Click Here for Printable Version

August saw the global equity markets go on holiday. The key US equity index, the S&P500was stuck in a very tight trading range, moved only by President Donald Trump’s tweets about China, trade and tariffs. However, in the bond markets it was a very different story.

Whilst the equity markets remain fearful of missing a post trade deal rally, the more pessimistic bonds are starting to price in a cycle-ending recession.

There are lots of issues facing the global economy at present but there is only one that really matters, that is the trade war between China and Trump.

Despite his protestations,adding new tariffs and extending existing ones is having an impact on the US economy.

On the one hand Trump is saying tariffs are having no impact, yet on the other hand he is demanding the Federal Reserve Bank slash interest rates, odd?

So far the Fed is not playing ball, they do not want to be part of any negotiation strategy.

Also the economic data, which is backward looking, seems to suggest that whilst the US is slowing it is not by much and at a gentle pace.

But Bond markets have to look forward not backwards and the omens do not look good. Why should the Chinese agree a deal and give Trump a boost just before a Presidential election?

If there is a chance of a “friendlier” Democratic President why not wait?

Or indeed why not help them by skewering Trump’s hopes of an imminent deal? The Bond markets have taken this view and think the US and thus global economy will deteriorate from here and the Fed will have no choice but to slash rates.

The markets think the Fed will have to cut by a massive 1% i.e. nearly halving the current US interest rate.

Fund managers returning to their desks from the summer break will have some difficult decisions to make,do they gamble and wait it out fora trade deal or face a deteriorating economic reality?

Boris and Parliament

Boris Johnson came bounding into Downing Street exuding optimism and offering a “can-do” attitude. But as we have repeatedly said, especially after Theresa May’s disastrous snap general election lost the Conservatives a Parliamentary majority,to achieve anything at all he will have to gamble on another General Election.

He knew this when after years of prevaricating he and his supporters forced Theresa May from office and grasped the “poison chalice”.

His first Parliamentary act was to prorogue (suspend) the House of Commons for what was only effectively a few days.

This unleashed a storm of criticism and inflamed the Remainer element of his own party but also oddly left a window through which a No Deal bill could be passed, why, surely he and his Machiavellian advisors knew this is what would happen?

Maybe the answer is that Boris’s priority is not Brexit, what he wants is to have a majority and is not prepared to wait until the next election is due.

On that basis the bruising events in Parliament, so far losing every single vote,is just a means to an end. He needs Jeremy Corbyn to take the bait and agree to an election and as we write so far he hasn’t done.

He is using the excuse to wait until after the No Deal Bill becomes law or even after the 31st October Brexit date, but at some stage he will have to and at that point Boris will have got what he really wanted.

The Coming UK General Election

The facts are we have a country split in half for and against leaving the EU, indeed three years after the referendum changes in demographics means that the percentage has probably swung towards Remain.

However, a General Election is based on constituencies not the percentage of voters and it is pretty clear from both the European Parliament and Local Council elections there looks to be a significant majority of constituencies in favour of Brexit.

It seems therefore simple, a vote winning strategy is to be pro-Brexit.

However, in British politics all is not quite so straight forward.

It is possible the pro-Brexit vote could be split by the resurgent Nigel Farage and his party.

It is also possible a Lib/Lab/SNP pact could be agreed in order to promote tactical voting.

Boris has also seen his successful leader in Scotland Ruth Davidson resign.

What if some of the sacked Conservative Remainers stand as independents and win their seats?

In theory it should be an easy win but then again that is what Theresa May thought as well!

So as investors we are back to the real risk of Brexit, as we have said all along,it creates a path for a hard left Labour government with all of the very negative economic consequences this brings. So Boris is making a reasonable bet here, but he will need to execute a perfect campaign and persuade Farage and his party to give him a clear run at the Leave voters.

Recession Watch

But Boris might just have his timing very wrong. Trump’s trade war has led the Bond markets globally to indicate that recession is imminent. If the US economy falls into recession,as Germany is already close to doing,then Boris will have an economic problem.

A No Deal Brexit would be bad (just not as bad as painted by the media) but timed with a global recession would not be at all good. Who is right,is it the optimistic equity markets or the pessimistic bond markets, only time will tell.

Global Purchasing Managers Index

The PMIs are the only forward looking economic statistics we have.

The first chart show the global picture with the collapse of Europe since mid-2017 the most striking.

We can see the delay that economics gives us as it is only now, two years later, that Germany is entering recession.

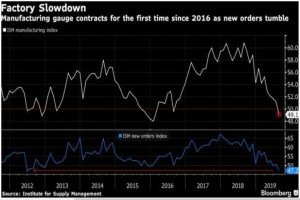

The real concern is in the second chart, this is USA, which had been bailing out the global economy, there has been a sharp fall in the index since the beginning of 2019 with new factory orders in particular collapsing. Normally such slowdowns are caused by Central Banks putting up interest rates but this time it’s due to the trade war with as yet no counterbalancing interest rate cut from the Fed.

Markets need and are looking for progress on both fronts and soon.

Gold

One of the consequences of the rally in US Treasury Bonds is the return to favour of Gold.

Gold is not an investment,it doesn’t pay interest or dividends and can’t be properly valued. No one needed to buy gold, your money was safe in US dollars and Treasuries gave a healthy 2% plus rate of interest when US inflation was c1.7%.

But the 5year Treasury now yields only 1.35% and some pessimists out there are suggesting the yield will fall to zero or even below. Hence with no inflation protection the smart trade has been to jump on board gold. Indeed,Central Banks are doing the same,if Trump is devaluing the dollar as the global reserve currency what else is there, other than gold? But gold is always a risky trade,all could change on a sixpence. However, the rise in gold is another red flag amongst many at present.

Markets

Equity markets are being driven at present by the Trump tweets and the Federal Reserve Bank of the USA.

As we write markets have been encouraged by the scheduling of trade talks at high level in early October. Hopes are also high the Fed will slash rates at the meeting on the 18thSeptember. Any delay to either of these events would not be well received.

All eyes will be on the economic stats for any sign of an accelerating slowdown.

The problem with economics is you don’t know you are in recession until you are well into one. Indeed we may already be there, the bond markets certainly think so. If we are then there is one man at fault, the danger in playing political games is there are always consequences.

Boris Johnson is playing a particularly high stakes game at present, but he had no choice, he was boxed into a corner and has come out fighting. We are in for an interesting few rounds to see whether he is finally able to land the knock-out blow that clears the Parliamentary log jam.

September2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.