January has been a strong month for equity markets with gains of around 4%. Why are the stock markets going up? In the good old days when a grumpy old stockbroker was asked such a question the standard answer was “because there are more buyers than sellers.” The reality was and still is that this answer is of course absolutely right.

Share prices are dictated by the market, they can be cheap but they will stay cheap unless buyers have the confidence to invest and importantly keep investing their cash flow.

As the US stepped back from the “Fiscal Cliff” and China produced more data indicating growth the asset allocators across the whole of the investment management industry looked at their portfolios and tried to guess where the best balance between risk and reward would be in 2013.

With European worries dissipating (for now), corporate profit growth holding up, share valuations cheap and bonds expensive, it then became an easy decision to make.

Some money flowed out of bonds and into global equities.

Cash Flow

According to US research firm TrimTabs $39billion dollars have been invested in equity funds during the first 10 trading days of January (just in the USA). This can be compared to a mere $18 billion during the whole of January in 2012. Similarly, another firm Lipper reported that $18.3 billion was invested in US equity funds over the week to 9 January, “the fourth largest inflow since 1992, as the US fiscal cliff deal encouraged some investors to put their money to work in the market”.

These numbers add to a mounting pile of evidence that institutional investors may be beginning to move money from bonds to equities. While the numbers quoted differ between different research companies, the trend remains the same. This rebalancing, if it continues, could be significant.

Again, according to Lipper, there remains $1.78 trillion in US cash funds, compared to $2.23 trillion held in equity funds. If this money continues to flow into the markets then we get the final piece of the investment jigsaw falling place i.e. below average valuations, above average growth and more buyers than sellers.

Cameron and the European Union

David Cameron in a keynote speech has raised the possibility of an “in or out” referendum on the UK’s or possibly (depending on Scotland’s own referendum) just England’s role within the EU. This appears popular with the electorate and his as well as the Tories standing in the opinion polls have risen accordingly. As is often the case with politics nothing is actually very clear.

Is this a negotiating ploy for a two-tier Europe with the UK acting as the cheerleader for non-Euro countries? Is it a dash for freedom away from the EU altogether, with trade barriers being erected and the Royal Navy evicting French and Spanish trawlers from UK waters or as is more likely some sort bodge in-between? What would then be the implications for the UK economy?

Whilst the natural instinct for many voters is perhaps more anti Europe than pro, this will be tempered by the financial implications of withdrawing or stepping back from the club. What this cost will be is very difficult to calculate.

Some industries will be winners some will be losers. A lot will depend upon any trade deals that are struck if we do leave the EU, but the world is very different place than when we entered the then EEC. Now there is the World Trade Organisation, protectionism is seen to be economically wrong and an efficient economy should be able to survive outside any free trade area.

As can be seen in the above table Europe does dominate our exports but China, India and Russia are growing rapidly and when the 2012 numbers are published no doubt they will be even higher up the league table. You could also argue that Ireland geographically is very much tied into the UK economy.

There is a direct cost of being a member of the EU but as a country we also get indirect revenue, the extent of which is hard to tell. But, this

political genie has now been released from the bottle and will be very hard to get back in.

UK Mortgages

Markets are being supported by low interest rates and QE both in the UK and USA. What will be the trigger for this to end and for us to be on our guard for a change in trend?

The key will be inflation and asset price inflation in particular e.g. house prices going up. To buy a house you need a mortgage. The banks have no cash and therefore are making it immensely difficult to get a mortgage.

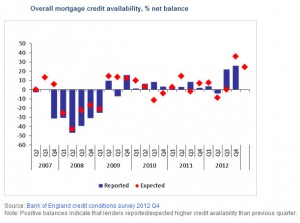

So an early sign of an impending rise in house price would come from a pick-up in the availability of mortgages.

While the Bank of England is rightly cautious there are some signs that Funding for Lending Scheme (FLS) is just beginning to work. It is worth noting that the amount actually drawn under the FLS, about £4 billion is relatively small so far.

This suggests that much of the initial benefit from the FLS has been an indirect one, as UK lenders need to raise less money from wholesale or retail sources. As this table shows mortgages are becoming slightly more available and interest rates on 5 year Fixed Rates have fallen slightly as well.

The BoE survey suggests further improvement in both demand for and availability of mortgages in the first quarter of 2013. Positive news, but it is still early days.

Markets

So goes January so goes the rest of the Year. Let’s hope this old adage continues to work. Markets have been going up in a straight line and remain at the top end of our Roadmap. Whilst nothing is ever guaranteed in the investment world, this is unlikely to continue.

Nevertheless, as cash has clearly begun to move out of bonds into equities the mind-set of the asset allocators will be to “buy the dips”. As such pullbacks based on current news should be seen as positive and not a change in trend.

There does seem to be a bit of complacency around in markets and this is when something comes out of nowhere to bite us (the “Black Swan”) so we must be careful of not being sucked into buying risk assets at a short term top.

Last year though markets continued to run until end of March so it is also possible for the same thing to happen again. But we are entering another round of “Fiscal Cliff” negotiations, there has been some trouble in the Italian banking sector and Italy is facing an election (Italian elections are rarely smooth events) so the higher equity prices go then the greater the short term risk.

We must stress though that this risk is short term and it would be wrong to be “bumped” out of equities just at this point of the cycle.

You should be aware that the value of investments call fall as well as rise and that investors may not get back the amount they invested.

January 2013

Click Here for Printable Version

If Scotland vote for independence that will leave “just England’s role within the EU” – what happened to Wales???