As summer seasonality comes formally to an end with the St Leger race on the 13th of September most investors will look back on this period with an element of confusion.

Whilst in the USA the S&P 500 index keeps hitting new all-time highs the FTSE100 in the UK has gone nowhere for over 12 months. Global markets normally work in step with one another.

Another strange phenomenon has been the performance of bonds versus equities. Remember we usually want bonds for recessions and equities during periods

of economic growth. So far this year the sector average UK equity unit trust has delivered a total return of 1.5%, for Gilts it has been 8%, Sterling Corporate Bonds 7% and International Bonds 3%.

There are powerful reasons why bonds have performed well, but we are investing for the future not for the past and the key question is do they represent good value?

This is especially pertinent as September, at present, is due to be the final month of the US Federal Reserve Quantative Easing programme as the

taper finally ends. This could also be when the European Central Bank finally puts in place a “proper” QE programme as deflation takes hold across Europe and unemployment soars to crisis levels.

Bonds

The yield on the US Treasury 10 year bond started the year at about 3% with the overwhelming view that the yield would rise as the US economy recovered and QE tapered off and came to an end.

As yield rises the bonds fall in value, so on the face of it a very poor investment. The reality has actually been that the yield has fallen to 2.4%. Why?

Big cash depositors don’t trust the banks. The Russians, Chinese and especially the Europeans still fear bank failures and Cyprus style bail-ins.

The Co-op and Banco Espirito Santo in Portugal are reminders that the crisis of 2008 has not gone away. Geopolitical risk is rising.

All banks are subject to rigorous and more stringent stress tests from regulators, so they have to buy high quality bonds for their balance sheets, regardless of whether they are good value.

Banks are still refusing to lend, instead they can borrow for nothing from the central banks, buy bonds and take a small turn for “no risk”.

Boards of Directors/Trustees remain risk averse. There is desperation for yield and/or perceived safety.

There remain limited alternatives for acceptable collateral, thus hedge funds have to hold bonds to fund derivative trades.

The “Deflationists” are still out there.

The bond markets are normally concerned with economic fundamentals, evaluating credit risk (will a country miss a debt repayment), and pricing in future inflation expectations, however, these basic investment principles have been distorted by QE. The bond market used to hold governments to account and punish them for overspending but they are now unable to compete with central bank buying. In fact, the likes of PIMCO/Goldman Sachs that used to be considered “bond vigilantes” are now part of the herd that is crowding into fixed income instruments in search of yield.

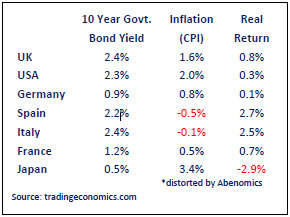

Spain and Italy are in deflation, the real return is therefore high and the Euro removes the currency risk. The big danger arises from this combination of both low absolute and real rates.

The real return, for the UK and the USA is significantly below the long term average, which over the past 110 years has been 1.4%. This means that if inflation picks up bond prices would be hit with a “double whammy”, as both the yield and real return would have to rise. Bonds are very expensive, as we have highlighted before it is far better to buy when assets are cheap.

Europe

As the above table highlights, Europe remains in a bit of a mess, low growth and deflation is not a good combination and as Japan shows not easy to solve.

This problem is not helped by the complex political structure of Europe and the limited powers of the ECB, especially when compared to the US Federal Reserve and the Bank of England. Mario Draghi the ECB Governor keeps trying to talk Europe into recovery, and has tinkered around the edges of QE doing what he can or more accurately what the Germans will allow him.

But time is starting to run out, unemployment is still rising, with youth unemployment in some countries e.g. Spain at a staggering 50% plus. Social unrest seems to be very limited but as summer draws to a close and so do “black economy tourist jobs” there should be a greater urgency to put in place measures to get European banks lending again.

“Super Mario” has not as yet delivered a broad based European recovery. Why is this important, well some 20% of multinational company earnings come from European sales, perhaps this explains why the US recovery has been so sluggish? With static wage growth in the US and thus static consumer spending power has meant that the recovery, whilst getting there, is not fully back to normal.

As we highlighted last month we should be getting consistent US growth above 4%. We need Europe to do something; the problem with the Europeans is

that they need a crisis to be spurred into action!

Banks

Banks as we have just seen are being made by the regulators to be very risk averse. Thus, they take the easy route of borrowing at virtually nothing, buy US Treasuries and make about 2% with no risk of criticism from the regulators.

But at the same time something else is going on, the US authorities are levying subjective fines on all banks including UK and European as punishment

for the 2008/9 crisis.

That is okay as long as you don’t expect these same banks that you have just fined to start lending again to stimulate the economy ahead of an election. Bank of America has just been hit with a $16.65billion fine, taking the total since 2010 to well over $110 billion, and the US regulators are not finished yet.

It does seem a bit illogical to keep the banks alive with QE and then take away their lending power with cash fines. This is on top of greater regulation limiting their absolute ability to lend.

Markets

“Being able to change borders in Europe without consequences, and attacking other countries with troops, is in my view a far greater danger than having to accept certain disadvantages for the economy,” stated Angela Merkel.

Europe is already weak, the ECB is being slow to act and now Russian aggression in the Ukraine is forcing Germany to accept some tough decisions. This could be the major theme during September.

Putin may be hoping for an early cold winter so he can literally turn the screw on Europe by shutting off the gas.

This geopolitical issue remains a threat for markets; it has not gone away and seems to be getting worse.

Markets though remain sanguine about Ukraine, many are sympathetic to Russian speaking Eastern Ukraine joining Russia, but it is just a question of how it is seen to be done? There is the real danger of a policy mistake and we need to be aware of that risk.

Oil and Gold prices suggest that the markets currently believe that risk is low. Nevertheless, the corporate world is doing very well. Despite a weak Europe the recent US results season showed profits growing by 11.7%, which considering inflation is low, is very respectable.

Imagine what they would have been if the US and Europe were growing normally?

Guidance suggests that we should expect, all things being equal, a further 11.4% growth for the next 12 months.

This would represent a current operating earnings valuation of 17.9 for the US market versus an average of 18.7 and a forward PE of 15.7. Not cheap, but then again not expensive either. So the equity markets are currently underpinned by good growth prospects and a reasonable valuation. We do need to remember that such growth expectations are just that, they are not cast in stone and can move both up and down depending on the news flow.

September brings news from the ECB, NATO summit and the end of US QE, an interesting month is ahead of us.

August 2014

Click Here for Printable Version