August has seen global markets becalmed.

Volatility has dropped to low levels and the trading computers have been happy to maintain the trend. Global equities remain the “least bad” investment according to many commentators, but there are also signs that the US economy might just be starting to grow again. We have seen many of these false dawns over the past few years yet this one might just be real enough to warrant “further normalisation” of the US official interest rate.

Whilst rising rates would be bad news for bonds, as long as the economy grows, equities should be fine, as a growing economy means greater profits and thus lowers the valuation.

Last month, we highlighted that US equities were getting pretty expensive by historic standards, this hasn’t changed, shares are however priced not on historic profits but on forward, i.e. what does the market think a company will make this year and does this make the shares cheap or expensive?

For the second half of 2015 and so far in 2016 we have had declining corporate profits, also expectations for the next twelve months have been guided down, not a good combination. Shares appear to have only held at current levels because bonds are so expensive (hence the least bad comment).

But is this changing? The data is improving, Goldman Sachs have raised their US GDP growth expectations for the next twelve months, could we be approaching a period where company profits start growing again and valuations swing from

expensive to cheap?

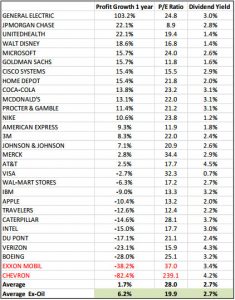

Dow Jones Index Company Earnings (source Thomson Reuters)

The constituents are ranked according to their estimated profit growth over the next 12 months.

We have also added the key valuation measure, the P/E Ratio (the lower it is the cheaper it is) and the Dividend Yield (the higher it is the cheaper it is).

What this shows is that there is a wide range of profit growth expected from the Dow constituents over the next twelve months.

There is also a wide range of valuations. Banks and financial companies such as JP Morgan Chase and Goldman Sachs are cheap, reliable defensive companies such as Merck, McDonalds, Proctor and Gamble and Coca Cola are more expensive.

The most expensive and lowest growing are the oil companies.

As we have consistently highlighted, these figures are distorting the valuation of the market.

The average for the Dow Jones over the next twelve months is for profits to grow by a pedestrian 1.7% and the P/E valuation an expensive 28.

If we strip out the oil companies growth is a far more reasonable 6.2% and the valuation drops to 19.9 times earnings with a dividend yield of 2.7%.

A combination of numbers which is not screamingly cheap, but when the 10 year US Treasury Bond only yields 1.5% is actually not that bad.

However, it all depends on whether growth is maintained or even accelerates.

That is why the economic stats are so important, one feeds off the other.

Also, if oil continues its recovery, then the energy companies’ distortion turns from a negative to a positive.

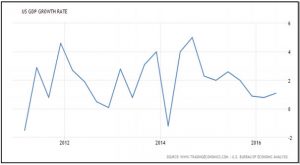

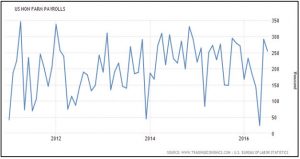

Whilst the economic data has picked up, the US economy it is not exactly booming.

Recent comments from individual Fed Governors as well as Chair Janet Yellen have raised the possibility of a further increase in US interest rates possibly in September but more likely in December (depending how the Presidential Election goes).

However, as the following charts show all this improved data is doing is taking the US economy back to the flat trend of the past five years.

So the US economy hasn’t really improved at all.

There is some data that suggests there is underlying strength but this is not an environment, as yet, where inflation (and thus interest rates) could suddenly take off.

Harley Davidson

Our favorite indicator for the strength of the US consumer remains the sales numbers of Harley Davidson motorcycles.

Nobody actually needs a custom motorcycle; they are an indulgence buy, but they are affordable for large numbers of US consumers.

Sales collapsed in 2008/09, have recovered nicely since then but are still below pre Credit Crunch levels.

Recently, Harley Davidson reported that US second quarter unit sales were virtually unchanged at 57,804 bikes, on the face of it not good news.

The stated reasons for this flat number were a 30% fall in touring motorcycles and falling sales in oil states such as Texas and Oklahoma.

There is also increased competition. Polaris Industries has resurrected America’s original motorcycle brand, Indian, to great success.

They are eating into Harley’s sales, but unfortunately for us do not quote unit sales but did sell $231m of motorcycles worldwide in the second quarter up 23%.

Therefore, what we can say is that overall the US consumer is still spending, but remains behind 2008 levels.

UK Housebuilders

Our biggest post Brexit concern is the UK property and construction sector.

This booming area had already started to see a slowdown ahead of the Brexit vote as tax changes and Russian sanctions hit high end London developments.

Whilst it is still early days and we are in the quiet property selling season, evidence from the big housebuilding companies suggests that the Brexit vote has had no impact.

Bovis Homes said it was too soon to assess the impact of the Brexit vote and a cut in interest rates on the housing market, but that it had been pleased with the solid level of interest shown by homebuyers.

Persimmon meanwhile has seen a jump in reservations by buyers of new homes over the last two months.

Bellway said trading had remained strong both in the run-up to the vote and in the subsequent weeks, but it was too early to assess the longer-term impact.

Overall, so far, the predicted collapse has not happened, remember, new Chancellor Hammond still has the Autumn Statement up his sleeve should the property market start to drop.

Markets

As summer passes all too quickly we enter a period of increased risk for markets.

The Fed could raise interest rates in September, which is not fully priced in, the US election gets into full swing and the new UK Cabinet actually starts to do some work.

In the short term markets are not predictable, price movements are random and the next few months are going to be even more opaque than usual.

Will Trump drop out?

Could he actually win?

Will the recovery in the US continue and therefore will US interest rates rise?

What about the Italian constitutional referendum?

Will US corporate expectations be upgraded or downgraded?

What we can say is that since the Brexit Vote volatility has surprisingly dropped to abnormally low levels.

This cannot continue. The cycle is getting mature and there are several major geopolitical hurdles for the markets to get over, yet the data is telling us that the global economy is still way behind where it should be leaving us with plenty of scope for growth.

For now though, given the magnitude of the recent share price move the logical conclusion would be to anticipate a period of difficult conditions.

However, as the Harley Davidson sales numbers tell us, we still as yet, haven’t got back to normal. August 2016

Click Here for Printable Version