Click Here for Printable Version

For investors 2017 has proved to be another profitable year, as it passes into history investment managers now start to make forecasts for the next twelve months.

As we have said before this is a particularly odd practice, as long as investors have taken the correct advice and structured their wealth appropriately, they needn’t worry about what 2018 may bring. It is how it fits into the long term trend and market pattern that is important.

We can’t get away from the fact that markets move in cycles and this present one by historic standards is long in the tooth.

Nevertheless, as the table below shows the key to growing your wealth is to be diversified and to take the long view.

Take note of the inflation numbers, your wealth is diminished by nearly a third over 10 years.

All the themes we have covered in the various newsletters this year remain valid, Trump has changed the game, love him or loathe him he has injected some optimism into corporate America and now that he has finally achieved his tax cuts we might just see acceleration in US growth.

This is important, since 2009 the US was stuck in neutral, recently it has moved rapidly through the gears but has yet to start cruising in top.

Valuations are not cheap but are justifiable as long as company profits keep growing. In the UK, inflation has returned, it has yet to do so elsewhere in the world. It will come.

Over previous years we have sounded like a stuck record saying “growth will come, it is not different this time” as economists and investment managers said the western world has entered a “new paradigm” of permanent low inflation and low growth, it looks as if they were wrong.

Inflation is coming and therefore so is higher interest rates.

The most important event in 2017?

Whilst the media remained obsessed with Trump and Brexit, perhaps the most significant economic event of 2017 occurred in China at the closing speech of the 19th Party Conference. Here, Premier Xi Jinping, having increased his hold over the Chinese Communist Party to become the most powerful leader possibly since Mao, announced that China was ready to become a “Superpower”.

This is a very unusual statement for the Chinese to make; it is out of character, which perhaps only serves to underline its importance.

Also Trump has created a foreign policy vacuum, particularly in the Far East and the Chinese seem to have sensed an opportunity which they can exploit.

The “One Belt One Road” initiative is just one example of how China is spreading its influence.

Technologically,China now matches Europe and is catching up with the USA.

It has a model of state control and investment whilst still encouraging wealth creation and private enterprise.

This for many countries is a very attractive model and coupled with Chinese hard cash gives a realistic alternative to the US/Western way of doing things.

A classic example would be Pakistan, where Trump is holding back military aid.

China already has a strong foothold in Pakistan; it is possible that Trump’s actions will push this strategically important country into direct Chinese influence.

With a large and young population China sees a big business opportunity in Pakistan and a strategic win.

Another example of the new more aggressive China is the deal with Russia, since the end of the Second World War the US dollar has been the world’s default currency.

Commodities, oil, pharmaceuticals etc. are all priced in dollars, However, US sanctions on Russia and China’s more aggressive international stance has led to the largest energy deal in history between China and Russia bypassing the dollar completely.

All trade between neighbours China and Russia will now be directly in Roubles and Yuan. Other developments include an alternative to the SWIFT system of moving money around the globe and new development banks as an alternative to the

IMF.

The world continues to change rapidly, moving eastwards whilst the west squabbles.

This table from the Centre of Economics and Business Research shows not just the inexorable march of China but of India, South Korea and Indonesia as well.

By 2032, not that far away, China will have taken top spot, and ALL the old world economies moved down the table.

This is why it is important for a diversified portfolio to have a long term exposure to the Far East/Emerging economies.

Brexit

For us we increasingly believe that the Brexit negotiations are being choreographed and for both sides a soft Brexit is the desired and planned outcome.

The media is obsessed with every nuance about Brexit but tellingly the markets aren’t. Most fund managers before the vote were of the view that a Brexit, in whatever form, wouldn’t be good for the UK but then again it wouldn’t be that bad either.

The Brexit doom mongering does not stand up to hard economic analysis. Forecasts before the vote would be for a negative impact on UK GDP of about 0.5%; but possibly a long term positive IF the UK adopts a fully free trade approach.

Since then despite all the news flow, the most recent forecasts say exactly the same thing.

The problem with Brexit is not economic but political.

Can any agreement pass through Parliament, or will it precipitate a General Election? The odds of a General Election before a Brexit agreement vote appear small, as it would seem there is currently little political advantage to be gained by forcing an election now.

Let Theresa May do the tricky job and take the flack, but with UK politics who knows! What we are effectively doing here is assessing the risk of Jeremy Corbyn and a hard left Labour Party running the country.

It is a possibility, though Corbyn, despite a strong showing in the last election, was miles away from a working majority, He won in places Labour shouldn’t have won and lost in places Labour used to win.

We would assume his success in the South East is based on Brexit so if the expected soft deal is negotiated he may well lose out to a lower tax party?

Mathematically, to win a working majority he would need to win in the pro-Brexit shires and take back the old Scottish Labour seats from the SNP, which is a big ask. But it does highlight the possibility of another coalition government, this time with the SNP?

Corbyn

Economically what is the problem with Labour’s manifesto?

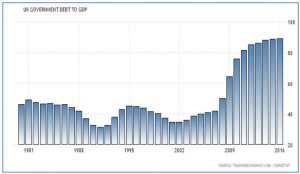

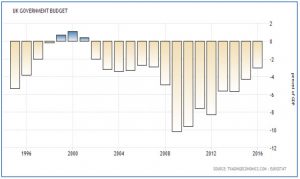

In a nutshell it dramatically increases government spending at a time when the present Conservative government is still spending more than it is receiving in taxes, and debt levels are high.

So if we ignore the politics and simply look at the maths then Labour’s spending plans would give the markets a problem.

1970s economic policies will be hard to translate in the 21st century.

The plan is to increase taxes on big business and the rich. But as Ireland has found with Apple, corporations are very happy to move tax domicile at the drop of a hat.

Following the EU tax investigation Apple is now based in Jersey for tax purposes.

It will be virtually impossible to push up UK corporation tax rates significantly, especially when they are being cut in the USA and Europe.

As for the super-rich, as Cameron and Clegg found when they increased the top rate of income tax to 50% the amount of cash actually raised went down, reduced the tax to 45% then the revenues went up.

For Corbyn to achieve his stated objectives he will have to borrow heavily from the markets, which will push up mortgage rates, as well as increase taxes for the only people who have no choice but to pay, i.e. those on PAYE, the middle classes.

FANGs and US Corporate Earnings

The rise in the US market is being driven by heavy buying of the big technology companies, Facebook, Apple, Netflix and Google together with Amazon, Microsoft and China’s Alibaba have been standout performers in the US stock markets.

These companies are not only profitable but generate huge quantities of cash, much of which will be returned to the US following Trump’s tax deal.

What this means is that in order to assess whether the US market is cheap or expensive we have to look at whether the market leaders are cheap or expensive?

Here we use Earnings per Share (EPS) to show the profitability of each company and then divide it into the share price to give a valuation (P/E ratio) which we can then the assesses to see if they represent fair value.

These numbers look to be scary, but then again they always have done. Amazon and Netflix effectively run a no profit business, for them it is all about subscriber growth.

At some stage they will turn the screw on their customers, once they have the put the opposition out of business.

Outside these two, the valuations are high but are justifiable based on the very high levels of growth.

Interestingly, the growth numbers elsewhere in the US market are rising nicely as well, this is good news, hopefully the buying will spread to the rest of the market as well.

We have written before how important oil is to market valuations and it has been relatively strong, helped by the hurricanes in the US.

It might be about to get even stronger?

Inflation and Saudi Arabia

The new Saudi King and the Crown Prince in particular are making dramatic changes.

This historically conservative state is trying to make a leap forward, and reduce its reliance on oil.

The crackdown on corruption is already starting to raise billions for the public coffers and negotiations are still taking place over the future of Kingdom holdings.

But with this economic progress comes geopolitical risk.

Saudi Arabia is deeply concerned about the increasing influence of Iran. It is fighting Iran directly in Yemen, and with Iran supporting Russia in Syria the Kingdom appears to be prepared to put its worries into action.

The blockade of Qatar, political problems in Lebanon, Trump’s decision to move the US embassy to Jerusalem and unrest on the streets of Iran all seem to be somewhat coincidental.

There have been suggestions that the Saudis might even fund Israel to take on Hezbollah in Lebanon. Oil is not the big deal it used to be but a war between Saudi Arabia and Iran would not be welcome. A sharp increase in crude oil prices would be good for the US economy, with its shale oil, but it would be inflationary globally, that would be an issue.

Investment Strategy for 2018

Bonds

It is inflation that we have to worry about, Bull markets are killed by Central Bankers, they have no reason to kill this one as inflation remains low and show little sign of accelerating.

But it will come, just nobody knows when. Interest rates will continue to rise around the world, the US as ever is leading the way and as ever Europe is lagging behind.

In the UK we have the Corbyn risk as well.

Bonds remain expensive and we have concentrated portfolios on the short dated, short duration end of the spectrum and so far see no reason to change this stance.

UK Equities

The FTSE 100 is driven not by the UK economy but the global one.

It has lagged because of the industrial mix of the largest holdings, Oil, Banking, Mining and Pharmaceuticals dominate, there is no Technology.

The pound drives short term moves, any Brexit inspired weakness does lead to a boost of buying, but if we are right that a “Soft” deal is the most likely outcome then in theory the pound should recover.

For the UK it’s not Brexit its politics, any hint that Corbyn has an opportunity to get into number 10, will frighten UK markets.

Global Equities

It is very unusual to get the four big economic blocs of the USA, Europe, China/Far East and Japan growing together, this is a powerful combination.

If we also think structurally, half the world’s population in China and India have a GDP per capita well below that of Greece then we have a very healthy long term background for global investment.

Clearly, there is the risk of war between North Korea and USA, South Korea and Japan but so far it is a risk rather than a reality.

Corporates around the world are starting to invest for the first time since 2008 and banks are back lending again, we seem to have finally returned to “normal”. We continue to concentrate client portfolios in Global and Far Eastern equities.

It is structurally the “right” thing to do. Long term the world is swinging away from the USA and towards China, we must use this to our advantage and invest appropriately.

Summary

Investment managers and economists are often guilty of behaving like children on a day trip, for years we seem to have been saying “are we nearly there yet” and now that we are here, we are asking “is it time to go home?”

We are presently in a very strong bull market, but as ever such markets rarely have strong foundations, this one will continue as long as inflation stays low and earnings continue to grow nicely.

This is the perfect environment for companies to make profits and share prices should rise to reflect this growth.

However, if inflation rises too fast then the Central Bankers will call the end of the party and the cycle will turn.

We have no sign of this happening at present. Most forecasts suggest another two years at least before the probability of this increases.

There are lots of geopolitical risks out there, Russia, Italian General Election, Merkel, North Korea, Saudi Arabia/Iran the list seems endless and growing each day! Will Trump be impeached, what about his infrastructure plans?

All are important, but for the markets as long as inflation is low and profits keep rising they will just be a sideshow.

December 2017

Click Here for Printable Version