Click Here for Printable Version

The old adage of so goes January so goes the rest of the year implies that the rest of 2018 could be volatile. In the USA technology stocks continued to lead the way and at times the US indices hit new all-time highs.

The UK and Europe were though left behind and coupled with a resurgent sterling exchange rate meant that, despite all the headlines, capital only returns for UK investors were flat.

In the USA commentators are talking about “Euphoria”, which as regular readers will know is the last stage of the market cycle, and certainly in the technology sector there are some signs of exuberance.

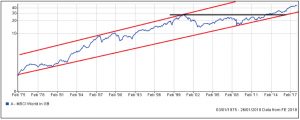

However, on a global basis if we look at the chart below of the MSCI World Index and on the correct Log basis, this does not look like an overheated, runaway market.

The World Index is in mid trend and could run for years yet.

MSCI World Index

But, it also shows that we must expect many bumps along the way.

The Trump trade has been reinvigorated by the US tax cuts but in markets nothing lasts for ever.

We have to assess the risk of share prices falling and investors seeing a short term diminution in the value of their portfolios.

We can classify the periodic falls in share prices into three categories:- Correction: 5% to 15% fall in prices.

Caused by share valuations getting ahead of company profits and thus have to “correct” to pull back to a more reasonable valuation.

Typically lasts 3 to 6 months.

Recession: 15% to 30% fall in prices. This is when the Cycle turns as Central Banks push up interest rates to slow down rampant economic growth. Causes corporate profits to collapse and thus valuations have to fall to reflect this fact. Typically lasts 12 to 18 months.

Credit Crunch / Depression: 30% to 50% fall in prices. Very rare, 1929, 1974 and 2008 only, occurs when the whole financial system is under threat.

Bank lending stops and economies grind to a halt, thus leading to severe recession. Typically lasts 18 months.

What we currently know is that the Fed is the only major global central bank that is pushing up interest rates.

Others will follow but only when inflation starts to pick up. There are a few signs that this is finally coming, oil prices have been strong and wages in the US are starting to grow.

Interest rates should therefore continue to increase. We must remember though it is not the first interest rate increase that turns the cycle but the one that “Inverts the Yield Curve”.

Rational analysis suggests that based on current data and forecasts we are some way from inflation becoming overheated.

So the risk of recession is there but not imminent. Meanwhile, for a Credit Crunch to occur it would have to come out of “leftfield”. Such events are by their very nature unpredictable.

There is the ever present risk of a collapse of the euro project, especially if Italy votes in an anti-EU party.

Alternatively a massive cyber-attack that wipes out bank balance sheets is a tiny but also realistic risk.

However, as we have said many times before a correction is long overdue, especially in the US markets, so we must look at valuations to assess the extent of overpricing, if any.

US Corporate Earnings and their Valuation

We are currently part way through the last quarter of 2017 results season for the US corporates.

Crucially, this will become the benchmark data as it will be the last on the pre-Trump tax basis.

We have only had about 50% of results but critically we have had the banks, oil and big tech including the FANGs.

The numbers are very impressive. In the last 12 months operating earnings grew by 16.8% and forecasts, with the tax cuts added, is for growth in 2018 to accelerate to 23.4%.

A rough rule of thumb is that reasonable valuation (Price/Earnings ratio) should be 1.5 times the rate of earnings growth.

On a historic basis this is 1.35 times and on a forward basis 0.79, which is very cheap.

These numbers are so strong and outside the “normal range” that there is an element of doubt surrounding them.

Thus, if the forecasts prove to be remotely accurate then there is substantial valuation support for the US market, which is currently the most expensive one, but also the one that leads the way.

Healthcare and the 4th Industrial Revolution

Whether it’s the NHS or Obamacare in the US, healthcare is a massive cost for mature economies.

It is a political football that could easily absorb every penny of tax revenue and still not be perfect.

So when three billionaire goliaths of US industry, Warren Buffet, Jeff Bezos of Amazon and Jamie Dimon of JP Morgan get together to develop a new lower cost healthcare initiative then the world has to sit up and take notice.

A combination of using technology for diagnosis e.g. Skype to interact with your GP, Alexa to check your heart rate, with Amazon delivering prescription drugs to your door is just one scenario. Artificial Intelligence could be used to speed diagnosis, coupled with Amazon’s buying skills to drive drug costs down.

A combination of vast capital and bright tech brains focusing on healthcare services that have operated in the same way for decades, has the prospect of being truly “disruptive”.

The big tech companies are showing that as they move into new areas their immense skills can improve service delivery at significantly lower cost.

This is yet another example of how the 4th Industrial revolution will transform our lives.

Markets

Bonds: It is inflation that we have to worry about, recently we have seen the first signs that US wages are starting to rise.

This has been the missing part of the interest rate/inflation conundrum.

If wages are returning to normal then so should interest rates.

They are simply too low for the current rate of economic growth. US 10 year Treasury Bonds are approaching the key 3% yield level.

In 2008 they were 5%.

UK Equities: As ever the FTSE 100 will follow what is happening in the US markets. The pound has rallied as Brexit seems to be getting “softer” but this could easily reverse if money starts to flow back in the dollar, attracted by the higher Treasury yields.

For the UK it remains not Brexit but politics, Corbyn is still scary for markets and May seems to be surviving only because she is the “fall guy” for the Brexit talks.

Global Equities: If markets do correct then the Far East and Emerging markets tend to fall slightly more, it is simply the nature of high growth markets.

The long term structural argument for these areas remains compelling.

Summary: Long term bull markets are like relay races, they are made up of legs or sections, for each part of the cycle there are different drivers.

We are at the stage where the low interest rate runner is now out of breath and needs to pass the baton onto the final runner.

This one has earnings growth on the vest.

These earnings, as shown above, are so healthy that the market does not actually believe them. But then again, the market thought inflation was dead, it isn’t and as such we are entering a tricky transition phase.

The markets will now become even more obsessed with economic data; this will drive bonds. If inflation really does accelerate from here, that will be a problem and the cycle will have to turn.

For now though, we remain overdue for a short term correction as there is too much froth in the markets.

January 2018

Click Here for Printable Version