The European rabbit for so long mesmerised by the approaching car crash finally blinked and started to do something. The Grand Plan to save the Euro was sketched out and the markets have so far breathed a sigh of relief, is it enough?But for October this was not the whole story, more importantly we also had good news about the US economy which has accelerated to grow closer to trend. Also the key to the markets immediate future, China, increased the news flow of imminent monetary easing. These three issues which in August and September had caused the markets such consternation all provided a significant and much welcome boost to global share prices.

As November begins we now have the critical meeting of the G20 leading nations. This perhaps will be more important than the EU Grand Plan, which may prove to be too little too late; markets would very much welcome some sort of co-ordinated stimulus/easing to finally kick the fear of a double-dip recession into touch.

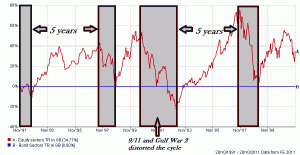

The Cycle over the past 20 years

Europe

The battle to save the Euro in its current form continues, finally we have a plan but it is far from the panacea that the markets wished for. The plan also raises a whole series of new issues that at some point will have to be dealt with. In essence what we have is that Greece will be allowed to write off half of its debts (the haircut); the existing bailout fund (EFSF) will be increased through financial engineering and by asking wealthy states such as China, Saudi Arabia, Norway as well as the IMF to invest in a fund of PIIGS debt. This could be up to e1trillion. There is also the recognition that European Banks need more money.

The positives we can take from this is that it is a plan and markets were beginning to worry that the Germans and French had simply buried their heads in the sand and hoped that the problem would go away. So as far as the markets are concerned anything is better than nothing and in is in all probability a starting point. By making the Greek haircut voluntary the Plan hopes to sidestep Greece technically and legally defaulting. This is critical as it may not trigger the Credit Default Swaps that have been used by the markets to short sell PIIGS bonds. These are the sort of unregulated financial derivatives that can cause so much harm to the global financial system. If this plan does make them worthless then it is to be applauded. However, bond holders who thought they had hedged their risk are now exposed and have to sell, just at the wrong time for everybody. This has caused the collapse of a major US broker MF Global, which will cause short term liquidity problems in most futures pits. Spain, Portugal and Ireland all steadily bringing their debt down may cry foul, why can’t we have half our debt written off as well?

The biggest problem though is one of mathematics, the numbers do not add up. e1Trillion simply won’t be enough particularly if as seems likely Belgium and Italy require support. Italy is the problem in all of this; it has always been massively in debt and has never been able to get it’s spending under control since the Second World War. Berlusconi has brought much needed political stability to Italy, which used to change leaders on a regular basis. He may not last much longer though and needs a credible austerity plan. Italian bonds are alreday falling sharply in value as holders realising their hedges are now worthless sell the underlying bonds instead. If Italy goes so does the French AAA Credit rating. The plan needs another e1Trillion from somewhere.

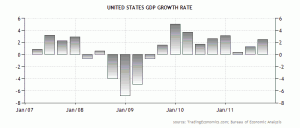

USA and China

Iran

The alleged plot to kill the Saudi Ambassador is intriguing and needs watching, it wouldn’t be the first time an embattled President has gone to war. The cycle as shown above was distorted by Gulf War2; we must be vigilant in case the same thing happens again.

Markets

As we enter what is normally the best time of the year for share prices we need the current positive news flow to

continue. The G20 will be critical in this, if they can co-ordinate a global stimulus the Europe can begin to show again and thus diminish the debt levels. Obama is running out of time he may yet persuade the Fed to adopt QE3. We may also be at a critical stage in terms of the balance of global power. The Chinese flush with cash may see this as the perfect opportunity to take centre stage. They may not save Europe by handing them a blank cheque but through monetary easing may ultimately prove to be Europe’s saviour.

In the menatime the USA is the best of the old world. The recent earnings season was exceptional. What these earnings numbers do is that as a company announces its current profits its investment rating becomes historic and shares get cheaper and cheaper. We have noted record disposals of very expensive safe haven US Treasury Bonds where will the money go? Gold has been underperforming equities so it seems that the hot money for now is going into shares.

We have recently had two economic worlds the old with stagnant growth and the new rampant but these worlds are now seperated by balance sheets as well. The new has cash, the old desperatly needs it. It is just possible that history books in ten years time will mark this time as the tipping point when the economic world changed dramatically.

October 2011

Click Here for Printable Version