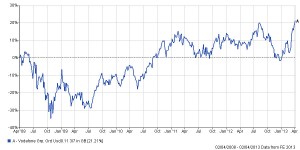

The first quarter of 2013 has now passed and it was a very productive one for equity investors. The S&P 5OO tagged a new alltime closing high in America and even the FTSE100 got back to its pre Credit Crunch level.

Money continues to flow into equities as managers shift monies from expensive bonds into cheap shares. The star performer this quarter has been the USA with the S&P rising 17%, the FTSE100 was way behind but still achieved a respectable 8.7% growth. Toward the end of the month though there was a reminder that the European problems have not gone away. This time, the banks (rather than the government) of Cyprus needed a bailout, but the EU’s response was unusual and slightly disconcerting.

This was then made worse by the Dutch Finance Minister, who currently heads the Eurogroup, stated that Cyprus was now a “template” for future bailouts, thus at a stroke breaking the major taboo of the whole global banking system. However, this news has so far failed to slow down the market’s growth.

Roadmap

Corporate News

The US results season is about to start and expectations are low. These profit numbers will reflect the last quarter of 2012 and the impact of the Fiscal Cliff negotiations. Furthermore most strategists are also accounting for Chinese growth not to be seen in US corporate profits until the second half of the year. Moreover, there have not been too many shocking pre-announcements which tend to happen when analysts’ forecasts are way out of line with reality. So whilst expectations have been tempered we might just get enough positive news to allow investors to look through to improved growth later on in the year.

Apple

Apple remains out of favour and has been left behind in this rally. The markets have not been impressed with the new products post Steve Jobs, and the company needs to lift its game or it will continue to lose market share to Samsung. This Korean company is not as profit focused as Apple and has a strategy of offering the same as Apple, just not as pretty, but at a lower price. Apple is still an enormous company and is flush with $137billion of cash. This company has the potential to ignite the market, either through new products or by paying the cash back to shareholders, who will then seek to reinvest it. Or alternatively it could just go out and buy up competitors. This market has managed to rise for once without the help of Apple, just imagine what it could do if Apple starts to run again?

One thing that has been missing from markets, and tends to come later in the cycle, is the merger/takeover. Such deals are often the impetus for share valuations to rise towards expensive levels. The recent rumour that ATT and Verizon (US versions of BT) might want to buy and break- up Vodafone, could be the first of many.

Vodafone

Historically, once such rumours start to go around it does stimulate thinking in rival companies. Vodafone is one of the top companies in the FTSE100 and with Indian and Chinese operators just as large and flush with cash a takeover may ultimately come from elsewhere in the world?

Cyprus

Cyprus has a large off-shore banking industry that was hit hard during the Credit Crunch. With a total GDP of only €19.5bn the banks like Iceland and Ireland were too big for the Cypriot economy. Especially given that these banks originally held €22bn of Greek debt and were thus hit hard by the “haircut” taken by creditors. Furthermore it is suggested that Russian cash represents around half of all bank deposits in Cyprus i.e. $60bn out of a total of $120bn. This is an economy that has banking and tourism and nothing else and half of depositors are non EU residents. So from a German perspective why should they bail out Russians? Hence half of the money needed had to come from cash depositors, a major change in policy. But one that in reality could only occur in an economy like Cyprus.

In a developed economy, such as the UK, depositors are sacrosanct. Banking is only possible when there is trust, and that trust relies on the ability to go to the bank and get your money out, lose that trust and the whole system collapses. That is why so much money was poured into Northern Rock/Bradford and Bingley, not to bail out depositors, but to maintain trust in the system.

Which explains why, when Jeroen Dijsselbloem stated that Cyprus was now a template for the rest of Europe, it caused so much concern. The reality is that a deposit levy has enormous knock on consequences for a more broadly based economy, it would impact everyone from business to charities, local authorities, schools, hospitals anyone who has cash on deposit. If the EU is wedded to this course, particularly for Italy and Spain, then there will be serious ramifications. Next on the list is Slovenia, what strategy the EU imposes here could be very important for future short term market direction.

Markets

The trend so far remains intact and there are many investors holding cash who would love to see a pullback. They may be hoping for a déjà vu? Last year markets rallied in a similar manner up until the end of April, and then European worries caused a significant pullback to June. Nevertheless, as ever, the US results season will be the key. We also have to keep one eye on North Korea; most US commentators regard the threats as a joke and rational analysis of their nuclear and missile capability suggests it is very limited, but war can distort the cycle, particularly in such an important region so we must remain vigilant.

March 2013

Click Here for Printable Version