February has given us more of the same with equity markets continuing to rise in straight line. This is a very rare occurrence and reflects new cash being invested on a daily basis. The only hesitancy came initially from Ben Bernanke reminding the markets that QE3 will not be here forever and then the return of Italian politics when a stand-up comedian beat Mr Bung-Bunga (Berlusconi) in the polls but not by enough to form a government. At the end of the month we did have the second instalment of the US Fiscal Cliff which was known by the equally catchy name of “Sequester” and is a much more serious matter.

Nevertheless, markets have had an excellent start to the year, amongst the sector average unit trusts Far East has been the best performer up 11.2%, UK funds up 8.5%, Global Bonds 3.4% and Corporate Bonds and Gilts flat.

The Sequester

The US for now remains the World’ largest economy and sets the tone for what happens elsewhere. Growth in the US is still very sluggish though it does seem to be picking up momentum, which is good news. What isn’t needed just now is the US government cutting back spending; the Sequester is a total of $1.2 trillion of spending cuts that has now begun. The cuts are split 50:50 between defence expenditure and other programmes and in the first year $85 billion of spending will be curtailed. The cuts were designed back in 2011 as a “doomsday device” that was so unpalatable to both Democrats and Republicans that it would force them to come together and agree on a compromise. Defence cut backs would have a big impact on companies such as Boeing and Lockheed Martin and it is estimated could knock 0.5% to 1.0% off US GDP each year over the next 10 years. The Sequester kicked-in on the first of March and despite negotiations between Obama and the Speaker of the House Boehner (a Republican) no deal on either averting or mitigating these cuts has been made. Just as in Europe politics is often the enemy of economic growth. As ever a deal will be done but no one knows whether the markets will be patient enough to wait. This is not a great time to have a political row.

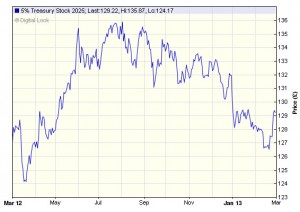

UK Rating downgrade

The inevitable happened when one of the rating agencies finally broke ranks and downgraded the UK to AA1 from AAA. What does this actually mean? Well in Moody’s opinion the economic conditions within the UK economy have not improved and the rating reflects the risk that the UK is now slightly more likely to default on its debts. In practice this is very, very unlikely to happen and Gilt investors will take little notice of this downgrade. It does have some implications for Banks and Insurance companies as the rules dictate they must hold a percentage of their assets in AAA rated debt. Whether this downgrade is of a magnitude to trigger such selling is not yet clear but in theory should be ok for now as this is only one agency, there are others that maintain the UK at AAA, but probably not for long.

It does though reflect the current mess that the UK is in, which we have written before about at length. In a nutshell we have too much debt, are not growing because the government has to tax heavily to fund the debt and the banks aren’t lending as yet so there is no growth. Until this cycle breaks the UK remains stuck in neutral.

UK House Prices

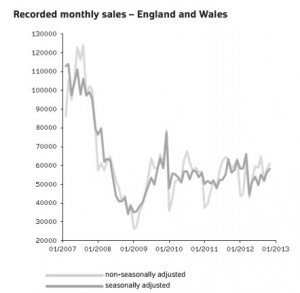

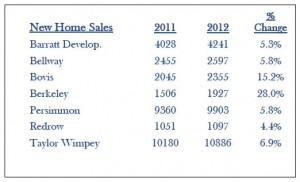

In last month’s newsletter we talked about the Funding for Lending Scheme which may be beginning to help the UK mortgage market. Here we can look at the housing market itself and see if there are any signs of life yet?

Markets

The background for equity markets remains unchanged, cheap valuations, good growth and low interest rates. Risks though did increase during the month. The Italian elections have reminded markets that the European debt problem has been deferred and not solved. The UK ratings cut has also brought other countries debt and austerity problems back to the forefront at a time when the USA is mired in political in-fighting. It is the US Sequester that could have the most fundamental impact as it will increase unemployment and take growth out of an already sluggish US economy. We were already expecting a first quarter slowdown and the Sequester may now limit the magnitude of the second half recovery.

The big indices have yet to tag new all-time highs and it feels like the markets would like to achieve this target. Much will depend on Italy and the Sequester, an early resolution of either or both could allow another rally? Cash continues to flow into equities but traders with healthy profits will have a wary eye on the exit door, particularly if profits growth starts to disappoint. There is currently no sign of this happening and thus no sign of the uptrend breaking. As always though, we have to remain vigilant, as markets love to frustrate investors.

February 2013

Click Here for Printable Version