Click Here for Printable Version

August has seen volatility return to markets, though the actual percentage move is still way below historic levels.

North Korea, Trump’s various non-PC comments and share prices not reacting to good news all led to modest returns for global indices.

The euro remains strong as investors top up on European assets.

But this isn’t good for German exporters and with the big car markers diesel scandal now being a major election issue in Germany the buyers have looked elsewhere in Europe. In the USA, the economy has yet to see any negative impact from the lack of Trump stimulus.

Growth is still below where it should be, but it is still respectable enough for the Federal Reserve Bank to want to raise interest rates further.

They also want to start reducing their balance sheet, which would have a similar economic impact to raising interest rates, but is struggling to find an excuse to do so.

There is still no real inflation in the USA. The impact of Hurricanes Harvey and Irma may push gasoline prices up but this will be temporary and the Fed normally looks through such short term events.

The problem remains that whilst the US and UK, are creating lots of jobs, they are, in the main, poor quality ones.

The jobs people are taking are simply not good enough to give them the confidence to go spending.

If Trump gets his economic plans through this might yet change, but as each day passes the likelihood of his plans being diluted or cancelled get greater and greater.

In the meantime the Fed wants to start running down its QE balance sheet.

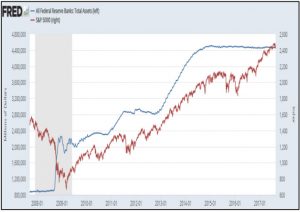

Central Banks Balance Sheet

Source: St Louis Federal Reserve Bank

Source: Tradingeconomics

We have shown this chart before; we repeat it because this is what is dominating market worries at the moment, why? We have reached the point where the US Federal Reserve Bank is planning on reducing all the bond assets it bought through the various QE programs.

There is an assumption in the markets that share prices have increased mainly because of the Fed’s bond buying; therefore as it goes into reverse, might share prices do the same? As the top chart shows there is remarkably similar pattern to the size of the Fed Balance sheet in blue and the S&P 500 in red.

No one really knows if the US is strong enough to cope with a combination of higher interest rates and a reduced Fed balance sheet.

The mechanics are complicated, but if the Fed does reduce the size of its balance sheet then that reduces the supply of money into the economy, banks will have less to lend and the impact would be very similar to an interest rate increase.

The present conundrum is that as unemployment falls, inflation usually rises. New jobs normally mean greater consumer spending and borrowing thus stimulating growth and then inflation.

Now, perversely, as unemployment has declined and growth accelerated, inflation instead of rising has actually fallen and is staying stubbornly low.

If there is no inflation then there is no excuse to raise interest rates. There are increasing mumblings amongst various market commentators that the cycle is coming to an end, and a recession is due.

We are certainly, on a historic basis, overdue one, but recessions are caused by central banks pushing up interest rates to choke off inflation.

Given there is no inflation, they have no reason to raise interest rates significantly. It may well be the recovery is so anaemic that even the so far modest rate increases might be enough to stop growth.

But this would be a very mild recession.

Perversely, the hurricanes may help, rebuilding will stimulate proper jobs (not picking for Amazon or making lattes for Starbucks) as many as 50,000 cars will need to be replaced!

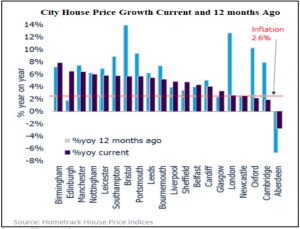

UK House Prices

Source: Hometrack

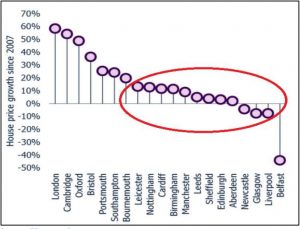

Source: Hometrack

You don’t have to be an economist to know how important house prices are to the UK economy.

Consumers are happy to take on debt and spend knowing they have substantial free equity in their property asset.

Also, as a mature economy,much of our economic growth is based upon asset inflation and the transfer of wealth down the generations.

We know that high end properties in London have been impacted by George Osborne’s tax changes and have been further hit by sanctions on Russia and now the possible exodus of bankers following Brexit.

Worryingly, it appears that the London property slowdown has started to ripple out to the commuter belt, as low affordability and overpricing has led to a sharp increase in the number of homes having their for sale prices cut.

New research by estate agent HouseSimple has found that cities and towns surrounding London have reported a bigger increase in reduced property prices than anywhere else in the country.

For example, in Reading, 44% of properties for sale have been reduced in price since they were first advertised.

Nevertheless, as these charts from Hometrack show, house prices across the UK are still increasing, but at a generally lower rate than last year.

Many cities though, as the second chart shows, have barely moved in prices since before the financial crisis.

Indeed some such as Newcastle, Glasgow and Liverpool are still below 2007 levels!

This is a complicated and mixed picture, can London prices fall and it not impact the rest of country and thus the economy, probably not.

Markets and the 7 Year Itch

The 7 Year Itch was a film made famous by the presence of Marilyn Monroe.

Since 1907, with the sole exception of 1927, years ending in 7 have the worst July-December returns, reporting an average stock index decline of just over 9%.

What could cause such a dip in 2017? The underlying market metrics remain good, profit growth and thus forward valuations are reasonable, however, has the Fed raised US interest rates too early and will they go too far?

Also,Trump is being emasculated by his own party and whilst this restricts possible market stimuli it also makes Trump far more unpredictable.

Therefore we need to watch for a slowdown in the US economy or a policy error from Trump. Reaction to North Korea is a big market risk and is one of those binary events that can’t be planned for.

But if the US does slow then it may actually help to remove the political log jam, so ultimately markets should be just fine, it would be the journey that could be more volatile than of late.

September normally sees the end of the summer doldrums and the US is running out of cash.

Trump has sidelined his own party to do a deal with the opposition for a short term debt ceiling increase.

There will be political consequences from this. Add in North Korea, the German Election and the Fed planning to run down its balance sheet then there are plenty of risk events for the markets to worry about.

As investors we do have to remember that volatility is healthy and we haven’t had much of it until recently.

The cycle is mature and the geopolitical picture is unclear. But we have to be wary of being too pessimistic, Trump walking or being pushed from the Oval Office or if he finally gets his tax cuts through may well see enthusiasm return to markets.

The short term outlook though might be best described as messy!

August 2017

Click Here for Printable Version