Click Here for Printable Version

As the first quarter of 2017 passes, the Trump inspired global rally has delivered healthy returns for investors.

The Far East and Emerging markets have led the way with sterling returns of 11.4% and 10%; the FTSE100 meanwhile was up 2.5%. Growth around the world is finally picking up.

For a global economy that was stuck in neutral for so many years this is a welcome development. Much depends on Trump getting his tax cuts through Congress, but his timing is good.

The global economy was already starting to improve; his proposed policies seem to have thrown some petrol on an already smoldering fire.

This Trump boost is based on change in market psychology from being deflationary and pessimistic to suddenly believing that a return to a “normal” economy was not just possible but now probable.

So the key aspect we have to monitor for the market now is when and how these policies are implemented.

American Health Care Act

This Act was supposed to be the replacement for the unpopular Obamacare and was Trump’s first attempt to get a major piece of legislation through both Houses of Congress.

A large part of the Trump rally has been based upon the Republican Party winning both Houses which suggested that Trump’s ambitious policies had a decent chance of making it into law.

The big prize is the US Budget but the first test of the Trump team’s ability to deliver came with this Act, and so far it is been a failure.

It wasn’t even put to vote as the right and left wings of the Republican Party could not agree on a unified set of policies.

Whilst this might have been seen as an embarrassment for Trump, Republicans were keen to make it clear that there should be no read-through from Obamacare replacement to tax reform.

The Act may yet come back to Congress and with few insurers now offering policies under Obamacare it is likely to quietly wither and go away.

US Consumer Confidence

Middle class consumers have less disposable income than in 2008 and remain fearful of losing their jobs and this has held back spending.

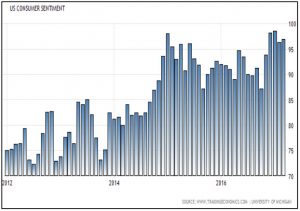

As this chart from the University of Michigan shows Consumer Confidence has picked up markedly since the election and crucially is being sustained.

Historically, this number has been a good predictor of future growth. The approval of the Keystone XL pipeline and reversal of measures on coal production are examples that have the potential to create well-paid manual jobs across America and would underline future growth potential.

“Deep State”

Conspiracy theorists like to use this term to cover vested interests within a country who seek to undermine a leader.

Trump supporters and others in his team have used this term repeatedly. What we do know is that there is an ongoing FBI investigation into links with Russia during the election campaign. As we said last month the bookies have odds of 3/1 on Trump being impeached this year, but we do have to remember it’s the economic policies the markets like not the man.

Nevertheless, we need to be aware that there are questions overhanging the President and any new news may cause market volatility.

Article 50

Prime Minister May has finally invoked Article 50 and the long and difficult poker game begins.

Nothing ever happens quickly in Europe and it would be a major surprise if these negotiations went smoothly.

However, there does seem to be an increasing amount of economic research being published that argues that if the UK feels it can negotiate free trade deals with other countries quickly, then walking away and trading with Europe on standard WTO tariffs would be just fine.

This is the “no deal is better than a bad deal” route. As ever the outlook for the UK post Brexit is dependent on the UK’s policy response not the negotiations.

We also need to consider that a snap General Election could still happen, though it is probably now too late for this year.

For the UK equity markets Article 50 is not a big deal, but we do need to watch Gilts, Property and Mid/Small Caps as any unexpected slowdown in the domestic economy would be felt here.

Corporate Earnings

Valuations on their own are worth nothing, they have to be placed in the context of earnings growth.

The higher the level of growth the greater the valuation the market can stand.

If we divide the valuation by growth we get the PEG ratio, 1 is cheap, over 2 is expensive, it is currently 1.7 so fine.

If the US cuts corporate and personal tax, then the growth number jumps and the ratio become“cheap”.

Is this growth sustainable? For all his faults the new President has reenergised the corporate world.

The business environment has moved from pessimism to optimism, so this bodes well for the profit recovery to continue.

Geopolitics

The expectation with Trump is that he will be more belligerant, so far we have seen limited evidence of this.

The use of chemicals in Syria has though stimulated a response.

North Korea is also proving to be challenging. Trump has met with China Premier Xi and we have yet to fully see what impact this will have. We do need to be aware that this is a risk.

European Elections

The Dutch elections passed as expected with the polls proving to be just about right for once.

Is this a sign that the move towards the right in European politics has been halted?

The French Presidential Election is imminent and Le Pen seems to be falling back in the polls. But she does have a route to victory albeit a low-probability one. In Germany Merkel did better than expected in the Saarland State elections. Her opposition seems to be mainly from left leaning Martin Schulz rather than the populist AFD party.

The biggest European political risk remains Italy where anti-EU feeling is at higher levels than the UK. We don’t have an election date yet, but it has to be held before May 2018.

Markets

The move upwards in global equity markets has been termed the “Trump Trade”.

The new President can be credited with changing the tone in the business world; however, the recent rise is actually justified by existing economic fundamentals.

The USA, Japan and Europe are at last delivering positive growth numbers. The USA can, however, accelerate this trend; investment, tax cuts and deregulation have the potential, in an already improving economy, to “unleash animal spirits”.

A phrase recently mentioned by Wall St’s most powerful CEO, Jamie Dimon of JP Morgan.

However, it does require the divided Republican Party to get these changes through both Houses of Congress, which will not be easy.

So we do have scope for disappointment. As we mentioned last month Ronald Reagan had the same problem and the market pulled back until the tax cuts were passed.

In the meantime we are now entering the first quarter corporate reporting season with, it seems to us, quite low expectations?

If the numbers do turn out to be a pleasant surprise then the market can sustain a higher valuation.

There are still plenty of hurdles to leap though. The European political ones seem to be reducing but a divided Congress, risk of impeachment and nervousness about the new President’s foreign policy will create bouts of nervousness for markets.

For market valuation though it’s the earnings season that is the most important.

March 2017

Click Here for Printable Version