Click Here for Printable Version

2021 turned out to be a very complex year for the global equity and bond markets. There were huge cross currents in play, the pandemic initially appeared to be passing as vaccinations kept hospitalisations and mortality low.

This meant that some governments tentatively reopened their economies. This blindsided many industries who were unable to cope with demand that returned much quicker to “normal” than they expected.

Furthermore, in many instances this demand exceeded pre-pandemic levels.

Ports were clogged up as transport companies found that truck drivers had decided to retire early, or had returned home to their birth countries and couldn’t or were unwilling to come back.

At the same time the “green energy revolution” had led to a lack of new wells and thus led to a shortage of oil and natural gas. Also, car companies, ramping up production of electric vehicles found that their orders for batteries and semiconductors had been redirected to the booming “work from home”, phone, laptop and tablet manufacturers.

Central Banks, that have for the past 10 years been trying in vain to stimulate some inflation suddenly found that it can be dangerous to get what you wish for.

Inflation shot up and preparations began to curtail Quantitative Easing and in some countries, including the UK, official interest rates rose.

But then the virus mutated, the Omicron variant spread and reminded the markets that Covid-19 had not gone away.

Underneath these complex macro events there were equally volatile sector performances.

Technology shares and “the rest” battled it out for market leadership during the year with each at times heading the race. The defining factor was the virus, during periods with the pandemic in abeyance, growth (and thus inflation) accelerated, bonds fell in value and money moved into “the rest”, when the virus came back, money moved back into bonds and into tech companies, i.e. the big winners from the lockdown.

So what we essentially have is the usual complex interrelationship between company profit growth, inflation and interest rates but for now at least, the fourth factor is Covid-19. How long this will be for cannot be forecast.

Some are arguing that the seemingly less dangerous Omicron variant is the natural progression of the virus to just another flu, the jury remains out, but if it is then the whole tone of the bond and equity markets will change significantly.

For 2022 the story, at least initially, will be the same. Covid-19 or rather the associated lock-downs will impact economic growth and will disrupt supply chains leading to inflation. Inflation could temper the consumer’s spending power just as they are flush with cash.

Central Bankers meanwhile are itching to remove the staggering monetary stimulus, but are fearful of killing the long hoped for growth just as it gets going.

Nothing is ever smooth in markets, but the pandemic and inflation will be the key factors to watch on 2022.

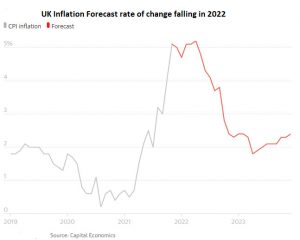

UK Inflation

“Bull markets don’t die of old age, they are killed off by Central Banks”, the governors of these institutions are all of an age where economics was dominated with keeping inflation in check.

Thus, this one economic statistic is crucial to the market’s outlook.

These charts show the UK situation, but the message is the same from other western economies as well.

Inflation numbers are currently very high and well above long term norms, however, they are expected to fall and crucially will stabilise at a higher level than before Covid and back to pre-2008 Credit Crunch levels. Why?

Much of the current inflation can be attributed to the impact of lockdowns, ships and containers in the wrong place, truck drivers retiring, supply of semiconductors being diverted and so on.

Most businesses planned for a long pandemic, the reality was that global businesses in general coped better than they expected to and the recovery came sooner and was stronger than expected.

The fact that inflation should stabilise at higher levels is primarily down to global labour shortages and high economic growth, the above disruptions should in theory be temporary, depending of course on the virus.

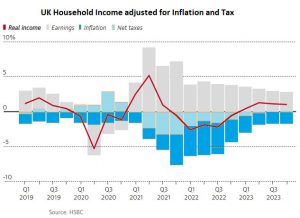

UK Household Income and Inflation

As the above chart from HSBC shows, all of the benefit of higher wages gained in the second half of 2021 is likely to be eroded by higher taxes (National Insurance and Council Tax) and from inflation, with gas and electricity prices in particular cutting spending power. The positive from this is that despite these drags on demand, UK growth in 2022 is forecast by the OBR to be over 6.5% (2% is the norm). Why?

Consumers have paid down debt and will no doubt start to build this up again and crucially these numbers take no account of wealth.

As we keep saying house prices dictate UK economic growth and these continue to rise, thus personal wealth, not just income is much higher post-Covid than before.

Energy and Inflation

It is worth looking at the energy market as this is a major factor in the global inflationary pressures.

Electricity demand is soaring and can only go higher, however, Covid-19 and an emphasis on renewable energy has cut back new exploration and existing wells are starting to run dry.

Joe Biden’s Presidency encapsulates this perfectly. His “Build Back Better” agenda has cut back oil shale production and cancelled the Keystone XL pipeline. This has removed some of the global excess oil and gas supply.

Clearly, in the long term this is the right thing to do, however, we are not there yet with green energy, electricity demand is already above pre- Covid levels and will rise further.

Estimates from the UK National Grid are that by 2050 the UK will need 339gw of electric generation capacity, it is currently at just 76gw! This is probably why Vladimir Putin is pressurising Ukraine, i.e. to encourage the Germans to ratify the Nordstream gas pipeline.

Gas will be a necessary evil for a long time yet, luckily, there is plenty of it around, but not if the oil companies don’t drill new wells.

The immediate pressure on prices caused by China “hoovering” up all available stocks of LNG seems to be passing, though it may take some resolution of the Nordstream pipeline issue before prices return to “normal”.

Interest Rates/QE….the Market’s Life Blood

If inflation stays higher for longer or indeed rises above current levels then the central banks will have to taper QE quicker and push official interest rates higher.

We have to remember markets are priced on future events not current ones. Whilst the current inflation numbers are eye-wateringly high the expectation is that they will stabilise around the desired 2.5% level.

Against this, Central Bank monetary policy remains technically in Covid crisis-mode. Some, such as the UK, Canada and Australia have moved base rates higher and the US Federal Reserve Bank has started to slow down QE bond buying but they are still in a monetary position that is at odds with the expected higher future growth levels and inflation at 2.5%.

How quickly they manage to “normalise monetary policy” is a huge question. Too quick and they kill the recovery, too slow and higher levels of inflation will become embedded and a recession will be needed to choke them off.

These are the big questions/risks for 2022

- Will the central banks make a policy mistake?

- How do they know whether current inflation is temporary or embedded?

- Is the Omicron variant the end of the pandemic and thus QE and low interest rates?

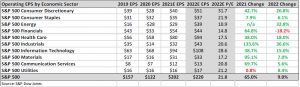

Earnings Growth: US Industry Sectors

Current forecasts for 2022 are relatively modest compared to 2021, though we are yet to get the final quarter’s results for a few weeks yet.

Expectations have been dialed back due to supply issues and the spread of Omicron. This should not be a permanent hit to profits but a delay.

If we are, as many are hoping, marking the end of the pandemic then there is considerable upside for these numbers. They also do not take into account Biden’s much delayed “Build Back Better” programme. The risk is as we have said before that the central banks tighten monetary policy too fast/too soon.

What is interesting is that valuations for the “old industries” such as Energy, Materials and Industrials remain well below the market.

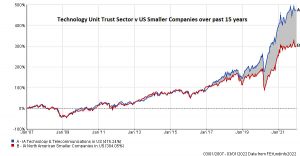

Sector Performance: Value v Growth

In recent years global markets have been led higher by just a handful of US stocks, Apple, Amazon, Facebook(Meta), Google(Alphabet), Netflix, Microsoft and Tesla. The rest have shown growth, just not as much.

These charts are just two examples…

…of a widespread relative performance pattern. The key reason behind this pattern is low interest rates and QE. The big technology companies can make money regardless of economic conditions and are highly cash generative. They act as a proxy for the bond markets.

As the global economy recovers from the pandemic and the boom accelerates then interest rates should rise, bonds should fall in value and thus the non-tech sectors should start to catch up.

We have already seen glimpses of this leadership change post the first vaccine approvals.

Whether it occurs in 2022 is of course hard to say, as it depends on the virus and thus the direction of interest rates and inflation. But such an undervaluation in markets rarely lasts forever.

Market Roadmap

This chart shows a typical Balanced portfolio built using unit trust sector averages, not actual SRS recommended funds.

It gives us a long term roadmap of how we should expect portfolios to perform. It shows that portfolios suffer in particular during recessions, however, the gap between recessions is many years.

What this roadmap tells us right now is that we are still early into the new investment cycle. It also tells us that portfolio valuations do not go up in a straight line. So at some stage we should expect a pullback of perhaps c10-15%. This is normal and just part of the risk needed to achieve long term returns much higher than cash.

Given the ending of QE and rising interest rates, markets are now dependent on just good corporate earnings, this will lead to greater volatility.

QE was abnormal and thus so were the low levels of portfolio volatility.

Investment Strategy for 2022

Bonds: The outlook for bonds depends entirely on the virus and thus inflation. Globally, yields are below the expected future level of inflation. QE is coming to an end and thus the artificial support for bonds will go.

Given these facts bonds have already fallen, but not by much. They expect the central banks to tighten too quickly and thus drag growth down to low levels.

If the central banks get it even partially right then market interest rates have to rise and thus bonds will fall further in value.

UK Equities: The FTSE100 and FT Mid250 are starting to catch up. Both are big Value plays so if interest rates rise globally and tech falls out of favour the FTSE100 with its heavy Bank, Oil and Mining exposure should do well.

The FTSE Mid 250 does have a number travel and hospitality constituents and will benefit as and when the pandemic finally comes to an end.

Global Equities: For these markets there has only been one game in town i.e. tech. Economies such as South Korea (Samsung/LG) and Taiwan (TSMC) have benefitted whilst others have lagged.

If the virus passes and growth continues to accelerate thus interest rates rise then there will be a rotation from tech to the others. Europe should do well in such circumstances. But Europe’s economic fortunes are increasingly tied to China’s and there the picture is complicated.

Far East/Emerging Markets: China is in a difficult position, their vaccines aren’t great and they will lock-down.

The economy is recovering, though actions by the government on property and tech companies is holding back the indices. At some stage this will stop and the markets will catch up.

Valuations are cheap and growth is high and accelerating but for now investors are happy to ignore these markets. This is normally a recipe for above average gains!

Summary: In the short term 2022 will initially be about Omicron, inflation and the central banks. Any removal of lock-down risk should see an acceleration of growth.

We cannot escape the fact that the staggering scale of pandemic stimulus, consumer savings and banks finally being prepared to lend again means that at some stage we will enter a sustained period of well above average growth, provided the central banks don’t decide to kill it off before it actually happens.

Politics would make this unlikely but the markets are fretting about a possible “policy mistake”.

So the long term picture looks very good, the short term is dependent, yet again, on the virus. Let’s hope we are finally close to the end of the pandemic.

January 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.