The Autumn has seen a change of nature within Global markets, the old pattern of bad economic news being cancelled out by Chinese good news broke down. The catalyst for this was the US Federal Reserve Bank saying that it would do whatever was necessary to inflate the US economy. “Don’t fight the Fed” as highlighted last month proved to be prescient. So now fickle markets look for bad news, the worse it is the bigger QE2 (second round of Quantative Easing, not the ship) will be. So now bad news is good news! Just as well, as China raised interest rates for the first time in many years. Not by much but enough to send shivers that the Chinese engine of global growth may be throttling back.

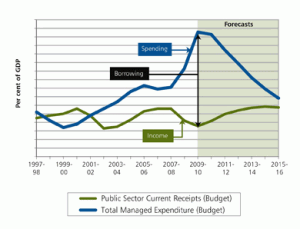

Over here the Coalition has started the unenviable task of cutting back on public spending. As a country we are spending more than we earn and funding the difference by putting it on “the credit card” i.e. borrowing more. Just as a private individual would if you keep on living beyond your means then the bank gets worried and lowers your credit rating, which restricts the amount you can borrow, and also ups the cost of borrowing. This is what happened to Greece and may yet happen to Spain and Italy. Painful but the first cut is the cheapest for the economy. Failure to act now could ultimately see interest rates rise by a massive amount, just as in the 1980s.

Government Spending v Income

Source HM Treasury

The key question from this Spending Review is will these cuts do more harm than good by depressing GDP growth? Specifically what impact will potentially 500,000 extra unemployed have on consumer spending? Also Government spending is a massive percentage of GDP the cuts will according to government estimates cut 0.7% from economic growth after inflation. Assuming this figure is correct this would be nearly half of a normal level of economic growth (about 1%-2%). So what sounds like a small number is very significant.

The Coalition is walking a tightrope cut too much and we drop back into recession, not cut enough, lose the credit rating, down goes the pound and up go interest rates in order to attract funding. Prior to this Spending Review we were already seeing house prices fall back, retail sales are sluggish e.g. Argos reported that sales are down 6.5%. The economy is clearly struggling, especially compared to other countries. The risk is high perhaps not of falling back into a full-blown recession but certainly of long term, low growth but with the pain of high inflation (due to commodity prices rising due to demand from Emerging Markets). Not a good investment outlook for the UK, we are very reliant on Global growth to bail us out.

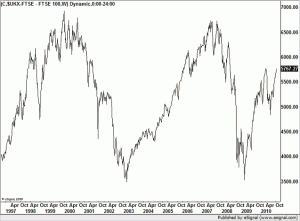

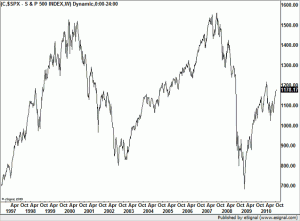

We mustn’t forget though there is a dichotomy between the UK economy and the UK stock market, over half the FTSE100’s profits come from abroad and whilst some sectors such as Retailers which are dependent on the UK consumer will struggle, the market as whole will simply go with the flow. This flow by and large is very positive.

Spot the difference between these two charts?

FTSE100

S&P500

Property

The Property sector is the most exposed to a UK economic slowdown. Valuations are set by surveyors not by the stock market and there is therefore no “hope value” prices simply reflect the current situation, which we have already seen is not good and doesn’t look like it could improve any time soon. Fund prices have risen as high yields have attracted particularly overseas investors to trophy London (West End) offices. Retail and Industrial sectors have been static at best; overall activity is at a third of pre-credit crunch levels. Yet there is a logjam, there are funds wanting to invest but holders (particularly the Banks and NAMA the Irish vehicle set up for distressed Irish Bank assets) aren’t sellers at these levels. Following the Spending Review and with government assets coming onto the markets the outlook hasn’t improved. Until UK economic growth picks up property looks likely to lag the stock-market.

Immediate Outlook

“Don’t fight the Fed” appears to be the dominant theme. There is now the almost inevitable risk that when QE2 arrives it will disappoint, (remember in the stock market it is always better to travel than to arrive). We also have US mid-term elections which are unlikely to be good for Obama (what exactly has he done?). A new development is that the Fed may force US Banks that have already foreclosed on homeowners to give them their properties back and write back the debt, due to “procedural failings. Hard to see what impact this may have but certainly worth watching.

Global growth though particularly in the Emerging Markets continues and US companies have just reported results better than expected. Chinese growth is now accelerating, hence the interest rate rise, top performing markets are Indonesia and Thailand which are benefitting from the China ripple effect. We do need though to watch the Dollar/Gold conundrum. Weak Dollar means that the big money market players are borrowing in America and hedging the currency risk with Gold. This money is then flowing into equities. A strong Dollar would indicate that sentiment is changing and thus needs watching.

October 2010