Nervousness returned to markets in August as a combination of a potentially “tapered” US Quantative Easing programme and Syria led investors to “take money off the table”, both equity and bond markets fell over the month. With stock and bond market volumes traditionally light, there were some notable news events. Terrible events in the Syrian civil war led to the risk of a US led retaliatory act.

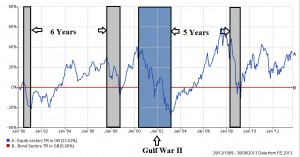

Markets remember the long drawn out fall in equity markets in the run up to the two Gulf Wars, so any geopolitical action that risks US military action has to be priced in.

The impending taper also saw cash being moved from the Far East and other emerging economies to be repatriated into US Dollars, thus causing sharp falls in currencies such as the Indian Rupee, another sign of the market dislocation caused by central bank’s cheap money. Global Equities thus fell by 2.5% and Global Bonds by 2.2%. In the UK, the new Bank of England Governor Carney surprised markets, for the first time giving forward guidance on UK interest rates and also linking them to unemployment.

Syria

So we need Equities for periods of growth and Bonds for recessions, with a 5 to 6 year gap in-between. Occasionally the cycle gets distorted and this is usually by noneconomic events such as terrorism (9/11/), war (Gulf Wars), political crisis or even a geographic crisis, such as in Japan (Tsunami).

Often during these events, the economic background remains healthy. But the uncertainty, (remember markets hate uncertainty) means that equities are sold and cash placed in safety i.e. bonds.

Syria is not an economic threat to the global economy, unlike Libya, Kuwait or Iraq it is not a major oil producer and unlike Iran is not geographically at a significant strategic location. The news that (as we write and might well be overtaken by events) the US may be considering a retaliatory act for Syria’s use of chemical weapons has caused some concern.

The risk of another Iraq/Afghanistan just as US armed forces are being cut back due to the Fiscal Cliff sequester creates the feared uncertainty, will it be a one-off “punishment”? Will the Syrians do it again, if so, does this mean another US retaliatory act, what will the Russians and Chinese do?

Will this escalate and spiral to troops on the ground? In theory, markets should be sanguine about a one-off retaliatory action, but if Assad takes no notice what will Obama do then? Remember the decline in equities compared to bonds before Gulf War 2 (as highlighted in Blue in the above chart) occurred before the actual attack. Once the invasion started, markets had some catching up to do and kept on going up until the Credit Crunch. As long as Syria does not escalate to a US invasion, which has to be unlikely, then the threat to the cycle should be minimal.

Governor of the Bank of England

After the last MPC meeting Mark Carney said the UK’s benchmark rate would remain at 0.5% until unemployment fell from the current 7.8% to 7%, or about three years. However, many economists thought this new US style unemployment threshold could mean that interest rates may actually rise sooner than suggested and so Gilts actually fell and thus market interest rates went up.

Recently though in a speech he went further stating that the 7 % threshold would not necessarily trigger an interest rate rise. The bank won’t raise interest rates until “jobs, incomes and spending are recovering at a sustainable pace.” However, there was one word that was notably absent in both statements and that was “inflation”. He simply cannot keep interest rates low if inflation grows significantly from its current level. With house prices on the up, historically the UK inflation rate usually will follow the same direction. If it does, then there is no way the Governor can keep to his promise.

The Importance of Dividends

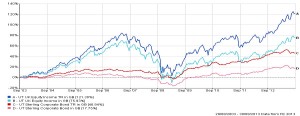

Dividends from equities or coupons/interest from bonds are a very significant part of long term investment returns. Most investors focus on the glamorous but volatile short term capital growth figures forgetting how critical these cash distributions are for their long term wealth.

Over ten years the impact of the income stream on the average UK Equity Income sector return was 121% for the total return compared to 76% for the capital only return. Likewise for the Sterling Corporate Bond sector, Total Returns were 47% compared to just 18% for capital only.

Many investors seek to or are advised to trade in and out of their holdings in order to enhance growth or protect profits, usually with limited success. But they forget the consequence that such a period “out of the market” will have on the stream of income that the portfolio would have produced had they remained invested. This is a hidden cost to trading and why long term investment is usually more valuable to investors.

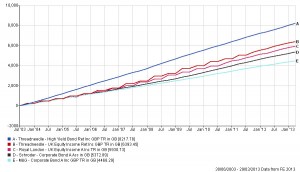

So for example, £10,000 invested in the Threadneedle High Yield Bond Fund would have generated £8,000 in income virtually repaying the initial investment, thus making the capital growth effectively “free”.

The Threadneedle UK Equity Fund which offers greater capital growth potential (equity based) has paid back 64% of a client’s original capital

investment just in dividends over the past ten years.

Markets

If August is often the quietest month of the year September is often one of the noisiest. This year possibly especially so, the US Federal Reserve Bank meets on the 17th/18th September and may endorse the start of “tapering QE3”. We will continue to get snippets of information from China concerning the reform process.

On top of this we have Jewish New Year holidays often a key inflection point for markets; Apple are due to announce two new iPhones which has the potential to boost many technology shares.

Plus we have the uncertainty of Syria. The key feature though will be the taper and how this will affect the many dislocations of cash flow in the bond and emerging market sectors. Will these develop or, as is often the case in markets, dissipate once the news is actually released?

August saw markets pulling back ahead of the taper news as investment managers and traders returned to their desks from their summer breaks. Their key decision will be, whether to use to current dip as a buying opportunity or whether to hold off and buy at lower prices. Much will depend, as always, on what Ben Bernanke says at September’s critical FOMC meeting.

31st August 2013

Click Here for Printable Version