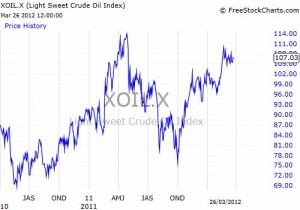

As the first Quarter of 2012 closes equity markets and some bond markets have continued to make progress and deliver good returns. “Bull markets climb walls of fear and worry” has been a particularly apt saying of late and with Greece fading away, for now, oil is the new worry.

A belief that economic growth will stimulate demand and the impact of Iranian sanctions has pushed up crude prices. This will bring the inflationists out of the woodwork and markets will begin to fret about interest rates and whether the Fed can hold rates at these very low levels until 2014.

March also saw the Budget, a threat of a UK rating downgrade and also some intriguing developments in China. Despite this, over the quarter equity markets have risen by around 8.5% led by the Emerging Markets which rose by 10.5% and Corporate and International Bonds up by approx. 2.5% however Gilts are starting to lose their safe haven status and fell slightly over the quarter.

Oil

The Budget

The Chancellor of the Exchequer’s Budget speech was a bit of a non-event. Fitch, one of the ratings agencies, had put the pressure on the government saying that there was no room for a give-away. So what we had was some tinkering around the edges with tax rates but nothing of any economic significance.

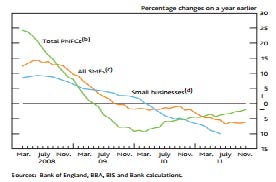

The UK economy remains stagnant and there was nothing in this budget to change this fact. This will not change until the banks start lending again or we import growth from the rest of the world.

Royal Bank of Scotland

After the Latin American Debt crisis of the early 1980s the British Clearing Banks each had money raising rights issue every year until their capital base was strong enough to lend again.

The problem for both Lloyds and RBS is having HMG as a major shareholder who is unwilling to make their contribution to such a share issue. This is important as Lloyds through its ownership of Halifax is the biggest mortgage lender and RBS with Natwest is the biggest business lender.

The news that HMG is thinking of selling a stake in RBS to the Abu Dhabi Wealth Fund is therefore very significant. A reduction of HMG to below 50% would allow RBS to tap the equity markets for funding again. If a deal can be done, and helps RBS to start lending again, then it would make sense for Government to sell at a loss.

A straight sale without an accompanying fund raising would not look good politically. Allegedly one of RBS biggest problem customers is among the Dubai property developers, with Abu Dhabi as the implicit guarantor to Dubai an RBS deal could begin to make sense for both sides as long as the bank ends up with more money to lend.

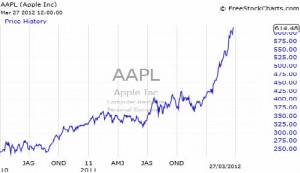

Apple

This current equity rally should really be called the Apple Rally. Since this company, America’s largest, announced fantastic profit figures the shares have gone up in straight line dragging the Global indices with it.

Keeping the pot boiling has been the launch of the new IPad and it now plans to buy back shares with the $98billion spare cash pile. Apple’s product led design continues to outperform the competition especially Google with its Android platform and rivals such as Amazon are targeting lower priced market segments.

Apple’s new Chief Executive is in China leading to rumours of a tie-up with Baidu (the Chinese Google). When this rally starts to run out steam perhaps it will be seen in Apple’s share price first? The figures refer to the past performance, which is not a reliable indicator of future results.

China

We are now in the change-over period for the Chinese President and whilst details are scarce this would appear to be a tricky but intriguing time for the ruling Communist regime. An old style Governor of one of the key Provinces has been arrested and one of his deputies asked for political asylum in the USA.

A purge of the old guard would seem to be underway leading to rumours of a coup. What is interesting is that censorship seems to have been relaxed with some internet curbs lifted and Falun Gong media being available to read online in China for the first time.

Could this be China’s Gorbachev moment? The Falun Gong movement is more of a self-help organisation than a political one and was only censored because it advocated communal tai-chi exercises in public places.

If China does move further from its old political ways the implications for the Global economy are immense.

Markets

The markets are looking for a continuation of the current economic growth trends, economic news is therefore critical for day to day market direction.

Greece is on the “back burner” for now, but Spain and oil prices are new worries. Having said that, many major markets have yet to reach their 2011 highs and valuations remain cheap, so there remains plenty of scope yet for equity indices to rise further.

Indeed many portfolio managers are underinvested and hold too many bonds. Each day the markets rise the worse their performance becomes and the greater the pressure to put money to work.

This is how Bull markets work, the pessimistic being forced to buy shares in order to keep up with the pack. Hence “Bull markets climb walls of fear and worry.”

March 2012

Click Here for Printable Version