Click Here for Printable Version

Global markets started 2022 in an ebullient mood, Omicron was not as deadly as feared, the vaccines were working and bond and equity investors were looking forward to a year that promised a powerful economic recovery helped by supportive central banks. Unfortunately, along came Vladimir Putin and Jay Powell, (the Chairman of the US Central Bank).

The Russian President, seemingly irritated by the German delay in approving the Nordstream 2 gas pipeline amid pressure from the USA, did two things.

Firstly he restricted the supply of gas to the contractual minimum just as gas stocks were falling ahead of winter, thus forcing up natural gas prices. He then upped the ante further by moving a sizeable military force onto the borders of Ukraine. This has had the consequence of pushing oil prices and thus inflation higher.

Faced with very high inflation numbers and the passing of Omicron the US Central Bank, which was seemingly relaxed, believing inflation was “transitory” and talked of running the US economy “hot”, suddenly and without warning flipped to being very worried about inflation.

They indicated that rather than just gently tapering off bond purchases (QE) they were going to suddenly stop buying bonds.

Furthermore, they would raise interest rates at least four possibly five times this year.

Not only would they do this far faster than the markets had thought but they also talked of Quantitative Tightening (selling the bonds they have bought through QE) which is brand new uncharted territory for markets. This was a shock and will have ramifications for a while yet.

Markets don’t like shocks, it leads to uncertainty and means that prices have to adjust to reflect the new information. The Fed has however put themselves in the best position to be, the pessimistic one, that means that if inflation pulls back they can dial back their dramatic monetary tightening indications.

Nevertheless, this news lead to sharp falls in bond and equity markets around the world. UK Gilts fell by 4%, the World index by 5%, Nasdaq and the UK’s FTSE Mid 250 index by 8%. The one exception (for once) was the FTSE100 which closed January up by 1%

FTSE100

This index measures the performance of the largest 100 companies by market capitalisation listed on the London Stock Exchange.

These are not the largest British companies but those from around the world that use the London exchange as their main listing.

So the index is not representative of the UK economy. Each holding within the index has a weight according to the size of its market capitalisation, the higher this is, the higher the weight, which will move second by second as the share price moves.

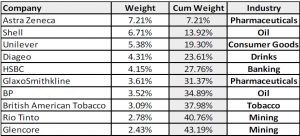

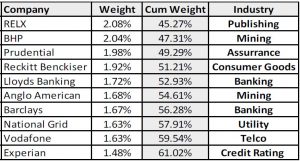

The following table shows the 20 largest FTSE100 companies.

Source FT Russell

What is notable about the makeup of the FTSE100 is just how concentrated it is, the top 10 companies make up 43% of the index and the top 20 over 60%. This means that share price movements in just a handful of companies can drive the index one way or the other, a lack of any technology companies and a concentration in Oil, Mining, Banks and Pharmaceutical industries has led to massive underperformance compared to the US and World markets.

However, in January, this concentration amongst this handful of “old world” industries worked in its favour. The Fed’s dramatic monetary policy pivot has pushed up market interest rates which has benefitted the banks, whilst Putin’s actions have boosted oil and mining stocks as traders feared sanctions and a disruption of supply.

As the FTSE100 is such a concentrated and highly focused index with just a few industries dominating, clearly, the FTSE100 shouldn’t be used as a benchmark for properly balanced investment portfolios.

Inflation

As we highlighted in last month’s newsletter markets are now reliant on just corporate earnings growth, which continues to be very good. However, earnings announcements come just once every quarter so there is little day to day news to help drive markets forward, hence we should expect a lot more volatility.

The inflation picture, which comes from a constant range of official economic statistics will though dominate the market’s news flow. It is possible though, depending on Putin, that we might just be about to pass peak inflation?

The CPI rate of inflation is a mathematical calculation that measures the monthly rate of change in consumer prices.

But the calculation, whilst reported monthly, is impacted by what the level was 12 months ago.

So on the above chart the period of very high inflation seven months ago (A in purple) directly relates to the three month deflation around March 2020.

Moreover, the recent high rate (B Red) is connected to low levels in late 2020. So for the next 6 months the 12 month comparator is a high number, which all being equal, should bring the monthly rate down closer to the Green target 2.5% annual rate line. This chart is US inflation, as it is this number that dictates the outlook for global markets.

In the UK, the inflation rate is being distorted by tax and utility prices, the Bank of England is now scrabbling to bring interest rates closer to where they should be. There is still a long way to go for Base rates at 0.5% to match even 2 year Gilt yields which are currently at 1.2%.

It is easy to become overly focussed on inflation, the UK economy is booming, house prices keep rising and corporate profits are only just beginning to recover. It is this battle between rising inflation and interest rates and corporate earnings growth that is driving the return to normal and healthy market volatility.

Investors will though need to adjust their mindsets to the new market reality.

Earnings Season

We are mid- way through the crucial US quarterly profit reporting season.

The message so far is consistent and pretty clear.

Technology firms have generally delivered good results, though there were some spectacular misses e.g. Facebook. Paypal and Spotify. Whereas many in the old world, GE, Caterpillar, 3M all struggled and the commentary was the same, supply issues, component shortages, staffing etc., this is all despite robust demand for products.

But here lies the opportunity, these companies are on very low valuations but with depressed profits. What we do know is that these supply issues will eventually go away as Omicron passes.

Thus, we can say that whilst technology stocks are expensive the rest of the market isn’t and should at some stage see a boost to growth.

Markets

Post the 2008/09 Credit Crunch and throughout the Trump and Covid years the “Fed had your back”, ready to buy more bonds and thus print more cash to keep the global economy ticking over at low levels of growth and stave off deflation.

Now, they don’t need to do this, they are no longer artificially supporting markets.

We should now gradually return to “proper” investment markets. Ultimately, this is a good thing, but getting there won’t necessarily be easy. We have already had a taste of what “normal” volatility feels like, it shouldn’t be a shock to long term investors but it does, as we say above, require a change in mindset.

This is also why clients should maintain adequate cash reserves and have an appropriate risk profile.

As the earnings season passes, markets will obsess over the inflationary implications of each economic statistic as and when it is announced. Ultimately. the Fed and the Bank of England are just trying to get back to pre-Covid monetary policy as quickly as they can and without too much economic damage.

Also they might be conscious of giving themselves room for manoeuvre, just invcase yet another Covid variant appears. For now, in the very short term, markets are dependent on Putin, the Fed and the economic stats.

February 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.