June is traditionally a tough month for markets and 2011 was no exception. A combination of poor US economic data, Chinese inflation and the Greek Debt crisis meant that equity markets had to pull back.

Greece was the dominant story, as we have said before Greece needs to leave the Eurozone and could yet do so. However it is the possible consequence of this action that unnerves modern integrated markets. European Banks are still weak from the Credit Crunch and Greek Government debt forms a part of their asset base. Devalue the bonds by defaulting and European bank assets become weaker. Factor in the extra yield increase investors would demand for particularly Spanish and Italian Bonds (causing prices to fall) and the issue becomes very serious, putting the whole European Banking system under threat.

A further complication lies in the insurance policies that these same banks have taken out on their PIIGS debt. This is called a Credit Default Swap and no-one knows who the counterparties are and whether they can afford to pay out on a default claim?

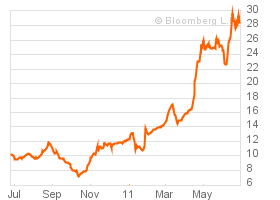

Greek Bonds

This isn’t so far off what the French Banks have negotiated with Sarkozy. Furthermore as an overseas investor this bond is currently priced in Euros but you might get it back in Drachmas which would be worth a lot less, 27% yield suddenly not so attractive. Translate this across Portugal, Spain and Italy and you can see the scale of the problem.

Greece

It is hard to find any economist or bond expert that doesn’t believe that Greece will default either deliberately as part of a restructuring deal or through continued economic mismanagement. So why are the Europeans effectively giving a “spendaholic” another credit card? You only do it when it is in your own interests. The fundamental problem again as we have written before is not Greece it is the structure of having a single currency without a Federal Reserve equivalent to dictate monetary policy and without a Pan European Sovereign Bond like US Treasuries. Many States in the US are as bust as Greece is but it doesn’t matter they are part of an integrated system that can overrule local legislators and impose the financial disciplines that are needed. For example the Greek rescue package could be derailed by German legal action. This is illogical, cumbersome and inefficient.

The European attitude to Greece may be more about buying time. Time to strengthen European Banks, and more importantly to change the fundamental monetary structure of Europe. Europe needs to create a framework where the default of one country does not threaten the existence of the whole system. No sign of that at present but this Greek crisis has gone so close to the brink and it is not fully averted yet, consequently it must under consideration. Remember the country with most to lose in all of this is Germany. The Euro is actually still quite strong but a Deutschemark would be very, very strong and would kill off all those BMW and Mercedes exports to the Emerging markets.

USA

Ben Bernanke has started to do a post FOMC meeting press conference. In the latest one he stated that the US economy had made progress since QE2. The deflation risk had receded and wages had started to rise again. The Committee believe that the recent poor US stats were influenced by a post Tsunami component shortage as well as high food and gasoline prices. Pressures that should ease in the coming months. Shortly after the meeting Crude Oil prices were crushed by a release of stocks from the US Strategic Oil Reserve, surely no coincidence? Interestingly he didn’t see a Greek default as a problem unless it was “disorderly”.

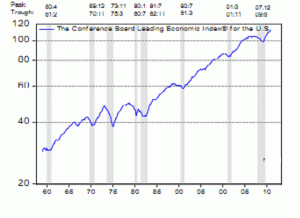

US Leading Indicators

The grey vertical areas on the chart are recessions and what can generally be seen is that the index turns down before the recessions starts. After dipping by 0.4% in April the index picked up again in May by 0.8%, which is good news.

China

Chinese Premier Wen Jiabao in a statement to the Financial Times declared victory over domestic inflation. “China has made capping price rises the priority of macro-economic regulation and introduced a host of targeted policies. We are confident price rises will be firmly under control this year.” Consumer price inflation has been rising since the middle of last year, reaching a high of 5.5 per cent in May. Politically sensitive food prices have been the main driver of headline inflation; food inflation hit 11.7 per cent in May. High food prices have in the past stirred up political unrest in China. Most analysts are predicting that Chinese inflation will peak in the next couple of months. Mr Wen also noted that China has an abundant grain supply after seven consecutive years of increasing output.

China’s leaders meet in July to decide the direction of economic policy in the second half of the year, and analysts say if inflation is under control then Beijing may be willing to ease credit restrictions. “There is concern as to whether China can rein in inflation and sustain its rapid development,” Mr Wen said. “My answer is an emphatic Yes.” This is an unusually robust statement to make and one that a Chinese leader wouldn’t make unless he can deliver it. This is critical for the continued Global economic recovery. If China, the second largest economy in the world can return to a more accommodative monetary policy then global growth will pick up again. This may prove to be the dominant theme for the second half of the year.

Markets

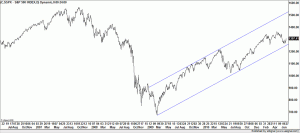

The poor news flow from Greece, China and the USA plus normal seasonality have moved global markets back to the bottom end of their Bull Market trends, as can be seen from this chart of the S&P 500. The Greek vote has though helped share prices bounce of a key support level. Other markets look very similar.

The second half of the year starts with some positive news from the US economy and maybe China as well. The poor seasonality continues through July before turning positive in August. Nothing has happened so far to suggest we are double-dipping. Greece might have tipped us back into recession but in the short term at least this may have been averted (unless the Germans throw a spanner in the works). So the trend stays intact and favours equities over bonds. China is the big unknown; if their inflation numbers do begin to moderate as promised by Wen Jibao then the next leg of the Bull market could begin.

June 2011