2014 started with much optimism, perhaps a little too much optimism? Whilst the global economy is showing steady progress the start of the Taper was always going to cause dislocations as various “false markets” that were supported by QE rather than fundamentals, lost their support.

Warren Buffett has famously said in the past “when the tide goes out you get to see who was swimming naked”. As the tide of QE slowly abates it is the currency markets and thus the peripheral bond markets where the signs of distress are now being seen. The first casualties are those economies where there is political instability as well, Turkey, South Africa, Thailand and to a lesser extent Russia have all seen their currencies come under speculative attack.

The self-congratulatory tone from many market commentators who have only recently moved back into equities has suddenly disappeared and there is a bit of fear rather than greed in the air. For us as long term investors this is actually good news.

Market Corrections

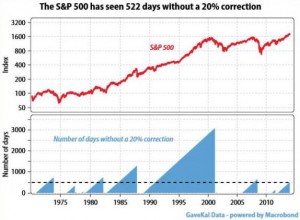

expected. We have had a very good, but not exceptional, run in share prices and it is over 500 days since we have

experienced a decent and healthy correction. Why healthy?

Markets need to zig and zag, it allows the traders and the “hot money” to recycle, it prevents “bubbles” forming and lessens the odds of a crash when the “bubble” inevitably pops, which is what happened in 1987 and 2000. So as the QE tide goes out, whilst there may be a bit of fear, history shows it can be a good thing.

Emerging Markets

This is a catch-all phrase that essentially covers all markets that aren’t developed, i.e. not USA, UK, Europe, Japan, Canada and Australia. Recently we have had various acronyms that attempt to define them better BRICs (Brazil, Russia, India, and China) or MINTs (Mexico, Indonesia, Nigeria, and Turkey). Fundamentally, what these markets have in common are very large populations and economic growth levels that are much higher than average as they undergo industrial revolutions.

China is at the epicentre of these markets as it has few raw materials and has to import from countries such as Brazil and Russia. Both of these economies are based on exporting oil, gas, minerals, lumber and food to China.

Companies such as Vale and Petrobras of Brazil and Gazprom of Russia have grown to become bigger than the majority of FTSE 100 companies. But the current issues are not with these massive companies but with what are classed as Emerging Market Government Bonds. This is not a China story but a QE one.

Carry Trades

These are currency and bond trades where speculators take advantage a combination of low interest rates and favourable currency to borrow money in one economy, such as the USA with its very low interest rates, take the money and buy high yielding bonds in another country, such as Turkey. As a speculator you borrow at 0.5% receive say 10% in Turkey and also make money on the exchange rate as the Dollar has been relatively weak. Good returns for minimal risk.

Until QE ends, which means interest rates may rise, the Dollar starts to get stronger, then because of political instability the Turkish Lira begins to weaken, a combination that squeezes your profit. The herd starts to move money and so a snow-ball effect sets in, the bonds you are holding fall in value and the carry suddenly becomes unprofitable. A domino effect then sets in with other similar economies, such as South Africa and Thailand.

The currency speculators then scent blood and start to sell currencies where the Carry Trade exists. This is just the natural flow of money in markets. It only becomes an issue when currencies fall to the extent that the underlying economy collapses and this drags down global growth.

This could happen, but at the moment we are long way from it, but risk always arrives quickly and as such we should be wary. As we headed into 2014 all the brightest brains on Wall St and Threadneedle St were saying that bonds will fall as QE comes to an end. So far the reality is that the Taper has added an extra element of risk to the markets and so as usual there has been a flight to safety and January has seen old world bonds being in demand, exactly the opposite of all predictions. This is why we have “Balanced” portfolios.

Oil

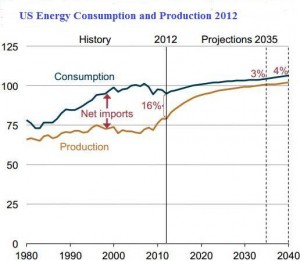

be imported. Recent projections, however, have shown the benefit of shale oil and fracking technology to the US as this year they will actually achieve energy self-sufficiency.

US legislation prohibits the sale of US crude oil, but not petroleum products. This is boosting production at US oil refineries and US exports as well. The US is planning an enormous pipeline, Keystone XL, starting in Canada to join up all the new oil producing regions with the refineries on

the Gulf of Mexico. This is a transformational project not just for the USA but for the world.

America’s position in the world as the only current Superpower has to some extent been based on ensuring a steady flow of oil; America has protected Saudi Arabia and fought two Gulf Wars to ensure energy security. As it becomes self-sufficient will US Foreign Policy also become self-sufficient as well? There could be serious geo-political consequences of America’s use of fracking.

Markets

Markets have known that the Taper was imminent but as always the consequences of the removal of the artificial stimulus are hard to predict. But what we do know is that it has to be removed for healthy long term economies and thus markets. QE means that prices for the past few years have been false and we will now have to go through a period of “price discovery”. Markets are like auctions the real price is what someone is prepared to pay.

Luckily, valuations are still reasonable, in the Old World at around 14x profits and screamingly cheap in the New World at 9x profits. This provides a cushion for buyers. We do, however, need the key market support to move from QE to profit growth. We have just had the US 4th Quarter 2013 corporate results and they have been a bit mixed.

So that potential support is perhaps not as strong as it needs to be and has yet to catch up with GDP growth. That means we are possibly in for a few months of “normal” volatility. The problem is we have become used to abnormal, minimal, volatility so the press will undoubtedly be full of scare stories. But markets ultimately need low valuations and good profit growth to progress.

We have the low valuations and we should get the profit growth as US accelerates and Europe recovers. But we are not there yet, so as the Taper tide goes out there will be casualties. January has been termed a “taper tantrum” and many will remind us of the old adage “so goes January so goes the rest of the year”, but we need to remember that the removal of QE is good news, as for the first time since 2008 we can say that markets are returning to normal.

January 2014

Click Here for Printable Version