Click Here for Printable Version

August for the global bond and equity markets could be summed up in three words, Delta, taper and China. These are three separate topics, but they are each connected to the key market drivers i.e. inflation, interest rates and corporate profit growth.

The tapering of Quantitative Easing (QE) would tighten monetary policy and would normally precipitate a rise in market interest rates.

The US Federal Reserve Bank was expected to start tapering by the end of the year as the Covid-19 pandemic passes and inflation is at a rate higher than expected. However, as the Covid Delta variant expands across the USA, then it raises questions, has the pandemic fully passed, should the planned reduction in QE go ahead?

So at the moment bad virus news might possibly be seen as good news for the markets.

Against that we have the worry that inflation is rising globally. Furthermore, Delta has arrived in China and caused an immediate lockdown of one of the world’s busiest ports at Ningbo.

For a global economy already suffering from supply disruptions this was not welcome news.

At the same time President Xi of China has begun a crack-down on China’s huge internet industry and started a drive to equalise wealth.

This is important as China is the main driver of the global growth, if China doesn’t grow then neither does the rest of the world.

The big risk to this Bull market is inflation and this is why all eyes are the supply disruptions with the nervous hope that these issues are truly “transitory”.

Global Transport

After the global lockdown the supply of shipping containers has fallen short of demand, particularly where and when they are needed most.

According to Container xChange there are approx. 25 million containers in use worldwide making 170 million trips a year plus another 55 million trips empty on return voyages. Historically, the system has worked fine, but like all aspects of “just-in-time” globalised business, it has proved to be vulnerable to the sudden disruption of the pandemic.

Furthermore, the varying speed of recovery across the world has created a container shortage, with empty containers stuck in locked-down areas.

Thus, there is now a particular shortage on the busy China and America/Rotterdam routes.

There are also backlogs at US ports, with uncollected containers and ones that missed sailings clogging up storage parks, this is being compounded by dockworkers quarantining and shortages of truck drivers.

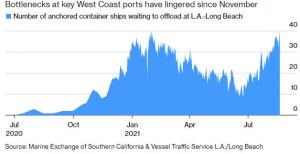

As the below first chart shows, at the busiest port on the US West Coast, there are on average, in excess of 30 container ships queued up waiting to unload at Long Beach. At the end of August this has risen to 44 vessels.

These delays mean that some ships will skip further route stops and thus some goods are now routinely ending up undelivered.

This global supply chain disruption was initially believed to be temporary, but it now looks like it will last into next year as the Delta variant expands in Asia.

Here vaccination rates are low and the Chinese vaccines are seemingly not as effective as the Pfizer or Astra Zeneca shots. The rise of Delta is therefore distorting factory production in Asia.

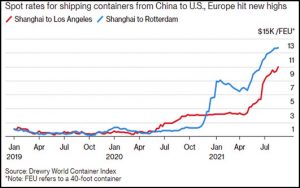

Manufacturers, already suffering from component shortages and higher commodity prices are being forced into bidding wars just to get space on vessels, pushing freight rates to record levels.

As the second chart shows, container rates have jumped over ten fold over the last twelve months.

This is prompting some exporters to raise prices or simply cancel shipments altogether.

Furthermore, China’s draconian Covid policies have meant that even a small number of cases can cause major disruptions to ports.

Last month the world’s third-busiest container port at Ningbo was shut for two weeks after a single dockworker tested positive for the Delta variant.

“Port congestion and a shortage of container shipping capacity may last into the fourth quarter or even mid-2022,”

according to container line Evergreen Marine Corp, also

“If the pandemic cannot be effectively contained, port congestion may become a new normal.”

What this means is that whilst pent up consumer demand may be at record highs, supplies are at lows and appear likely to stay that way.

Economic theory says that when demand exceeds supply then prices have to rise and that is inflation.

The consequences could be that QE is withdrawn faster than expected and interest rates rise.

For now, with Delta cases spreading across the US, the Federal Reserve Bank is inclined to see these inflationary pressures as “transitory” and say they will run the US economy, in their words, “hot”.

But Central Bankers instinctively are fearful of inflation and if these supply pressures persist and push prices to higher than expected levels, then they will find it very hard to resist raising official interest rates.

The markets, in the first instance, will do it for them by selling government bonds.

UK Transport

The Confederation of British Industry’s latest industrial trends survey found that UK factories are suffering the worst stock shortages on record.

Clearly, the factors highlighted above are partly to blame but in the UK (as in the USA) one of the main problems is a shortage of truck drivers.

Estimates from the Road Haulage Assoc. suggest that carriers are short of around 60,000 drivers.

Clearly, the heavy use of agency drivers makes these numbers hard to be accurate and is part of the problem.

Carriers tend to have a core of employed drivers and use agencies to manage peak demand. The age profile of the employed drivers meant that high numbers retired during the Covid lock-down, whilst at the same time Driving Test Centres were closed.

It is estimated that over 30,000 HGV tests were cancelled. Changes to HMRC’s IR35 self-employment code has also meant that the post-tax income for predominantly Eastern European agency drivers has dropped significantly, whilst Covid and visa regulations are currently making it difficult for them to physically return to the UK post lock-down.

This has created a perfect storm of driver shortages. Again this risks inflation and could delay the recovery. Christmas this year may well see some empty shelves!

China Common Prosperity

The other big influence on markets at present is the change in tone from the Chinese leadership.

There is a crack-down underway on the perceived worst aspects of capitalism in China.

The phrase that is being used is “Common Prosperity” (actually not unlike HMGs Levelling Up agenda). The difference is that the Chinese are taking direct action.

Restricting online education; cuts to excessive working hours; children’s access to online gaming reduced to a few hours at weekends, are just some of the measures being introduced. These were first seen as a direct criticism of the big Chinese tech companies but could also now be seen as a process that might lead to wealth taxes being introduced on the very rich in China and the

establishment of a “welfare state”.

There are lots of changes underway in China, they are starting to take climate change seriously and all this might be preparation for a slower and more realistic level of economic growth.

Markets

As traders, ministers and central bankers return to their desks from the summer break, markets are entering the often difficult Autumn period.

Markets will be looking at the economic statistics and trying to work out just how strong the global economic recovery is. Economic theory suggests it should be strong, but prior expectations that the final quarter of this year would see the start of a multi-year period of growth are being tempered.

The rising Delta variant infection rate, poor vaccination rates in some countries and global supply issues are acting as major, albeit temporary, hurdles to growth.

It is not the actual inflation numbers that matter, it is what the US Federal Reserve Bank will do in response to the numbers that counts.

They are promising to “look through” the higher inflation rates, but there is always the risk they lose their nerve. Whilst inflation and interest rates are probable future negatives for markets the good news lies in corporate profit growth.

This number has reached a 1980’s style 12%p.a. compared to c6% in the last decade and despite the above issues, shows no sign of slowing down. That is with a mixed recovery picture.

If company profits go up so must their share prices. Many investors are hoping that markets are returning to ones that are driven by fundamental profit growth rather than Central Bank financial engineering.

We are not there yet though, so for now the taper and Delta variant will dominant the market news flow.

September 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.