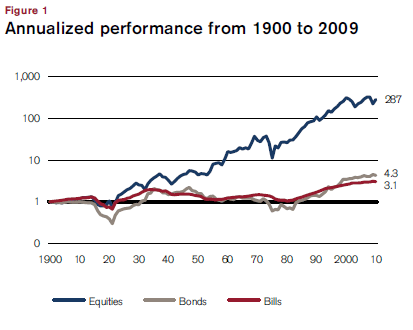

Welcome to the first edition of SRS’s Market View, here I will express our views about the Global economy and the outlook for individual asset classes. The traumas of the “Credit Crunch” are slowly passing and the Global economy is undoubtedly recovering. What we need to identify is the nature of this recovery will it continue and accelerate (as per normal) or will it fizzle out and end up as a long Japan style depression? There are two camps of opinion out there, and depending on the news flow one view or the other takes precedence and can drive the markets up or down. Before we look at these views we always need to bear in mind the long term cycle, the chart below shows the UK Stock market since 1900, a period that covers various crashes, two World Wars and explains why we invest in equities. It goes up in a straight line. With this in mind we have therefore to constantly ask ourselves “is it different this time” or are we still on this long term trend?

Source Credit Suisse

The Deflationists

These are mainly Economists and Bond managers. They say that all the money pumped into the Global Economy since the Credit Crunch is not enough, Banks are running scared and will not lend, governments are running out of money and as such the UK, USA and Europe are entering a period of deflation when the economy grinds to a halt just as Japan did. They point to the imminent collapse of the Euro creating another Credit Crunch!

The Inflationists

This, the optimistic camp, consists of mainly Equity fund managers and analysts. They point to the long term cycle and that stock markets are driven by company profits not necessarily by the economy. Over 60% of UK Stock market constituent profits come from abroad. They also point towards the New World of China, India, Brazil and Russia, these economies that have huge cash surpluses; economies that are being transformed from centrally planned chaos into highly efficient capitalist ones. They are experiencing strong growth and are bailing out the west. Where is the deflation they say, inflation will bail out the Old World Central Banks and is already here.

Current Position

So who is winning the argument? The Inflationists were in control but suffered a double whammy. The initial blow came from Greece/Spain where high levels of debt saw their Government Bonds dumped by investors. A default would impact on European Banks who hold these bonds as part of their capital base; a fall in value reduces their capital and thus their ability to lend. We have to remember that Spain and Greece are not NINJAs (no income, no jobs, no assets) which caused the first credit crunch. They are substantial economies, are neither Argentina nor Zimbabwe their issues are not insurmountable and the Europeans are particularly pragmatic.

The second blow came from China. The New World is having a normal recovery, to the extent that growth is so high they having to try and slow it down. They are already at the next stage of the economic cycle. China has taken the first critical step in freeing up its currency it is however scared of letting it off the leash as the Yuan will become very strong. China is a high growth economy with huge budget surpluses and will become the home of choice for most of the World’s spare cash. A strong currency will harm China’s exports so gently does it; China is trying to slow its economy down by restricting lending rather than pushing up interest rates. As the swing growth economy any slowdown in China causes alarm bells to ring in the Old World.

Investors hate uncertainty and these issues plus some only average US employment numbers has caused a run to safety amid fears of the “double-dip” recession. However, historically markets nearly always experience a mid-cycle pause for breath when growth slows just as it is now. No-one knows whether the deflationists or inflationists will be right but much will depend upon Obama. The President is, now Gordon Brown has gone, the last of the “reflators”. Federal Reserve Bank Chairman Ben Bernanke has embarked upon a stimulus package to get the US economy moving, any sign that growth is stalling should be met by more US Quantative Easing. We need to remember that the US Central Bank not only has an inflation control mandate but a full employment one as well. Another package will be met with euphoria by the inflationists.

Corporate Earnings are also critical. The global markets are volatile but the fundamental basis on which they work are company profits. If they are rising and by more than expected the markets go up. Goldman Sachs has calculated that this year US Company profits will be one and half times higher than they were in 2000 and yet the market is 30% lower. So shares are cheap.

Forecasts are being met, expectations are also rising, as long as this pattern continues the markets will be fine and the inflationists will claim victory. A new US corporate results season is imminent, hoped for good numbers will support the low valuations and all will be well. Similarly signs of continued growth from China will trump European bad news. History does tell us to be optimistic rather than pessimistic but we must also be vigilant for any sign that the pattern may be changing.

July 10