The euro debt crisis should by now have been long gone the reason for this continuing soap opera lies in Germany’s refusal to change the nature of the ECB to become a “lender of last resort”. The current rules say that the ECB can’t lend to governments only to banks. The French being French suggest that the rules are interpreted a little bit more liberally but the Germans say nein.

The process to change the rules could take many months and possibly include a new European treaty which would need referendums across many countries. So the hunt to circumvent these rules continues. The Germans simply don’t want to pay for other countries profligacy. In a way they are right, the IMF lends to countries the ECB to banks. Let the IMF sort out Italy etc. let the ECB sweep up the problems in the credit markets afterwards. This appears to be Germany’s favoured route together with a mini euro of France, Holland, Germany, Finland, Denmark and Luxembourg. As we have said before it is not the actual plan that matters it is having a plan. The UK is in a bigger debt mess than Italy but crucially has a plan; as such Gilts now yield less than German Bunds. It is indecision that markets hate.

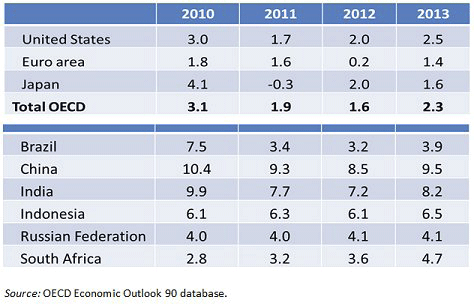

What is also intriguing is the dichotomy between academic economists/Central Bankers who are predicting the imminent end of the financial world and the market’s economists who aren’t. Somebody is “talking their own book” and perhaps trying to scare the politicians into action, normally it is the market’s economists are the correct ones, let’s hope so. The latest OECD economic forecasts have downgraded European growth but not to recessionary levels.

The Organisation of Economic Co-operation and Development Forecasts

2012 and 2.1% in 2013. The real story is the new world with stunning levels of growth despite high interest rates and restrictive fiscal and monetary policies. Europe is going cap in hand to some of its former colonies, how the tables have turned?

Whilst some of these numbers have been eased back they are still high levels of growth.

The New World

In 2001 Jim O’Neil Chairman of Goldman Sachs Asset Management used BRIC (Brazil, Russia, India, China) for the first time. He predicted then that if the then levels of growth were maintained these countries would become so rich that the world order would change.Ten years later it is now happening, when this debt crisis passes, as it will, everything from the G9, G20, IMF to the United Nations Security Council will have changed. What is intriguing is that none of the BRICs are happy bedfellows, which is good for us as it creates healthy competition. The BRIC economies combined have grown to around $13 trillion and are poised to overtake the USA. According to Jim O’Neil they “have created the equivalent of close to seven new United Kingdoms…. China alone has added slightly more to world GDP than the USA.”In the decade ahead, he goes on to say “the BRIC countries will probably create at least another one of their current self, i.e., grow by around $12-13 trillion……assuming that they collectively grow at somewhat softer rates. If they grow by similar degrees as the last decade, their contribution could be closer to $20 trillion.”

Then there is the First Division to the BRICs Premier League, Korea, Indonesia, Mexico and Turkey are identified as high population countries growing rapidly but also industrialised and going through their own economic revolution thus creating a wealthy middle class. It is this middle class that creates a balanced economy, one that is self-supporting and not reliant on cheap exports. Not only have the BRIC economies “emerged” but they are dragging the next wave with them. As growth from the new to take up the economic slack.

Tesco and India

For years UK businesses have complained that one of the world’s largest markets has been closed to them. The

requirement that any joint venture has a majority Indian partner has created a barrier for many businesses. This is starting to

change. The Indian government frustrated by inefficient food distribution and thus high prices will open up retailing to big Western supermarket chains, including Tesco, Wal Mart and Carrefour. This has the potential to be a “Gold Rush” and could set a precedent that opens up India’s enormous and wealthy middle classes to Western consumer goods companies. For example the Indians are the world’s biggest whiskey drinkers, but it isn’t Scotch Whisky!

Share Valuations

Markets

Like the markets we remain frustrated by the European Debt crisis. This indecision creates uncertainty and raises the risk of distorting the cycle. We have a global background of halfthe world’s population undergoing high levels of economic growth with share prices the cheapest for 20 years; this should be a golden age for equity investing. It isn’t, not because Old World debt levels are high but that the politicians can’t put a plan together to sort them out. The danger is that by running for cover now investors would be buying expensive bonds at exactly the wrong time. We do have to be vigilant though, if company earnings do start to fall then cheap share valuations are meaningless. However, as of now there is no sign that this is happening and so we will invest for future growth. We will however continue to monitor your portfolios and should circumstances change will not hesitate to recommend changes. As December begins so does what is normally the best time of the year for shre prices, let’s hope the French and Germans don’t cancel Christmas this year.

November 2011

Click Here for Printable Version