Click Here for Printable Version

February saw the recovery in global markets continue. The two major issues that lay behind the sharp falls during December are seemingly being resolved, or at least that is what the market currently believes.

The Federal Reserve Bank of America is “on hold” and will make future interest rate decisions based on economic data.

Furthermore,Trump seems ready to sign a trade deal with China, but as we write this has yet to be confirmed.

The bounce in Far Eastern and US share prices,as well as in commodity prices,suggest that expectations for a resolution are high. So we need to be aware that there may well be severe consequences if these high expectations are not met.

Trump should sign a deal, the Presidential election bandwagon is slowly starting, the Chinese are hurting,as are US farmers and technology companies.

It’s the start of a New Year in China and Party Congress season as well.

So the “ducks do seem to be lined up”for this critical event. But the one thing we do know about Trump is that he is unpredictable.

He is a real estate trader,they do like to walk away at the last minute, just so they can get that “little bit extra”, Trump hopefully will realise that the Chinese are no pushovers,but he might just not be able to help himself!

Earnings Growth

Share prices are a direct function of the profitability of their underlying companies.

They go up over time because so do the profits of the corporations.

They go down when the global economy goes into recession and thus company profits fall.

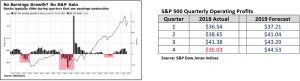

The above chart from Bloomberg clearly shows the direct relationship between corporate earnings and share prices. This is why the current slowdown in quarterly earnings is so disconcerting.

The above table shows that with 96% of S&P constituents having reported profits for the last quarter of 2018 there has been a marked (and unexpected) decline in Operating Profit per share.

However, this number is still up on December 2017. The forecast numbers do though suggest a recovery throughout the rest of the year and if a trade deal does get signed they might be too pessimistic.

A decline of this magnitude and one that is across all industries is, however,disconcerting.

What might explain the Global Slowdown?

Source:Capital Economic

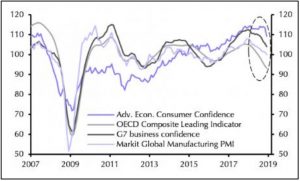

This chart shows that the global economy is undoubtedly slowing down but as Capital Economics quotes:-

“Part of the problem is that it’s often difficult to isolate the causes of economic downturns (and, for that matter, upturns) in real time. It’s also the case that the recent weakness in the data may prove to be a flash in the pan”.

They identify three areas of concern.

Firstly,a sharp slowdown in Europe. Here much of the blame can be placed on the Diesel-gate scandal, but perhaps also on French and Italian political problems.

Secondly, China and the trade war.

Lastly, a marked slowdown in investment. This may be due to higher interest rates and tighter lending by banks.

With the Fed on hold and a trade war armistice in sight these issues may indeed prove to be temporary. But we must remember that if there is any sign of inflation,particularly wage inflation, then the Fed will go back to being a headwind for the economy and thus the markets.

Brexit

As we write it is possible a Withdrawal Agreement might just pass through Parliament as Theresa May and Parliament seem to have boxed the Brexiteers into a corner?

Crucially, the currency market now applies a less than 5-10% probability of a No Deal Brexit.

In hindsight,with 70% of MPs, the House of Lords, the broadcast media, Civil Service and big business (who fund the Tory Party), all anti-Brexit,it was always going to be an uphill task to implement a Hard Brexit.

The current belief is that ultimate outcome will either be a revised version of Theresa May’s very Soft Brexit or a delay which could lead to no Brexit at all. The question has turned from,will the Brexiteers block the Prime Minister’s plan,to whether the Remainers now feel emboldened enough to push for a route that leads to no Brexit at all?

This has triggered a significant rally in the pound.

What is fascinating is that all of the various potential crises highlighted by Project Fear e.g. planes being grounded,UK companies excluded from bidding for Global Government contracts, no insulin etc. all have been quietly sorted-out in the background, including the trillions of dollars’ worth of open derivatives contracts.

The final lie of the Bank of England putting up interest rates to defend the pound has also been put to bed. The economists were right, a Hard Brexit wouldn’t have been good, but then again, would have been nowhere near as bad as Project Fear presented.

In the long term there will undoubtedly be political consequences from the whole Brexit process.

If the Withdrawal Agreement doesn’t pass, will those who voted for Brexit feel disenfranchised by the London Establishment?

How will they express their displeasure politically?

Jeremy Corbyn appears to be struggling at present as do the Brexiteers, but in UK politics who knows!

Peak Car / Uber IPO

In the USA,ride hailing companies Uber and Lyft have both quietly registered to list this year.

Uber will probably qualify to be the biggest International Public Offer ever, despite being loss making.

Lyft is smaller but equally loss making.

Why is such a high valuation being placed on what are essentially just taxis? The majority of the world’s population live in Mega-Cities such as London and New York, in both these cities the percentage of the population having a Driving Licence and owning a car is dropping. This is particularly the case amongst younger demographics.

This might be due to a “green bias” but more fundamentally it is that the mathematical cost of owning a car no-longer adds up.

Big cities have introduced congestion charges and are now penalising diesels as well. Add this to the prohibitive cost of parking, increased interest rates on Contract Hire/Purchase schemes, and heavy depreciation it simply doesn’t make financial sense to have so much capital tied up in a vehicle that might only be used for a couple of hours each day.

Renting by the hour in cities such as Moscow now outstrips new car sales.

Forecasts are that Uber and Lyft will have driver less fleets in the marketplace by 2030, with the added personal safety that such vehicles offer.

Some commentators and indeed car companies have declared “peak car”.

From here sales are forecast to decline. There will always be a demand outside the mega-cities and for “trophy” vehicles but the boom days for car manufacturers and dealers does seem to be over.

Markets

For the markets it’s all about company profits, any sign that the profit decline we have seen during the last quarter on 2018 is continuing and becoming a trend will not be well received by the markets.

If global growth is stagnating then the blame will be placed on Trump and trade war.

Hence, if a resolution is close, as it appears to be, markets will give the earnings numbers the benefit of the doubt and look through them to a potential recovery in profits. The slowdown in Europe is a concern.

Much depends on German exports and in particular on a car industry which is approaching an inflection point.

Furthermore,if Trump does sign a deal with China he will then turn on the European Union where there is presently a trade cease-fire.

Political issues in France and Italy have seen both economies go backwards at a time when the ECB still hasn’t raised interest rates and thus has very little to offer to help stimulate both structurally failing economies.

All Germany can do is hope the trade war between the US and China is resolved soon and ride on the back of the ensuing Chinese recovery.

So March might prove to be a critical month, the markets believe that a deal is imminent between the US and China and the second stage of Brexit might be resolved, we might also get some news of the various investigations into Donald Trump. We do need to remember the cycle is very long in the tooth and the US Presidential Election process is just getting going.

March2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.