Click Here for Printable Version

July was dominated by US company profit announcements. As expected these were spectacularly good, so far the S&P 500 index operating earnings are up a staggering 27% over the past 12 months. Against this good news Trump continued his Trade War rhetoric with the EU and China whilst at the same time threatening to strike Iran.

So far the markets have chosen to ignore Trump’s tweets and they still seem to believe that revised (in America’s favour) trade deals will eventually be signed.

Trump met with Juncker and whilst nothing concrete came out of the meeting an agreement to keep talking was enough to make the markets happy and the German car stocks rallied. In the UK the political crisis that is Brexit continues.

Prime Minister May announced an odd post Brexit trade plan that surprised even her own Department for Exiting the EU.

In hindsight this was perhaps a political exercise to split the Brexiteers and with Gove staying but Davis and Johnson quitting the Cabinet she might well consider it a success.

The probability is high that there will be a last minute trade deal with the EU, it won’t be this one. What might it look like?

Brexit and the Chequers Proposal

We have stated all along that Brexit is a political problem not an economic one.

The present UK government at its recent meeting at Chequers finally came up with a proposal to the European Union.

It won’t be the final deal, that will be agreed at the very last minute, it was however very surprising.

It was clearly not the proposal that May’s own Brexit minister David Davis and his department had been working on (hence the various ministerial resignations from this team) and was also fundamentally odd.

Itbasically proposed a Soft Brexit for agriculture and manufacturing and a Hard Brexit for everything else.

Maybe this was designed to be a “conversation starter”, i.e. if you are being forced to make the first offer make it a strange one!

The reality about Brexit is that it is just not that big an economic deal especially compared with the sheer quantity of inaccurate news flow.

The following is a direct screen print from the Office of National Statistics website:-

Almost half (48%) of UK goods exports went to the EU in 2016. UK goods exports to the EU were worth £145 billion in 2016, or 7.4% of GDP.

Motor vehicles and parts is the largest product group by value of exports: the UK exported £18 bliion of motor vehicles (and trailers) to the EU in 2016. The next largest product group exported to the EU is chemicals and chemical products, £15 billion in 2016.

Most media coverage focuses on the fact that the EU is our major destination for exports, BUT, they are answering the wrong question.

The correct “business-like” question is, how much of our sales are at risk if, in the unlikely event, we were banned from selling to the EU?

The answer from the government’s own statistics department is 7.4%, i.e. not that much. Or to put it another way 92.6% of the UK economy is not at all dependent on having a trade deal with the EU.

We also know that this number is overstated. Any ships that leave a UK port and then stop at say Rotterdam mean that all of those UK goods have been officially exported to Holland not their ultimate destination.

Similarly and allegedly, a pint of milk crosses the Irish Border multiple times and thus is over-counted; also Germany has been steadily repatriating its gold reserves from the vaults of the Bank of England, thus enhancing UK exports to Germany.

The net result is that it might only be 6% of our economy, or even less that is dependent on EU markets.

So if you are very pessimistic and think that we might lose say 20% of our export sales to Europe on a Hard Brexit, then the impact on UK GDP might only be 1% to 1.5%, not enough, at present, to tip us into recession.

Post-Brexit Free Trade models

It is pretty clear that the EU would prefer the UK to drop into an existing free trade model, civil servants, like lawyers are more comfortable using precedent.

It also makes it easier to “sell” to the other countries of the EU who ultimately have to agree the final deal.

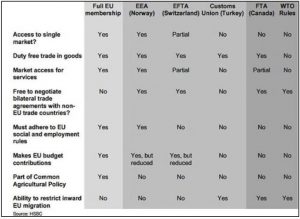

There are various models available including the European Economic Area (EEA), the European Free Trade Area (EFTA) and the Canada model (CETA).

What complicates each of these models is the argument over being in or out of a Customs Union. The EU would clearly prefer it if we remained in a Customs Union as this would limit any loss of their exports to the UK e.g. a Lexus becoming cheaper than a BMW if a UK free trade deal was done with Japan.

The UK couldn’t sign new free trade deals if we were in the Customs Union.

The EU is using the Irish Border issue to their advantage here. But critically being outside the Customs Union does not prevent a free trade deal being signed with the EU.

Norway is not in the Customs Union and neither is Canada.

Being outside the Customs Union does significantly increase bureaucracy as you have to have “Proof of Origin”, otherwise Chinese goods could be imported in the UK, re-boxed as “Made in England” and then sold tariff free in Germany.

But with modern IT systems not a massive problem and remember it’s only for 6-7% of our economy.

This table from HSBC details the main (existing) options.

Left hand side is “Soft” and it gets “Harder” as you move to the right. Canada is probably better than Turkey, as it can do trade deals elsewhere and has partial service sector access.

Norway is the best of the others as it has single market access but has to pay for it through an EU budget contribution and cannot control immigration (a Red Line for the UK).

So whether it is Norway or Canada depends on politics.

For the Brexiteers, Norway is perhaps a step too far, particularly with having to adhere to EU social and employment rules.

Something like Canada therefore seems to be the most likely outcome?

Labour at present is in favour of remaining in a Customs Union, but that could just be Turkey?

So Corbyn’s position is very unclear, he will probably just do anything to force a General Election, so hence Brexit remains a political problem not an economic one.

What if we do leave without a Free Trade Agreement?

This has to be quite a high probability given the various political issues.

The UK shrewdly retained its seat at the World Trade Organisation thus all trade with the EU would take place under WTO/EU tariffs.

This would cost industry c£5bn as well as being bureaucratically very disruptive; particular for the car industry where tariffs are as high as 10% and just-in-time production relies on friction free borders.

But, very temptingly for the UK Government, they would receive tariffs from EU exporters of c£15bn.

Also the UK would retain part of the VAT proceeds that is paid to Brussels and HMRC rather than the EU Customs Union would charge for non EU imports into the UK (though you would assume that this would rapidly diminish as free trade deals were signed).

This is potentially a huge financial windfall and significantly, businesses don’t vote.

Could this be where Theresa May’s extra NHS funding is coming from?

Markets

For the Global Markets it’s still all about Trump. The game of trade poker with the Chinese is ongoing and so far there is little to suggest the stand-off is going to end soon.

The Chinese stock market, currency and economy seems to have suffered more than the USA , so it could be argued that after the first round of card dealing the USA appear to be up.

The EU seems to have blinked first in their trade spat with the USA though there are few concrete details as yet.

Trump is using his persona of unpredictability to his advantage. At some stage someone will call his bluff, and what happens then is a very big unknown.

Threatening with a big stick is one thing, actually using it is another.

The markets so far still assume that various trade deals will ultimately be signed and this will be good news.

The journey may be bumpy though. As earnings season passes so does a significant source of positive news-flow for the markets.

US interest rates continue to rise and the dollar remains strong, both are headwinds. Traders are still obsessing over the Yield Curve.

With a US Presidential Election in 2020, if the cycle runs true to form, we should expect the Yield Curve to invert mid-2019.

So the cycle is mature and the headwinds are increasing and we are in negative seasonality. However, if Trump pulls a Chinese trade deal rabbit out of the hat then markets can and will go higher.

August 2018

Click Here for Printable Version