As April passes so does the positive seasonality, but for investors the first four months has been a good one with equity returns ranging from the FTSE at 6% to the Far East with 15%.

As the summer doldrums approach has anything fundamentally changed to place the Bull market under threat? The Greeks are still in the euro for now; the Federal Reserve Bank wants to put up US interest rates but can’t justify it just yet.

In the rest of the world the financial engineering is continuing with mighty China cutting interest rates and moving into economic stimulation mode. Big name Hedge Fund managers called bonds the “short of a lifetime” and yields have now increased by 0.5%; oil is recovering, putting the inflation maths under threat. Ultimately, as long term investors we rely on the big multinational companies to keep churning out profits and paying out dividends, how exactly did they do in the second quarter of 2015?

However, the one event that dominated the news for UK investors was the General election.

UK General Election 2015

The first thing to say about the General Election is that for the UK Stock market, and in particular the large Blue Chip companies it doesn’t really matter.

Approximately 20-25% of profits come from the UK, less if we ignore the banks and supermarkets. Where it does matter is for the future direction of interest rates and thus sterling and the gilt market. But given that the Bank of England is independent interest rates will be a function of economic growth (therefore what is going on in the USA and China), and inflation.

The role of the government in UK economic success depends on taxation (i.e. how much do we all have to spend each month) and also how much debt the economy carries. If the debt is too high then interest rates have to be high as well.

Just as if an individual has high debt levels they will end paying more in interest each time they go cap in hand to borrow more.

The new purely Conservative government can, and probably will, cut the spending deficit harder and faster without the Liberals to hold them back.

This may even be to a greater extent than their manifesto pledge. This should be seen as good news for inflation and thus interest rates. Though, as we have said before, it is the US that sets the agenda.

The Conservatives are clearly the most pro-business and pro-investor party. Overseas investors will see the UK as good place to invest and “to do business”.

Personal taxation should be cut thus boosting consumer spending. Politically, the Conservatives may make a move towards Federalism for Scotland, especially as Labour is so weak. There are many advantages for the Conservatives, it splits the Labour vote, gives the SNP extra power without full devolution and also cuts government spending by potentially billions, thus filling the hole in the manifesto numbers that commentators are worried about.

The big market risk from this election is the promised EU exit referendum. This could lead to some sort of change in the UK’s relationship with the EU.

It is the risk of a “Brit-exit” that will impact on corporate earnings and thus the stock market. UK profits might be small for FTSE100 companies, when combined with EU profits then we are talking significant numbers, 50% plus.

It may also bring political risk. The Conservatives may have gained control over Parliament but it is by a slim margin.

Any spat between the pro and anti-European sides of the party, which has happened many times before, could see this margin evaporate very quickly.

Corporate Results

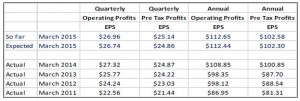

We have talked in previous newsletters about the importance of corporate earnings and also the potential for a slowdown in the rate of growth of these critical numbers. The following table shows the expected and the actual numbers reported so far.

We are 75% through the first quarter results for American companies. There was a lot uncertainty about these numbers as a combination of the oil price collapse and strong dollar could restrict corporates from benefitting from what is supposed to be a “normalising” US economy.

As the table shows the results so far have been a little better than expected, but at the Operating Profit level (pre interest costs and tax) are below this time last year. These numbers were “saved” by Apple as the results, prior to the tech leader, were actually below expectations. So in a nutshell profits aren’t collapsing but have stalled. 1.7% growth in projected annual pre-tax earnings is a bit anaemic at this stage of the cycle. The valuation is okay though, just slightly below the long term average, so if earnings can re-accelerate then the Bull market remains intact. But we also need to be wary that these numbers don’t deteriorate either.

Harley Davidson

A strong dollar allowed foreign competitors to aggressively undercut its prices, thus impacting on sales and prompting it to lower 2015 forecasts. Harley-Davidson said the discounting had affected sales in the USA and its market share had slipped by 5% as competitors offered discounts of up to $3,000 per bike and slashed their suggested retail prices by up to 25 percent.

Discounts like these have been “enabled by a dramatic shift in world currencies”. Harley thinks that the second quarter should be its weakest of the year as the full impact of the strong dollar hits home.

As such it expects to ship around 85,000 motorcycles, down from 92,217 shipped in the same quarter in 2014. This encapsulates the impact of the strong dollar on US manufacturing, Harley is optimistic, but if the dollar stays strong then our indicator of discretionary consumer spending will have turned down.

Markets

Hedge fund manager David Tepper, of $20 billion Appaloosa Management, is one of those closely-followed fund managers who have a tendency to move the market when he speaks. At a conference recently he said:

“Don’t fight the Fed…Now you’ve got four Feds. Four! Four Feds, all going one way?'”

He is pointing out that monetary policy in the US, China, Japan and Europe is easy now and will remain so whilst economies remain sluggish and critically inflation stays low.

That remains the big picture. But despite this stimulus, markets often miss-price assets. We have talked before about Bonds being overvalued, and can stay overvalued for a long time, but when the dam finally bursts the moves happen quickly and painfully.

Two leading hedge fund managers Bill Gross and Jeffrey Grundlach highlighted that the negative yield on German Bonds was at odds with a recovering European economy.

Consequently, the dam sprung a leak and European market interest rates rose by 0.5% in days, which means capital values fell.

Whilst it doesn’t sound much, this is a big move. This then has a ripple effect through other asset classes and has triggered stop-losses on equity

derivative trades, pulling down the European and US stock markets.

Thus, we finally have a return to volatility in equity markets, as we keep saying this is actually very healthy.

We are also entering a period of negative seasonality for markets, so our mindset from now on should be to expect such moves. Does it mean the end of the bull market? No it doesn’t, that will come when the “Four Feds” start worrying about inflation rather than lack of growth. We are not there yet.

There is a danger that despite the global easy money strategy, growth still remains slow and could even slow further. What do the Four Feds do then, they have gone “all-in” with QE; they have nothing else they can do, except pass the baton back to their respective governments and try good old fashioned tax cuts and government spending, which they will struggle to afford.

But this scenario is not a reality at the moment. We asked in the first paragraph what has changed in April, on the face of it not a lot, but the Dollar is weakening, European Bonds are collapsing, however, company earnings are ok. This may all just be normal noise but we do need to be careful, that as the cycle progresses, this noise isn’t a canary singing in a coal mine?

April 2015

Click Here for Printable Version