As April passes and we enter the traditional summer doldrums for markets, the big question is can the bull market continue to run on without a setback? “Sell in May and go away” was originally more to do with a long summer of social and sporting events when gentlemen stockbrokers courted clients rather than traded the markets. Transaction volumes would dwindle and prices stagnate.

In today’s more profit orientated and less sociable world the summer quiet periods are more to do with asset allocators having moved their money in the first quarter and waiting to see how their decisions have performed. Nevertheless companies keep on reporting earnings and at this stage of the cycle we are keeping a close watch on these critical numbers.

Corporate Earnings

We have talked at length before about the investment cycle and the impact this has on corporate profits. The cycle remains favourable for company earnings but with restricted bank lending and the consumer preferring to pay down debt rather than spend the global economy is not an easy place for companies to be operating in.

The US first quarter earnings season has nearly finished and has given us a clue as to real strength of the global economy. Generally, we have seen the majority of US companies match or beat analysts’ expectations which on the face of it is good. Companies had been guiding down these very expectations as the US economy remained sluggish (hence QE3) and China, whilst the government is starting to reflate, will not get back to full growth until

the second half of the year.

We need to see the average earnings of the S&P 500 continuing to grow otherwise we start to lose a key support for equities.

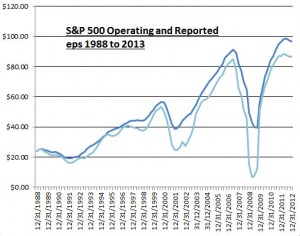

The first chart shows how the profitability of USA inc. has grown since 1988, it also highlight how severe the “Credit Crunch” was in 2008/09. The difference between the two lines is that operating profit is calculated before any interest, tax or restructuring charges are levied and reported is post all of these factors. We do appear to have a marginal slowdown but expectations are that end 2013 earnings will be north of $100 per share.

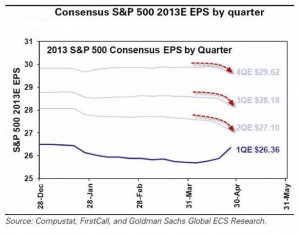

Companies have again guided expectations down for the rest of the year. However, as the first quarter results show it is a “bit of a game”. Companies like to persuade analysts to lower their forecast to a level which they know they can beat, hence the pick up in the actual numbers over the expected ones. The forecasts on the second chart would suggest that profit growth for 2013 over 2012 would be of the order of 14%.

This is probably too high given the current levels of GDP growth in the US and Chinese economies but anything around 10% growth would still be respectable. There is still hope that the various global stimulus packages will accelerate economic growth, in which case these forecasts could end up being way too low.

Harley Davidson

There are some signs of stress in markets, gold had a two day crash which knocked 14% off its value, and traders are still unclear as to the reason; especially as Japan’s massive QE programme should be good for gold? Maybe a big bank made the wrong bet?

Gold

Japan whilst hedging against any Dollar weakness by buying gold. Cyprus is though planning to sell its gold reserves and whilst this will not be enough to hurt the markets maybe other Euro countries will have to follow suit, and Italy has one of the world’s largest gold reserves?

Markets

With the passing of the results season we now enter the sometimes choppy period of May to June. Company news-flow tends to reduce and traders are conditioned to bank their profits at this time of year. Nevertheless, for equities the trend still remains intact and there are many investors holding cash who would love to see a pullback. Recent economic data from both the US and Europe does points towards interest rates staying lower for longer but this data has a time-lag, it can be many months for a stimulus such as the US QE3 to work its way into the economic numbers. With US house prices steadily rising we should in theory end 2013 with good levels of sales and thus profit growth. This means as long as consumers keep buying the likes of Harley Davidsons then the cycle should remain intact for a while yet. There may be some that sell in May but they will have to be very nimble.

April 2013

Click Here for Printable Version