June finished with another EU Summit, the Germans, Italians and Spanish were fighting it out off the pitch as well as on it. The results were similar, though the German loss at the summit was so marginal it should really be counted as a nil all draw. We have written before that the Euro structure is wrong, you can’t have a single currency without an all-powerful central bank that issues its own debt; there is still no progress towards that goal.

The current crisis, the Spanish banking one, is typical of how Europe deals with a problem. The problems of the Spanish Banks (lent too much for housing development, house prices fall and so borrowers default) have been known since 2009. The bad debts have now got so big the banks can’t afford to write them off and Spain is too weak financially to bail out the banks. So Spain asks Europe, Europe says you can have the money but the current rules will actually make things worse for you and the rules can’t be changed. Thus we have a crisis, the EU leaders then get together and lo and behold the rules are changed. Hence the “can is kicked down the road again” a short term problem solved but the real cause of crisis, the wrong structure, remains.

Markets now know to force the issue to the point of a political crisis and then they get what they want. For investors it gives us a bumpy ride but some protection in the knowledge that when pushed, politicians will act. Personal self-interest always prevails over national, as no leader wants to go down in history as the destroyer of the Euro!

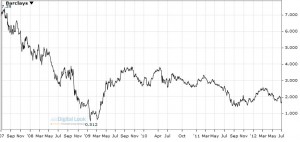

Barclays Bank

Prior to the 1980s, Banks lent money, stockbrokers traded shares and Merchant Banks arranged company mergers and takeovers. Each had a clear objective and a defined market. But in America and Japan all these disciplines were merged together. So in response London deregulated and the integrated investment bank was born. These banks could then access cheap capital from high street depositors, plus the protection of the Bank of England in the “unlikely” event of anything going wrong. They could then trade the markets using their customer’s money yet keep the profits for themselves. The only way retail customers benefitted was through free banking, unless of course you went overdrawn.

For 30 odd years this was a great idea until greed overtook reason and the Credit Crunch occurred. With JP Morgan looking like its recent trading loss could be $9billion and now the Barclays scandal (which will undoubtedly spread elsewhere) banking must change. The ideal would be for Banks to do only banking and not trading on markets, but these institutions are now bigger than individual countries and could easily move domicile to Dubai or Hong Kong out of the reach of UK regulators. They need to change but it will be very difficult to achieve. A brave politician would start by breaking up state controlled RBS and Lloyds and recapitalise the constituent banks and tell them to lend or else. But brave and politicians are two words that are rarely seen together.

China

As we have said before Europe is a side show, it is China that’s sets the agenda for share prices. The fact that the global economy is struggling is we believe due to China deliberately slowing itself down. Disappointing economic data from China is showing that the medicine has worked and we are now getting a steady drip feed of news that suggests that China is embarking on reflation.

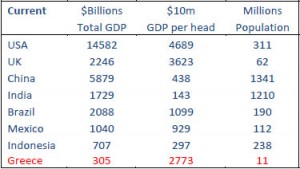

What is perhaps not fully understood is the scale of the growth potential of China, India and the other emerging economies? Most commentators will talk of India and China matching or overtaking even the USA as an economic power but it is not until we look at numbers can the scale be truly appreciated. Let’s assume that one day China will be as wealthy per head of population as Greece.

If we simply times the current Chinese population by Greece’s GDP per head then clearly China’s GDP clearly must go up, but what is staggering is that it would go up by over 6 times its current level and 2.5 times the current level of the USA! Do the same exercise for other developing countries with large populations then the growth potential is quite incredible. The UK falls behind Mexico and Indonesia. This is not going to happen tomorrow but it is reasonable to assume that it will do so at some stage. Given that a Pension plan has to support you for what could be decades into the future then it is clear why these volatile markets must be present in your portfolio.

Markets

In the short term, the summer doldrums continue with markets being driven by Spanish and Italian Government Bond Yields. The EU summit proposed a buying mechanism based on the ESM but this has to be ratified by the member states and that is not a forgone conclusion. Also does the ESM have enough firepower to make a difference? Only time will tell, suffice to say the Euro crisis continues. There are signs that, as Europe slows further and the reflation of China has yet to have an impact, we may be entering a period when companies start to talk down their profit expectations. This is very important as it is corporate profits that drive markets. Reduce the forecasts and what is currently a very cheap stock market becomes a fairly valued one.

Last Friday Ford and Nike both warned that current year profits would be less than forecast. Ford has a big presence in Europe but is weak in India and China. Ford also lacks premium brands, which is where the main sales growth is, whilst it is being squeezed by strong products from value brands such as Korea’s KIA and Hyundai. Nike meanwhile is susceptible to fashion change and has experienced rising costs. So both downgrades appear to be company specific.

As we enter July, Spanish and Italian bond yields and Chinese reflation remain the key issues. However, we must also be watchful for any further profit warnings from corporate USA. We also need to watch for signs that the Fed might initiate QE3, and another LTRO from the ECB remains a strong possibility.

June 2012

Click Here for Printable Version