October historically has been a stormy month not just for the weather but for stock markets as well. Hurricane Sandy lashed New York and caused the closure of the New York Stock Exchange. The last time this happened due to weather was 1888. This closure could have ramifications for prices as pent up buying and selling orders might add to what is already elevated volatility.

October was also an important earnings season for US companies and there were many headlines that suggested profit targets had been missed, notably from Apple and Google, as well as from “old style” businesses such as Du Pont. As usual the news headlines don’t tell the whole picture; whilst indeed targets were not being met, profits were still growing at healthy levels.

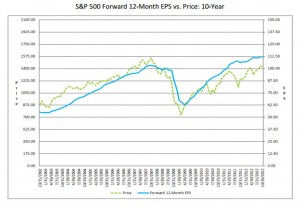

This means that share valuations remain cheap at close to 10 year lows.

The imminent Presidential Election in the US seems to be moving in Obama’s favour, though polling suggests that the result could be very close. The only person Hurricane Sandy is good news for is Obama, he can be calm and statesmanlike in dealing with the ensuing chaos and would look particularly good compared to GW Bush’s handling of Hurricane Katrina in New Orleans, Romney in many ways similar to Bush could be tarred with his historic incompetence.

USA Q3 Earnings

On the face of it the October US corporate profit results season has not been good. Many companies appeared to fail to meet analysts’ expectations with headline grabbing misses especially from the Technology Sector. We do have to differentiate though between not meeting forecasts and profits not growing. The fact is that this was another record quarter for most US companies, just not as good as the stockbroker’s analysts hoped. If earnings were declining on the same period as last year then we would be concerned, but they aren’t.

share prices follow company profits. When they are rising so does their share price. During recessions as earnings fall shares become overvalued and investors sell.

Earnings are the fundamental driver of all share prices; everything else is just “noise”. The estimated profits for next year are still rising and therefore so should share prices. We do need to be vigilant though, as there is always the risk of profits falling if the global economy slows further.

What is slightly concerning is that sales growth numbers are slowing. If we exclude the banks, year on year sales growth was only 2%. If we were heading into a period when the Central Bankers were trying to slow the global economy down then this number would worry us, but we are not. What it is doing is reflecting the lack of economic growth across the world. We already know about this and in theory with QE3 in the United States and China stimulating growth, hopefully, we will see a much improved picture over the next two quarters. This should then be reflected in a pick-up in sales growth and thus even greater corporate earnings.

We only have a problem if the Central Bank packages don’t work. What will happen though after this quarter’s results is that the stockbroker’s analysts will reduce their forecasts as they are currently too high. But again this could easily reverse if GDP growth starts to accelerate again.

One of our favourite “tells” for the health of the US economy is motorcycle maker Harley Davidson. They produced respectable results with sales down only 1%; US sales were down 5%. So this is an example of a non-essential, discretionary purchase product where despite the lack of growth in the US economy this company is still selling healthy volumes of motorcycles and only experiencing a modest fall in sales.

Another company that gives us a direct insight into the global economy is Caterpillar. Profits at this, the world’s largest earth moving and construction machinery manufacturer, were up from $1.1bn to $1.7bn helped by a pickup in US sales from a 30 year low. They did say that they expected the first half of 2013 to be tough with Chinese growth not picking up until the second half. So again we have a picture of slowing growth followed by subsequent recovery. The key now is whether QE3 and China reflation actually works.

US Presidential Election

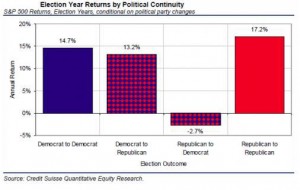

Whilst Obama/Romney are neck and neck in the polls the markets shouldn’t really mind who wins as the worst case can’t happen, as the incumbent, Obama, is a Democrat.

What isn’t priced in is a draw, which would bring back memories of GW Bush’s somewhat tainted victory in 2000 over Al Gore. Markets won’t like legal challenges, spoilt ballot papers etc. 2000 was also the top of the “tech bubble” and marked a turning point in the cycle from growth to recession. We are in a very different economic situation now but the markets do have a memory. A conclusive result either way is what is needed.

This is the big market moving event for November. Voting day is the 6th and many polls have Romney and Obama running close to one another, though the New York Times pollster who uses betting research techniques says that there is a 70% probability of an Obama victory.

It seems that just like the UK, there isn’t that much to choose between the two candidates. Romney is perceived to be more business friendly though like the Conservatives may introduce some form of austerity to bring down the very high level of US Government debt (the Fiscal Cliff). Romney would, however, not go down well in the international community as he may take on Iran sooner rather than later.

Markets

November historically is normally a good month for stock markets as the holiday season starts (remember there is Thanksgiving in America). We do however have a larger than normal number of key events this month. Clearly the Presidential Election trumps all but we should also get Spain finally asking for a bail-out, and something may happen in Greece (not had a crisis for a while must be due another one soon). Markets may also feel the impact of Hurricane Sandy for some time with pent up orders adding to volatility.

Some commentators are already suggesting that post Sandy reconstruction may even boost US GDP and would be positive for the East Coast housing market?

Markets have though been surprisingly strong despite the poor headlines during the results season and for share prices to be virtually unchanged on this difficult month should be seen as a victory. We are though towards the top end of the trend and are due a pullback, if this happens based on current known facts this would be healthy and normal. We are though now very dependent on growth coming through and markets will react either way should the outlook deteriorate or indeed improve.

In the very short term though, we do need a conclusive result in the Presidential Election.

October 2012

Click Here for Printable Version