May, Hammond and Johnson may sound like a team of TV motoring presenters but no, they are new political leaders of the UK. The poker game of “when will Article 50” be invoked has started and will go on for many years yet.

There has been much handwringing over the immediate economic future for the UK, but the correct answer is no-one really knows, it ultimately depends on the UK’s policy response.

Will the UK become a true “Free Trade” economy with a raft of deals in place before the Article 50 trigger is pulled, or will inward investment into property collapse and precipitate a wider recession?

Alternatively, has the fall in sterling stimulated bargain hunters wanting to buy London properties and cheap companies such as ARM?

Only time will tell, we do need to be mindful that in markets the consensus is nearly always wrong, and this consensus is currently pessimistic.

The world is becoming an increasing fraught place, a failed coup in Turkey, terrorism across Europe and a very messy Presidential election in the USA do not make comfortable reading. We have to assess economic risks and as the incidence of terrorist events increases so does the risk of political change across Europe.

This makes the future path for the European economy very unclear and hard to assess. Similarly, in America, Trump did get the Republican nomination.

He is currently miles behind Hilary Clinton in the opinion polls as well as at the bookies, but we now know neither of these indicators are an accurate reflection of the mood of voters. Thankfully, we aren’t investing in politics but in global multinational companies and their long term dividend stream, history tells us that political chaos is not necessarily bad for company profits.

As we are nearly through the second quarter US results season, this gives us a chance to reflect on the current health of the global corporate world.

Company Earnings

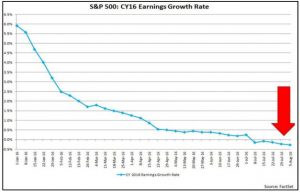

The headlines and the subsequent share price performance seem to suggest that profits have been good. However, as the left hand chart shows, expectations for the 2016 full year had started at a respectable 6% profits growth.

Now, with 80% of the second quarter results in, these expectations have been cut yet again to now forecast a fall of 0.3%.

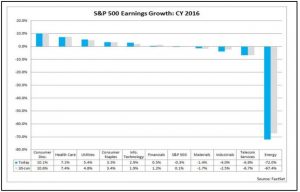

There was hope that the bounce in the crude oil price would help the Energy Sector (Exxon, Chevron etc.) profits recover, it hasn’t. As the right hand chart shows they were actually worse than expected. In the rest of the economy most sectors matched expectations; however, growth still remains below par.

Why is there no growth?

We have mentioned in this newsletter many times that the consumer in both the USA and UK is simply not spending.

A recent report from the UK based Institute of Fiscal Studies showed that median income has finally moved 2% above pre-credit-crunch (2008-09) levels but for adults aged 31 to 59 it remains at its 2008 level and for those aged 22 to 30 it is still 7% lower.

The IFS reports “it is highly unusual to see no growth in working-age incomes over a seven-year period.”

Furthermore, “in key respects middle income families with children now more closely resemble poor families than in the past.

Half are now renters rather than owner occupiers and, while poorer families have become less reliant on benefits as employment has risen, middle- income households with children now get 30% of their income from benefits and tax credits, up from 22% 20 years ago.” The few comments we have had from Theresa May do seem to understand these facts.

Until consumers feel they can afford to start spending again then growth will be low.

QE helps stock markets and banks but not the “real economy”. Helicopter money and possibly Universal Income (where targeted benefits are replaced with a direct payment to everyone in the population) are possible next steps.

But if growth returns, or if oil moves significantly above $50 per barrel then this valuation measure will move from

expensive to cheap very quickly indeed.

This calculation is though just the USA. For example the Far Eastern and the Emerging markets, despite recent strength, are on a very cheap P/E of 13.

Furthermore, a return of growth and inflation would also see the Banks return to “normal” profits, which would also help to bring this ratio down

Property

Post Brexit virtually all of the largest direct property funds (i.e. investors in physical buildings rather than property company shares) temporarily closed their funds for withdrawals.

They did this as they had received a large number of redemption requests which exceed their cash reserves and thus couldn’t be fulfilled without completing sales of individual buildings.

This gave the impression that the UK property was collapsing or would collapse as these funds became forced sellers.

The suspension has allowed a cooling off period with many sell instructions withdrawn as it became clear prices weren’t crashing.

Overseas investors chasing yield and looking for a bounce in the pound have “bought the dip”.

The largest property fund is managed by M&G and they very recently reported that they had completed on £20m of sales and exchanged on a further £40m all at pre-Brexit prices.

This does not mean that there are no “fire sales” taking place, M&G themselves believe that the market as whole will post a negative return this year but not at the scaremongering levels the newspaper headlines have proclaimed.

Markets

July has defied historic norms by delivering good returns for most major markets.

It has become clear that bond yields around the world are staying low for now, at least as long as inflation stays low.

Equity prices have been aided by signs that the US economy is still just about growing.

Given these facts and crucially corporate dividend payments remain healthy (therefore equities remain one of the few places investors can receive an income) then shares continue to find support.

For UK equities Brexit is now a distant memory, as we have consistently highlighted, it is what happens in the USA and China that dictates where the FTSE goes.

We cannot though shy away from the fact that shares are becoming expensive by historic P/E standards. But shares are also valued relative to bonds, so if bond yields are low then it is reasonable to expect that shares can stand a much higher than normal valuation.

It would also support this valuation if corporate profits are returning to growth.

What is clear from the current results season is that underlying growth remains modest.

Oil companies such as Exxon, Shell and BP continue to distort the headline numbers but there is at least some growth elsewhere, which is good news.

As we said at the outset we are entering a long phase of increased political risk.

A referendum in Italy and the US Presidency vote in November, create the dreaded uncertainty and will undoubtedly roil the markets every so often, but growth is occurring and will eventually bring the overvaluation down to more reasonable levels.

In the UK we do need to watch property prices; for now they seem stable and Phil Hammond still has plenty he can do to help this market, such as the reversal of the Buy to Let stamp duty increases.

Overall, we are still waiting for “normal growth” to resume, but may have to wait a little longer, especially for US and UK middle-income bread winners to start seeing a meaningful increase in pay.

July 2016

Click Here for Printable Version