The image of September has to be that of a rabbit sitting in the road mesmerised by the approaching car headlamps, except it is not a rabbit but the European political system and the car is Greece. Despite pressure from the IMF, The World Bank and the USA each of whom have used stronger and stronger rhetoric to try and scare the Europeans into action the French and the Germans appear happy to keep having meetings about meetings and put the decisions off until they really have to be made. There is much reporting of another Credit Crunch but currently that is not correct, there are no signs of tension in the inter-bank market where rates remain stable and the ECB active. There are concerns that one may happen that is true and if European leaders continue to prevaricate and Greece does it’s inevitable default in a disorderly manner it is a possibility, but we cannot invest on what may or may not occur, if we did portfolios would constantly swing in and out of cash and achieve nothing.

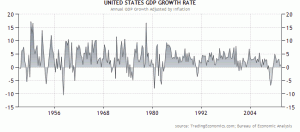

We have to look through all of this noise and make a judgement based on the available evidence. That evidence is pointing towards a continued slowdown in the rate of growth for Europe, USA and UK and without further stimulus in all probability will get worse. Whether this slowdown will tip into recession, the dreaded double dip is not yet clear, but the longer US and European politicians dither the more likely it becomes. It remains our view that China is the key, the US economic recovery slowed when Chinese interest rates went up; it is in the East where we our attention should be focussed for the real market direction not Brussels.

Should the double-dip be dreaded?

What we are experiencing now are two separate political crises that are preventing significant economic issues to be resolved. Obama is powerless to carry new stimuli through Congress without Republican Party support. The Europeans can’t make a decision and if and when they do may be restricted by national politics. As investors it makes it very difficult for us to plan a short term strategy. Bonds are a safe haven but are overvalued and if the above issues are resolved and growth resumes to near normal levels we would lose money on bonds and equities would be the place to be. However if not, despite being much undervalued equities will struggle and may fall further whilst these political impasses continue and as a result recession talk intensifies. But for how long could they continue in the doldrums?

US Equities

Well for US it’s easy to calculate, taking the very worst case if Congress and the Tea Party block Obama’s dash for growth jobs plan and the US does double-dip then Obama looks like a dead-duck for the Presidential election which begins early next year. The most likely outcome would be the Republicans come back to power on an economic growth ticket and up go markets. Remember markets move ahead of the event. So from here our maximum time frame for pain is no more than 12 months. Not nice but in the long term scheme of things very manageable.

Europe

Finally seems to be getting some sort of plan together and more importantly it appears sensible. The risk with betting against Europe is that when they do act it always involves an element of overkill. The spectacular late grand gesture is nearly always the European way. For Anglo-Saxon investors this is a nightmare making markets even more unpredictable than normal. Selling now may look very clever for a week or two but equally in month or two could look very stupid. The plan as reported by the BBC’s Robert Preston who is the usual Treasury conduit for public information is for a 50% cut in the value of Greek Bonds, an e2trillion stability fund to buy up Italian and Spanish Bonds (stop speculators from trying the same thing with those countries) and a TARP style fund to buy Greek bonds from those European Banks that have included them in their capital base. On the face of it this plan ticks all the

boxes. But can it be enacted? Particularly can Angel Merkel carry it through the German political process, the EFSF vote is a start? Unlike the USA this is potentially an open issue though we suspect that the deeper the crisis gets the closer we are to a grand resolution as the politicians will have no choice but to make a decision.

China

The Chinese must look at the West and rub their hands with glee, China sees itself as the historic pre-eminent economic power with the last 200 odd years as a short term aberration. They may not “do” democracy in the western sense but the Premiership does change every 10 years with 2013 the next changeover date. All Chinese Premiers like to consider their legacy and for Wen Jiabao he is unlikely to want to leave on a downbeat note. China is due to reflate soon, just a question of when it starts and by how much, this to us is the real key to the future of the markets not Europe.

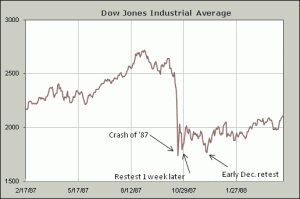

The 1987 Crash Roadmap

Markets

These continue to be tricky markets as we are dependent on upon politicians on both sides of the Atlantic doing the right thing. Predicting politicians is fraught with danger particularly in Europe. But as we have said before current market conditions are not exceptional, this is normal with equity investing and is why we have balanced portfolios. A final thought; currently the top 8 US Banks have $1trillion in capital and $54bilion exposure to the PIIGS, they can all default if they want to US Banks could cope. Compare this to 1981 (the last double-dip) when most of Latin America defaulted, US banks then exposure was 263% of their then assets. The World didn’t stop, “it’s different this” time remain the most expensive words in the investment world.

September 2011

Click Here for Printable Version

OT but fascinating–very csniervatove Fed officials appear to want a crackdown on derivatives.St. Louis Fed President Supports Lincoln’s Derivatives OverhaulSt. Louis Federal Reserve President James Bullard supports the strong derivatives reform authored by Sen. Blanche Lincoln, D-Ark., according to a Senate source who recently spoke with Bullard.Bullard is currently in Hong Kong and will not return to the United States until Friday. He is the third Fed President to endorse Lincoln’s tough crackdown on derivatives which has emerged as the most important Wall Street reform still on the table for 2010. Kansas City Fed President Thomas Hoenig and Dallas Fed President Richard Fisher have also endorsed the plan. Several key economists, including Nobel laureate Joseph Stiglitz, Nouriel Roubini, Simon Johnson and Jane D’Arista have also offered support for the provision.Lincoln’s proposal, known on Capitol Hill as Section 716, would end taxpayer subsidies for derivatives dealing by forcing commercial banks to spin off their derivatives operations into independently capitalized subsidiaries. By ending taxpayer subsidies, the massive speculative market in derivatives would shrink, making the global economy less beholden to Wall Street gambling. Derivatives were at the center of the 2008 financial meltdown…Is this regulation of the type that will wreck the economy? Or are the Democrats doing something right?