July has been characterised by the battle between companies and economies. The US quarterly results season has produced some spectacular results with a large number of companies from various industries reporting profits ahead of forecasts and guiding future expectations up. Just the sort of stuff you would expect at this stage of an economic recovery. The same was true in Germany with for example BMW unable to meet demand. But how can this be, the USA, UK and most of Europe are technically bankrupt, whilst equally bust Japan is still suffering from the terrible earthquake/tsunami. Well as we have said before we mustn’t get hung up about what is happening locally it is about what is happening in the Global economy as a whole and that is growing nicely. Multinational companies are making exceptional profits and we must remember that it is these companies we are investing in not their underlying home economy.

The events in Greece have not been resolved, the EU has managed to “kick the can down the road” for now. What does though seem to be pretty clear is that the EU has decided that they will not abandon the Euro and if the consequences of this are closer integration then so be it. This ultimately could mean individual country budgets being subject to scrutiny and approval from Brussels. Can’t imagine that would go down well in Downing Street.

The ratings agencies that were so inept and helped caused the Credit Crunch are now focussing on Spain and Italy, these are the big two, and the EU’s actions over Greece will not prevent the markets exerting severe pressure on Spain and Italy. The problem has not been solved. The market’s attention though has been diverted to America where a political argument is putting the USA’s AAA credit rating under pressure.

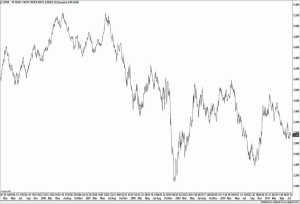

US Treasury Bonds

This chart shows the current yield for the 10 Year Treasury, this is about 3.0%, down from a high of 5.2% which shows that despite the risk of a default and a downgrade no-one has been selling US Treasuries.

The US has a self-imposed borrowing limit, and should it need to go above it, it simply asks itself for more money. Sounds strange but that’s the way it works, however this increase has to be approved by both Houses of Government as well as the President. Problem is the Senate and the President are Democratic but the House of Representatives is Republican which has new right-wing faction known as the Tea Party. Since the Second World War free spending Democratic Presidents have always had a problem with this borrowing limit. From JFK, Jimmy Carter and more recently Bill Clinton all have had to run the gauntlet of Republican budget deficit brinksmanship and Obama is no different. After pushing it to the wire a deal has been done and the real focus can now move back to the lack of growth in the US economy. It is growing but by not as much as it should be. This gives Obama a problem, all this free spending and QE2 should by now be delivering enough growth to get unemployment down and house prices up, not looking good at the moment hence the Tea Party smelling blood.

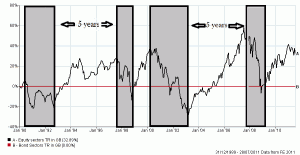

The Investment Cycle

Occasionally non-economic events can distort the picture such as between 1998 and 2003. 1998 was a normal recession but then Y2K caused a huge global boom, which had to be choked off early thus bursting the Tech Bubble, then just as recovery was starting the terrible events of 9/11 and the long run into Gulf War 2 caused share prices to pull back until 2003 when a new5 year cycle started. This cycle is important; if your timeframe for investment is less than 5 years then you can afford to take the extra risk that equity investing holds? This new cycle started in March 2009 so all things being equal we should favour equities for a few more years yet.

Markets

The excellent US corporate results season and a slowdown in China (good news as this will impact on inflation) had helped Global share prices to bounce. Initially the political impasse in the US was ignored but the lack of resolution caused uncertainty, which the markets hate, and so the major indices went down. It looks now as if the political arguing in the USA has passed, also August marks the end of the negative seasonality. Most markets are on their 200 day moving average (the average of the last 200 days share prices) this is important as if an index is above its 200 day moving average then it is generally regarded as being in a Bull market. This is a key support level which has held throughout the European and US Debt crises.

The recent US corporate results have hopefully given markets enough ammunition to keep this trend going. This summer’s doldrums have thrown a lot of bad news at the equity markets and it is perhaps encouraging that they are not down more than they are.

Recent US data on unemployment, and house prices were marginally better but a magnifying glass was needed to spot this, a significant improvement in the autumn will be needed if the trend is not come under threat again. The “trend is your friend” and so far despite another tricky month it remains intact.

July 2011

Click Here for Printable Version