Click Here for Printable Version

April saw the geopolitical risk ramp up, from North Korea to France and the UK, market news flow was dominated by politics and fear inducing headlines.

But, the big news was the continued back-tracking by Trump on many of his controversial election promises.

The border wall and scrapping the NAFTA seem to have been replaced by more pragmatic policies.

Has the establishment emasculated Trump? As one commentator said “Trump has turned into just another Republican President.”

Many in the UK were surprised that Theresa May called a snap General Election, regular Market View readers wouldn’t be.

There were just too many potential wins for the Prime Minister not to call it at this time. A weak opposition; weed out Tory “Brexit wets”; possibly weaken Nicola Sturgeon’s position in Scotland and gain the moral high ground over unelected European officials was just too good to resist.

Or it might have been the Court case over expenses in the last General Election!

In France whilst Macron is no Trump and has no party to push his reforms he at least is a step in the right direction for France and Europe. Only time will tell if he is a “lame duck” President, hopefully not.

But all of this is just noise, which will pass. As ever what really matters is the profitability and thus the value of the multinational companies we invest in, we are in the first quarter results season.

Corporate Earnings

As expected the current quarterly results season for global multinationals (not just the US) is proving to be good.

Big depressed sectors such as Energy and the Banks are reporting healthy earnings.

This is on top of continued progress from other industry sectors as well. So far, with 64% of the S&P 500 having announced, 12 month Operating Earnings show a healthy 12.9% increase on 2016. Estimates place the forward 12 months Price Earnings Ratio at a reasonable 17.5 and this can be compared to projected earnings growth of c20%.

Whatever else is going on in the world, the key driver for future share price capital growth and for dividends remains very robust.

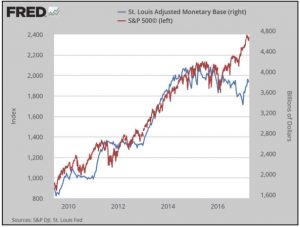

Fed Balance Sheet v S&P 500

What this means in practice is that when the bonds that it bought during the various Quantitative Easing programs mature, it will not reinvest the proceeds.

In economic terms this has an impact similar to increasing interest rates; it reduces the supply of money within the global economy and acts as a brake.

On the face of it this is good news and as the chart from the St Louis Fed shows markets have decoupled from the Fed’s Balance Sheet thanks to Trump’s promised (and as yet still undelivered) stimulus plans.

We do remain concerned about the timing of this, with market interest rates increasing and now the Fed tightening further all in advance of the Trump stimulus, it needs to come soon.

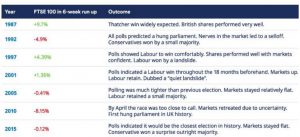

UK General Election

Prime Minister Theresa May is so far proving to be very adept at playing politics.

The feeling in the markets is that calling an election early is a smart move.

There is still plenty of time before the vote but, following the Council elections, commentators are suggesting that the Conservatives will take seats off Labour and in some parts of the country (maybe the West) off the Liberals as well.

Though in the South East where the “Remain Vote” was the strongest the Liberals may pick up seats from the Tories.

Any loss of seats by the SNP would weaken Nicola Sturgeon’s hand and make calls for a another Scottish vote easier to refuse.

So the markets are pricing in a Tory win with an increased majority but not the landslide the polls at the moment suggest.

The Conservative Manifesto, lacking the usual tax cuts or promises not to raise tax, to us suggests that the Brexit

plan maybe to go for (or at least give the appearance that the plan is for) a “Hard Brexit” i.e. no trade deal and just go for WTO terms.

Philip Hammond’s hands would not be tied like they were by the 2015 Manifesto and the UK could then aim to be the offshore, low tax, free trade economy the EU fears.

It is uncertainty that traders don’t like. They take their money “off the table” until the picture becomes clear.

Source: Schroders

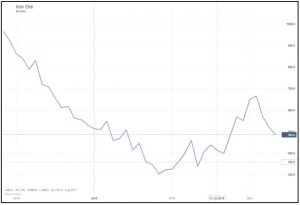

Commodities/Iron Ore

Commodities in general and metals in particular have suffered sharp falls during the past month.

The fundamental reason is mainly the same whether it is oil or iron ore, production is exceeding demand particularly from China.

Stockpiles are building and speculators, especially Chinese ones, are selling and moving to cash.

There remains lots of excess capacity; in oil the US shale producers can quickly turn the production tap on and off.

For metals much depends on demand from China, stats suggest that the Chinese economy is accelerating again but there are leadership changes due this year which will act as a drag on Chinese demand.

Any continued weakness in commodities will ultimately impact the equity markets.

Markets

Since the end of 2016 markets have had two major themes running through them.

Firstly, economic growth has fed through to corporate profit growth for the first time in several years.

Secondly, geopolitical risk is elevated; the rise in “populism” and dissatisfaction with the existing political elite has led to Brexit, Trump and now Macron.

Economic growth and a return to “normal” conditions is now the dominant theme and have become embedded in market psychology.

History tells us that no growth period ever offers us a smooth ride. There will always be fits and starts and fears that the global economy is rolling back into recession, it is these periods that for twitchy investors can prove to be very expensive.

As we prepare to enter the seasonally weak period of the investing year there is still plenty to be nervous about.

For us, the risk remains of a short US recession before the Trump stimulus has its desired effect.

Also Trump’s plans are being diluted on a daily basis in order to become law; a Budget delay would leave the market vulnerable to a pullback.

Nevertheless, the US President can be credited with changing the tone in the business world and the market rise is justified by existing economic fundamentals.

In the UK, the General Election and Brexit will dominate the news flow but neither is likely to significantly impact the UK stock markets.

One thing we need to watch is the recent sharp fall in commodity prices, they heralded the current Bull run and as we enter the negative seasonality, “sell in May etc.”, are they warning us that in the short term we have gone too far too fast?

April 2017

Click Here for Printable Version