The Greeks have suddenly woken to the fact that as John Paul Getty once said “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” The German inspired austerity package of massive cuts in Government spending has now become a political issue, and the new anti-austerity political parties are playing a game of “chicken” with the EU leadership. The Greeks have realized that far from going begging to the Germans for money they have power way beyond their size and are prepared to use it to defend the economic health of their country.

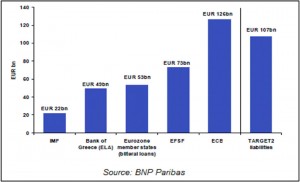

How can this be? Well it is partly down to the unusual way each country’s Central Bank settles banking debts with the ECB. No hard cash ever changes hands; each Central Bank such as the German Bundesbank has either a deposit account or an overdraft with the ECB. As money flows into an ECB member country their deposit account at the ECB gets bigger however the opposite is also true as money flows out, the overdraft gets bigger. Since inception this concept known as Target 2 has worked very well. But now as money rapidly leaves Greece the Greek Central Bank overdraft is reaching epic proportions. Add to this to the other IMF/Eurozone loans and you can see why it’s the bank’s problem.

The Greek Debt Burden

The German policy of saying that the rules cannot be changed and that austerity is the only solution is fine as long as everyone else plays the game. However, the personalities of the different European nations are varied and also democratic, national suffering is not acceptable when a cross on a voting slip can stop it (in the short term at least).

New Greek political parties have sprung up offering salvation and have found ready support. However, these new parties have also realised that they have great bargaining power. They are saying “that if you throw us out of the Euro we will bankrupt you” and so the game of “chicken” begins. Neither actually wants Greece to leave the Euro but who will back down first? Greece wants to renegotiate the cuts but may settle for huge sums of investment or aid instead (Marshall Plan style). Like any game that relies on nerve and bravado, accidents could happen.

Whilst Greece ultimately would be better off outside the Euro there would be intense short term pain for the Greek people. So Greece has power beyond its size but for us as investors we may finally be approaching the day when the “can will no longer be able to be kicked down the road”.

Two other new factors are coming into play as well. Firstly, we have a Spanish Banking crisis (this is separate to Greece) and secondly the election of a new French President has changed the political dynamic in Europe.

Spain

Spain has had a several decades long property boom. Developers borrowed money, built houses and sold them not only to increasingly wealthy Spaniards but to northern Europeans wanting retirement/holiday homes in the sun. As the 2008 Credit Crunch sapped the wealth of the northern Europeans and the mortgages needed to fund the purchases dried up the developers were left with unsold properties and no cash flow to fund the interest payments.

Many of these loans were made by the Cajas, Spain’s Building Societies, small but numerous. Together these problem loans are estimated to add up to e184billion. Bankia, was created by merging a number of these Cajas together and has just been nationalised as it needed e19bn in cash. So as far as the markets are concerned the Cajas’s debt is the Spanish government’s debt. Thus, Spain which is still in recession with 24% unemployment is effectively far more in debt than it first appeared.

Hence Spanish bonds are being sold at yields higher than the critical 6% level and rumours of an e300bn IMF led bailout are going around the markets. This has, however, finally created a flurry of action from the EU. A Europe-wide depositor protection scheme is being proposed, this could then naturally lead to greater cross border banking integration. Thus, showing that the Europeans will act but only when they have to, infuriating for markets. Spain may ultimately be the catalyst for the Germans to rethink their stance? Will they eventually say yes, probably, as the alternative for them is Japanese style deflation? A Deutschemark or Mini-Euro would be cripplingly strong for the German economy.

Hollande

The new French President Francois Hollande is turning out to be quite market friendly. So far the ECB and the EU have done what Germany wants, their economy is growing nicely selling Mercedes and BMWs to the Chinese, any stimulus would cause inflation in Germany which is unacceptable and yet German exports benefit from the relative weakness of the Euro.

Sarkozy went along with this but Hollande isn’t, he wants deficit reduction but only if there is stimulus as well. Chancellor Merkel is becoming increasingly isolated and whilst nothing positive as yet has come from this change (and won’t until after the Greek election in June) the balance of power within Europe has changed, and should be for the better.

Markets

We talked of “Sell in May” last month and yet again it would have worked, but as investors the short term is of little practical interest to us. Bonds are expensive and pay us less than inflation, equities are cheap, and the underlying companies are making record profits.

It is the long term we are interested in and as investors we must follow value and be patient for it to be realised, as history shows it always will be. June with the Greek election and the ensuing posturing means that this will be a very volatile month. Everyone is betting on a Greek exit but markets rarely give participants what they want. If the Germans “blink” first and we get the much wanted “Euro Sovereign Bond” then markets could just as easily take-off as collapse; likewise the long awaited Chinese stimulus appears to be getting closer. Spain remains a concern.

June could be a particularly tricky month to navigate, but whatever happens, it is the long term that matters and as long as your portfolio matches your needs we can afford to sit and wait for the storm to pass.

June 2012

Click Here for Printable Version