Global equity markets continued to rise in January as evidence that the US recovery was at last fully underway emerged. It would appear that on that side of the Atlantic QE is working and corporate spending rather than consumer is accelerating. We have known that the winners from this recovery have been the Far East and Emerging economies with the old world stuck in first gear, now the USA is starting to accelerate whilst here in the UK we are still in neutral and there is a real danger of accidentally finding reverse.

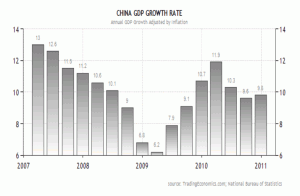

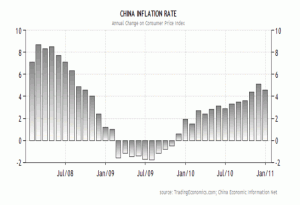

There is a set of contrasts in the news flow this month. Chinese growth is accelerating, but so is inflation; US corporate earnings are also accelerating; the UK economy is decelerating but inflation is growing. Two of the “tells” for 2011 Gold and US unemployment are not being supportive.

China

Gold

Is a measure of how much speculation there is in the markets. The Dollar Carry trade relies on Gold to hedge the currency risk. Gold prices are falling which may mean there is less “hot money” driving markets. This is perhaps apparent in the relative weakness of US smaller companies and profit taking in the Emerging Markets. As the froth comes off markets the more volatile areas will underperform. Gold has been falling of late; it may just be that the carry traders are seeing more value in America than China at the moment, and don’t need to hedge?

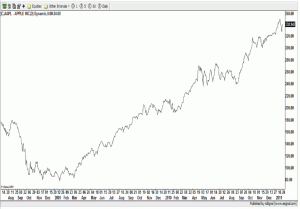

Corporate America is having a very profitable time. The quarterly results season is underway and virtually without exception the results are better than expected. This is critical as it creates the virtuous circle for share prices. Shares are valued according to earnings expectations if the results are better than these expectations then shares are mathematically cheaper, also expectations for the following year go up, and from a higher base, hence up go prices. As long as earnings are rising we are safe to invest in equities. Bellwethers such as IBM, Intel, Google and Apple all pleased the market and shows that cash rich US companies are investing again.

Apple

Britain v America

Both countries were hit hard by the credit crunch and both have embarked on a low interest rate and QE policy regardless of inflation risk. However, in the US it seems to be working but in the UK not. UK GDP far from accelerating in the final quarter of 2010 (the Christmas spending quarter) actually fell by 0.5%. The weather will have some part to play in this but cannot explain all of the fall. QE was supposed to help the banks to lend again. However, they simply are not, just £136bn was lent on mortgages in 2010, the lowest amount for 10 years. It is not interest rates that are the problem but the terms the banks are demanding. Most commentators are expecting house prices to fall further this year. The banks won’t lend on falling security values. With the unemployment rate rising this is a vicious cycle with no obvious solution, maybe take the money from QE and lend directly? The UK is a mess.

In America a much more vibrant business sector is cushioning a similar problem in housing. Commercial and Industrial loans are increasing at an annualised rate of 7.6%, US GDP growth for the final quarter is expected to be 3.5% (the UK minus 0.5%). If the US consumer starts spending again then the US is off to the races. The key remains unemployment, a fall in unemployment has a direct impact on the US housing market. There has been no meaningful shift in the US unemployment rate as yet. Hopefully this is only a matter of time.

Equity markets must have a breather at some point; however this is the sweet spot of the cycle as economies recover. What is clear however is that there are winners and losers and the UK is a loser. Luckily for UK investors the UK Stock market is not dependent on the UK economy.

January 2011

[…] http://srsifa.co.uk/january-market-view/ 13 April 2012 3:37am – Images « Chinese economy normalizing not double dipping Citigroup Trading china gdp growth » […]