Click Here for Printable Version

In the investment world there are two universes, the real economy and the markets. The former clearly influences the latter but they are not parallel. The world of bonds and equities is forward looking and by 12 to 18 months into the future.

With so much negative news around, particularly in the UK, it would be dangerous to be caught up in the pessimism, it is what will happen next year that counts.

We have had one significant piece of good news, China went back to work. This, hopefully, removes one of the big three negatives that have been a drag on markets. There is still the risk of Germany’s gas being cut off and the very real and increasing fear that the US Federal Reserve Bank will go too far and precipitate a recession.

For now, in world record time they have returned market rates and inflation expectations back to “normal” i.e. about 2.5%. They have made it clear they will go further, if inflation continues to accelerate. This is where the economic data is becoming very complex and not at all clear.

During June commodity prices rolled over, even Crude Oil fell back to a low of $106 having peaked at $130.

Consumer Confidence numbers have fallen sharply, retail sales have slowed, all together pointing to a slowdown, however, there is, at present, no hard economic data that currently supports that a recession is imminent.

Markets famously have predicted “8 out of the last 2 recessions”. We are though in a situation where there might well be a recession if Germany’s gas is cut off, or the Fed goes too far.

Most brokers put the current odds of a mild US recession at around 50:50, though these odds could deteriorate if pessimism takes hold, emotion could trump the facts. Inflation remains the key to this market.

Inflation Update chart source: Scion Asset Management and IG Index

Whilst it is very early days there are some indications that inflation may be close to peaking.

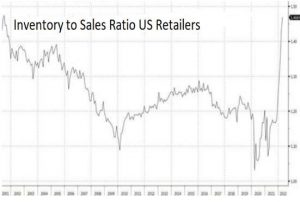

Firstly, the amount of stock at US general retailers is at a dramatic high. They have overstocked, indeed there are reports of some retailers paying consumers not to return unwanted items.

Consumers are savvy, they simply won’t pay higher prices and that is not an inflationary environment.

True inflation is when you buy now in the expectation that if you don’t, it will be more expensive in the near future. The fact that consumers have gone on strike is actually very encouraging, they are waiting for the sales.

The other charts are a selection from the commodity markets.

All are showing that prices are starting to roll over. Softs (wheat, soya, etc.) are responding to greater seasonal plantings, metals to reduced demand and increased supply making up for the Russian shortfall.

Inflation Update: US PCE

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, stayed unchanged at 6.3% on a yearly basis in May.

However, the Core PCE Price Index, (ex food and energy), which is the Federal Reserve’s preferred gauge of inflation, declined to 4.7% in the same period from 4.9% in April.

What is more, the forward looking market inflation rate, the 5-Year, 5-Year Forward Inflation Expectation Rate (not a typo), which is very closely watched by the Fed, also declined in June to 2.1%. This is all suggestive that the markets are just beginning to move on from inflation to worry about growth. That is good, as it means that fear is becoming the dominant market emotion and thus means we are getting closer to the eventual turning point.

UK Economy

Whilst many of the problems facing the UK economy are common to North America and Europe, specifically labour shortages, there are, as ever, some self-inflicted issues.

It would appear that across the western world the Covid pandemic has stimulated a whole

generation to retire early or reduce their hours and work from home.

For tightly managed businesses this has meant a loss of labour and experience that is taking time to replace and train. Tanker drivers, pilots, baggage handlers are just a few of the high profile examples.

Unfortunately, the UK decided to undertake fiscal tightening just at the wrong time. This was before inflation took off, which then precipitated rapid monetary tightening from the Bank of England. To be fair, coming out of lock-down first, meant that the UK was the economic guinea pig and an increase to government revenue to help repay the huge transfer of wealth from the state to the private sector looked sensible at the time.

Rishi Sunak’s critical error was not to subsequently realise that the world had changed post Ukraine and go fully into reverse. That is now very difficult, for example, having failed to increase personal allowances it would take a huge increase to get back to where they should have been, that is the problem with inflation. The only saving grace from this error is that the pound has weakened, this will help offset some of the impact of the tax increases, however, the UK needs fiscal stimulus and soon.

US Corporate Earnings

July will see a critical US company profit announcement season. Not only will the actual profits be important for market valuations, but the verbal outlook and forward earnings guidance will be scrutinised carefully for any signs of an imminent recession.

There is a risk that expectations are still too high and need to be reduced.

In theory, consumer goods from iPhones to trainers should be slowing, whilst oil production, mining and banking should be doing well.

Energy companies and banks have historically been a major drag on the index valuation whilst tech has been the main driving force. The overall index valuation has fallen to 18 times, but that is dependent on earnings growth. The current forecast is for the S&P 500 constituents to see profits growth of around 8%, this year.

Given that consumers are now seemingly on strike that has to be too high.

Correction or Crash?

This chart shows the percentage of stocks that are above their long term moving average. This has historically been a pretty accurate indicator of when we are at, or close, to market lows.

The green box shows that we are approaching a level where for major corrections (shown as Red Circles) equities have reversed.

For the big drawdown events such as during Covid-19 or the Credit Crunch (Blue Circles) we have a little further to go. So the big question is are we in Correction or a Crash? For now the balance of probabilities is that this remains a correction, why?

Earnings haven’t collapsed, unemployment hasn’t risen and house prices are unchanged, though asking prices in the US and London are starting to dip. However, if the markets think the Fed is going too far, then they will fall further, but what we can say is that bulk of the potential drawdown has already taken place.

Markets

Are we nearly there yet? For a Correction, equities have fulfilled the 20% fall in prices and the 6 month timeframe, for a recession, even a mild one, we might have another 10% off equities and 3 to 6 months to go.

Ultimately though, markets are driven by the direction and rate of change in inflation, interest rates and corporate earnings.

For now, all three are giving negative signals, but it wouldn’t take much for these negatives to reverse direction. For a quick turnaround oil would need to move back below $100 per barrel.

In turn, that might need a ceasefire and serious peace talks with Ukraine. There are rumours that Ukraine would give up the Donbass in return for instant EU membership. The problem the US has is that the Fed has a very small window of opportunity to tame inflation. There are mid-term elections this year and the 2024 Presidential Election is getting closer.

Joe Biden will want the US booming by Christmas 2023, just 18 months away.

For the Fed this means there will be pressure to get the job done ASAP. Is this good or bad?

Good that this negative period for interest rates and thus corporate earnings growth is likely to be short, however, it does increase the risk of a policy mistake. For July, it will be all about corporate earnings, there is an expectation that they are too high and need to be dialled back, question is by how much?

These are very tricky markets that are being influenced by multiple disparate factors and it is difficult to say with any confidence when or where the turning point will come. But it will and when it does, markets will move very quickly indeed to reflect this new information.

For patient investors buying below the average could easily double your long term return.

July 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.