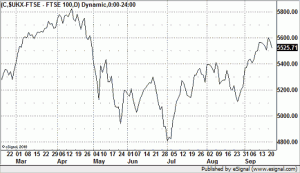

The old stock market adage of “sell in May and go away” is well known but it is actually a bit longer, most forget about the “don’t come back ‘til St Leger Day” which this year was Saturday 11th September. Would it have worked this year? Well lets be generous the recent short time high on the FTSE 100 was 5833 on the 16th April, and on the FTSE Mid 250 10773 on the 26th April not quite May but near enough. After touching a low at the end of June by the end of August both indices down by about 15% but following for once good economic news from the USA have since rallied to be down by only about 5%. So technically it has worked but in reality not significantly and we have had a huge trading range. Nimble footed traders who didn’t have a holiday this year could have made some useful gains. It also shows that fundamentally the markets are not predictable over such short time scales and to be invested in equities we have to have the appropriate time perspective.

FTSE 100

Corporate News

What is going on in the corporate world can be best encapsulated by an old British Steel plant in Redcar. From the glory days of the industrial revolution, nationalised under socialist economic policies, privatised as part of British Steel under Thatcherism, merged into a Pan-European company (Corus) under the first Old World phase of Global rationalisation; and then into an Indian company (Tata) as part of the second phase as the New World arrived. Unable to compete and too far away from the steel buying action Redcar was mothballed and due to be closed down. But now we have a new phase, instead of big steel companies buying up competitors we now have new smaller steel companies wanting to get onto the global stage and compete with the few remaining big boys (both Indian by the way Tata and Mittal), this time from Thailand. This is significant as we can no longer ignore countries such as Thailand, Indonesia and Malaysia. They are moving out of the Emerging markets into the mainstream, companies such as Sahaviriya Steel have the financial strength to fund such deals and be taken seriously by those in the West. As investors we mustn’t overlook what is happening in the East, there are still political risks but these economies are growing rapidly when we are not.

Where there is growth in the Old World it is in technology, not just in IT but also high tech engineering as well. We have already seen that sales of luxury cars are growing, but if the Global economy is contracting then airlines and more importantly plane makers should be suffering more than most. This was certainly the experience in the recessions of the 1980s and 1990s when plane makers such as Boeing made huge losses as equally loss making airlines cancelled orders. This time it’s different.

Boeing Shareprice

A similar story has emerged from one of the world’s greatest investors Warren Buffet. This is the man who has made a $27 billion bet on a US economic recovery by buying Burlington Northern Santa Fe Railroad. He reported that that all businesses owned by his holding company Berkshire Hathaway are growing. They are adding workers and he reported “we will not have a double-dip recession at all. I see our businesses coming back almost across the board.”

What is impressive about global businesses is their financial strength, again in America Oracle (software) has enough cash to buy back $7.5 billion of shares, RIMM the Canadian maker of BlackBerrys can afford to invest $4billion in research. London based but really South African/Australian BHP Billiton is bidding for Canadian fertiliser group Potash. China car manufacturer SAIC is looking to buy a stake in GM as the US government unwinds its rescue stake. There is a lot going on none of which is consistent with a Global economy in trouble.

Economic News

Here in the UK house prices have stalled, mortgage sales are down none of which is surprising, banks are still rationing finance to only the safest of bets. This will not change unless Government policy does or until there is enough growth in the rest of the world for bankers to take their tin hats off and remember what they are in business to do. As always the USA will have to lead the way. Galling as it is UK Government policy makers will wait for the US to move first and only then follow.

This week the Federal Reserve Bank declared itself as being in the Deflation camp, by saying that there was not enough inflation in the system for it to meet its objectives. This means that further stimulus is on the way. Things are improving over that side of the Atlantic, unemployment is bottoming and American consumers are reducing their personal debts and rebuilding savings at a rate much faster than expected. This is important as so far the consumer has not contributed to the economic recovery, should mom and pop start spending again the impact on markets will be very significant.

The latest signals are that the Fed is still worried and that means they are ready to help the markets in whatever way they can should it be needed. Another old stock market adage is “don’t fight the Fed” this will be important to bear in mind in the coming months.

September 2010