, Trump does not have much time. The next Presidential Election is in two years and before that we have the Senate and Congressional mid-term elections, which are only a few months away. He needs a big win and soon.

The US mid-term elections are due in November and there are 3 other Congressional seats up for election before then. The Republicans have already lost in Pennsylvania, a long standing safe seat. If these three elections go against Trump then pressure from within his own party will mount.

Trump needs the big trade wins and well before November. Furthermore, the FBI Mueller investigation into ties with Russia remains in the background.

There were rumours that Trump was about to sack Mueller (along with everyone else) earlier this month.

However, there were suggestions that if he did that then his own party would move to impeach him.

Remember, he wasn’t the Republican Party’s favoured nominee and we suspect that his own party would be quite happy to see him replaced by the Vice President.

Mike Pence has so far been virtually invisible and is rarely seen with Donald Trump.

For now Trump is useful to the Republicans, particularly getting the tax cuts through and effectively ending the hated Obamacare, if he starts to become a liability, then do they have the wherewithal to get rid of him?

US Company Profits

With all the bad news it’s easy to forget the good news, Trump has reenergised USA Inc. and this should be reflected in a healthy increase in company profits.

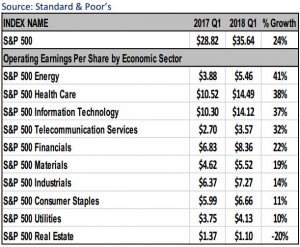

As we enter the first quarterly results season of 2018 analysts have upgraded their earnings forecasts.

Companies normally issue guidance if they are likely to miss forecasts and these have been few and far between.

For Bulls these numbers are critical, we need low valuations and healthy growth to drive the markets into the future.

As QE ends investors have to understand the new market drivers, many younger traders will have not experienced “normal” markets and this is just what we are entering now.

exceptional and if everything else was equal we would expect them to deliver a substantial increase in share prices.

Why? We know for a fact that short term share price movements are random and thus unpredictable; however, long term share price growth is equal to corporate earnings growth.

This is the fundamental basis of investing in equities.

The projected level of growth, if correct, will lower the market’s valuation.

But at the moment it is not “believed” by many market participants.

If the actual numbers match the forecast and the numbers for next year are upgraded as well, then despite the Trump nonsense, the markets (as this is common to the other global markets as well), are fundamentally good value.

This should ultimately act as a significant support.

Markets

We have been warning for some time that a correction in global equity prices is long overdue.

Now it is here as usual the “doomsters” have come out of the woodwork and are calling yet again for the end of the investing world.

The real question is; will Trump’s trade wars tip the global economy into recession, thus collapsing company profits?

If so, this means share prices will have to fall to reflect this temporary, lower denominator in the valuation calculation.

So far rational analysis suggests not. Could we get a 1987 style “flash crash”? Well we could, especially as 90% of US equity trades are made by trading algorithms, none of which have yet been fully tested in all market conditions.

Would this change the long term investment case, of course not. So far the pull back in share prices barely meets the qualification for a correction which normally lasts for around a quarter or two.

But unless what is happening fundamentally changes the underlying global economic trend, then this is just the normal noise of markets.

For now we are in the hands of Donald Trump and his trade negotiations, but we also know he needs a win and soon.

This is a poker game, but it should be noted that so far both sides have played a cautious and defensive game, leaving open the door for a negotiated settlement.

The forthcoming earnings numbers are fundamentally critical to the long term trend, but forthe short term, it is the trade news flow that will drive market direction.

March 2018

Click Here for Printable Version