Click Here for Printable Version

It looks as if the UK and Global economy bottomed in early May. Economic data is showing a significant improvement from the very poor numbers of April. As the virus lock-down shuttered economies, consumers have moved online and in the UK furloughs kept some businesses alive.

Nevertheless, pent up consumer demand was started to be seen in the June data.

So the trend is now upwards just as lockdowns are easing and consumers can now start spending again, though still in a very restricted way.

However, we are also starting to see many redundancy announcements, though virtually all are focussed in those industries that are unlikely to recover quickly, i.e. airlines, aerospace, travel, retail and hospitality.

As we said last month these industries may need a vaccine or clear signs the virus has burned out before they can start to truly recover. This seems unlikely before the final quarter, though the vaccine news continues to be positive. The question is will the extent of these redundancies derail the overall recovery or just temper it?

There are green shoots out there, but we are very early in this process, we do need a few months of good data before we can declare it a trend.

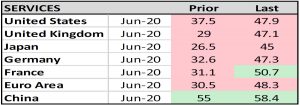

Green Shoots….Global Purchasing Managers Indices

(source Tradingeconomics)

We have quoted the PMIs before, these are the only consistent forward looking indicators.

They are based on survey data and when the index is above 50 it indicates a growth phase is underway. The latest data for both manufacturing and service industries is clearly telling us that from its lockdown “unprecedented” lows the global economy is back growing again.

Indeed, some economies are back in an expansionary phase, somewhat predictably China (first in, first out) and also surprisingly the UK.

This may be a function of a weak pound? As with all these statistics the first bounce is easy to achieve, it will be the development of a sustainable trend that will dictate whether we are truly moving on from the lock-downs.

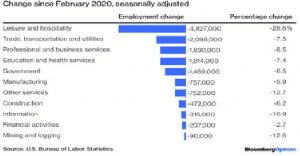

Green Shoots…. US Jobs Growth

(source Tradingeconomics)

The other widely watched market statistic is the US Non-Farm Payrolls, it is often forgotten that low unemployment is a key statutory target for the US Federal Reserve Bank and does drive it’s policy actions.

Since the cataclysmic numbers of April there has been a surprising and very welcome number of new jobs created by the US economy.

However, it is important to note there was no US furlough programme so the only option when sent home was to register as unemployed. With 20 million US jobs in abeyance, over a quarter were in Leisure and Hospitality (just as it is in the UK) how quickly those at home return to the payroll will ultimately dictate how far the markets can go in the short term.

Markets are focusing on the rate of change, not the absolute unemployment level, it therefore needs to keep improving. Whilst many of the above sectors can return to work there is a risk, that as new infections pick up, particularly amongst the young in States such as California, Texas and Arizona, the Leisure and Hospitality job losses might become permanent. But so far the overall jobs news is positive for markets.

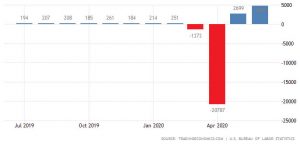

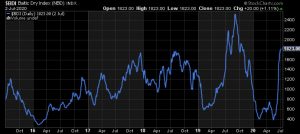

Green Shoots…. Baltic Dry Index

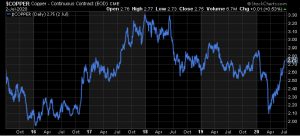

Copper

In the 2008/2009 financial crisis market watchers turned to shipping rates as an early sign that the global economy was starting to grow.

Encouragingly, these as shown by the Baltic Dry Index, are rising nicely again. Another very encouraging bounce is the rise in the price of copper. As the most widely used industrial metal this price rise is suggestive of future economic growth, especially in China.

Clearly we are only just over a month from the recent low, but even at this very early stage of the recovery this again is another significant positive.

UK Fiscal Stimulus

Fiscal policy refers to the use of government spending and tax cuts to stimulate an economy that is slow growing or in recession.

Post the 2008/09 financial crisis governments had limited ability to borrow and thus relied on the Central Banks with QE to recapitalise the banks and thus get them to lend more.

However, austerity measures at the same time sucked growth out of the global economy i.e. the exact opposite of fiscal stimulus, hence the sluggish recovery.

Historically, tax cuts and build a few battleships or ocean liners were the key stimulus strategies used by prior UK governments.

Today, the lock-downs have meant that all global governments have thrown off their self-imposed thrift and are saying they will spend more. But so far it is mainly talk and loans which is not true fiscal stimulus.

Perhaps, many are hoping that by delaying, the virus will go away and thus they don’t have to spend?

In the UK, Rishi Sunak recently announced some stimulus plans, this was not a full Budget and it does seem he is keeping his powder dry until the Autumn Statement. The focus is on tax cuts with only limited spending plans.

Cuts in Stamp Duty and some aspects of VAT (hospitality only) are welcome but are not the “bazooka” that many think will be needed. In the US a possible $2 trillion programme is being discussed.

In Germany a e130billion package has been announced, including a e50billion for climate change and digital programmes, e25billion loans for hospitality and rebates for electric cars.

The UK, so far, is not in that league.

Markets

Markets continue to look at the improving global economic data and are still extrapolating a quick return to something approaching pre virus levels.

This is still a two tier market, technology, healthcare, supermarkets and online retail are benefitting from the crisis whilst others such as high street retail, bars and restaurants are still either shut down or very restricted.

Nevertheless, there are clear signs of improvement in the global economy even though the new infection rate, in many places, remains stubbornly high. Markets are not pricing in another total lock down, but neither are they pricing in a vaccine.

The news flow about a vaccine has slowed but as each month passes we do get closer to what would be transformational for whole industries. As we write the announcement that Warren Buffett is starting to invest again may spark further mergers and acquisitions across the world.

Good news, but this is still a market that remains addicted to Quantitative Easing and needs “proper” fiscal measures. Markets continue to play the “long game”, they will be susceptible to new virus shocks but as long as these are met with new stimulus measures the recovery trend should remain intact.

July 2020

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.