The summer doldrums have continued for global markets, the first half of the year has ended with the indices virtually unchanged.

The FTSE was down 0.7%, the World Index up 0.6%, the Far East was up by 3.6% and Gilts down by 2.9%. But the end of the second quarter was dominated by news from Greece, as this long running debacle appeared to be reaching some sort of conclusion. An attempt from Europe to “kick the can down the road again” was rebuffed when the Greeks called a referendum; this was after missing a repayment to the IMF and actions from the ECB causing the banks to be closed.

This was a hugely complex situation for markets to digest but as we write it appears that a deal has been agreed, subject to Parliamentary approval.

Markets don’t like politics as the emotions involved often lead to policy errors; they are much more comfortable with pricing companies where profit is the main motive.

Greece

The marathon poker game between Greece and the EU/ECB/IMF seems finally to have come to some form of conclusion.

There was and remains a certain amount of distrust between the players. There was initially an assumption that the Syriza party, with no experience in government and openly radical socialist/Marxist, would go to Europe and play the game.

An analogy would be UKIP negotiating on behalf of the UK in Europe, the politics would be very different but negotiations were always going to be very, very unpredictable.

The markets, however, assumed that Syriza would be rational and would argue for the best deal they could get and ultimately compromise and despite periods of self-doubt the markets seem to have been proved right.

A radical socialist party with a 61% referendum vote might have actually believed they had the mandate to walk away, and tried hard to “play this bluff”, but ultimately failed.

The consequences for Greece though would have been very scary e.g. mass nationalisation; economists would have to dust off their 1960s text books.

Could Europe have afforded for the Greeks to be ejected from the euro?

The numbers as shown below do appear big. They could have afforded what Greece actually needs i.e. a debt haircut. But the German’s concern was always that by agreeing a debt restructuring for the Greeks it might have a knock on effect, as possibly Portugal, Spain and Italy come and ask for the same. This is the concept of “moral hazard”.

Perhaps other countries asking for a haircut is unlikely at present but what if they elect a radical political party, even France is then at risk with Madame Le Pen?

If the euro group was a bank or hedge fund then haircut would have been taken years ago, but politicians cannot cope

with booking a loss. Professional investors know that this is simply just a cost of doing business.

Greece has been absorbing cash for some time which means it now owes e100 billion to the system. This isn’t a loan but an equivalent to an overdraft. If a Grexit had happened, this money might have just “disappeared”. This is on top of the e343billion already owed. These are staggering numbers

The consequence of this (assuming Greek Parliamentary approval) is that Greece is now under the economic control of

the Eurogroup.

This may yet prove to be a model that starts the process of creating a United States of Europe.

Greece has shown the limitations of the European structure and could prove to be the catalyst for full fiscal union.

The first hurdle could be the Spanish elections later this year; no-one wants a repeat of this particular poker game.

Puerto Rico

This small island in the Caribbean has an odd legal status; it is not a US State but is technically “owned” by the USA.

It has a population of 3.6m people and public debts of a staggering $72billion and has just announced it can’t afford to pay them back. Europe has Greece the US has Puerto Rico. The big difference is that the debts here are owned by private investors whereas the Greek debt is owned by governments.

As investors, this is potentially far more dangerous for us, as there will be a “ripple” effect through markets if losses become crystalised. Puerto Rico has been funded by the US municipal bond market.

This market, with relatively high yields, has attracted many investors, particularly hedge funds.

Just like Greece, Puerto Rico’s debt level is unsustainable and it must restructure or default, either way this will have a market impact.

Hedge funds will have to book losses and given their complex financial structure this could lead to sales of equities to cover cash flow shortfalls.

The danger with any crisis is that just as in 2008 whilst everyone was focused on Bear Stearns (i.e. Greece) a more serious problem was building elsewhere Lehman Brothers (Puerto Rico).

But it must be remembered a Presidential Election is close, which should focus political minds for a quick resolution.

The “Dots”

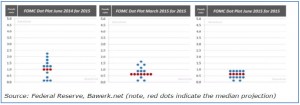

The chart below shows what appear to be braille characters but apart from Greece they are the main focus of the markets just now.

Each governor of the US Federal Reserve Bank marks on a chart where he or she thinks US interest rates should be for the following year.

What this chart shows is how their views have changed since 2014. In 2014 a few were expecting the economy to be strong enough to justify US rates over 2%, clearly they aren’t, they are still 0.25%.

As time progresses and as we move across the chart the dots have moved lower and become more concentrated. So the message is US interest rates will stay low for longer.

Whilst the Fed is looking for reasons to “normalise” rates closer to where they think inflation will be, there is no belief that a big rise will be needed any time soon.

Especially if events in Europe lead to a strong Dollar, which may do the job an interest rate rise would normally do?

Markets

The events in Greece have dominated the headlines but on the whole the markets have been fairly sanguine about the stand-off.

Yes, prices have pulled back but the magnitude has been small and just qualifies as “normal market noise”.

Whilst this was all very painful for Greek citizens the markets worked out that the losses from a Grexit would lie with Governments and not market participants.

This issue with the collapse of Lehman Brothers in 2008 was not the losses associated with the bank itself but the fact that it was interwoven into the complete financial system and these losses snowballed as interlinked derivatives contracts fell into losses.

Also, the ECB could have mitigated any issues by just pumping more QE, which would be market positive.

There may now be pressure for Europe to move closer to a full fiscal union, leaving non euro members such as the UK in a second tier, which might be music to David Cameron’s ears?

Assuming this deal goes through, the effective control that Europe now has over the Greek economy has broken the first taboo of Europe effectively “running a country”. Now this first taboo has been broken, there will be forces in Brussels that will start pushing towards “ever closer union”.

There is lots of other negative news out there, especially from the restricted, local Chinese stock markets where there have been enormous losses, but contained just to China.

We have to keep asking ourselves what impact all this could have on the profitability of the companies in our portfolios?

It would appear for now the answer is not much, a delay in the European recovery would be disappointing but not critical, it is the US and Chinese consumer that calls the tune. Will the collapse of the casino that is the local Chinese stock market hurt the Chinese consumer? July sees the second US results season of the year and expectations are low.

Once again the summer season has proved to be a difficult one.

July 2015

Click Here for Printable Version