Click Here for Printable Version

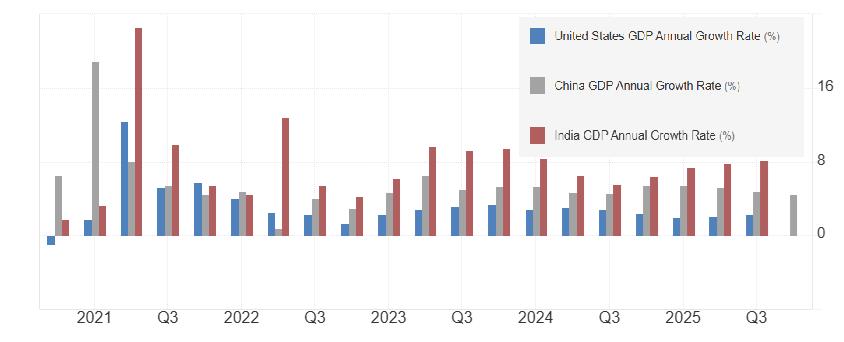

2026 is developing into a year in which the global economies are experiencing strong economic growth, rising corporate profitability, subdued inflation and interest rates that are still moving lower. However, while these strong fundamentals provide firm foundations for the new bull market, daily share‑price movements continue to be dictated by comments from the current President of the United States. Markets had thought they were becoming used to Trump’s rhetoric, but January saw it escalate to a higher level. Greenland, Denmark, US mortgage companies, US credit‑card providers, the EU and even the UK were all targeted by the President at various points during the month. Once again, most of these turned out to be “bluffs” intended to create a sense of urgency and accelerate negotiations. The fact that markets did not react significantly suggests they are becoming better at judging when to take the President seriously. Interestingly, two recent events indicate that, behind this apparent “chaos,” rational and economically driven actions are taking place. One example is the proposal of Kevin Warsh to replace Jay Powell as Chair of the US Federal Reserve. Another is the long‑awaited trade agreement with India.

Kevin Warsh

The most powerful position in the investment world is the Chair of the US Federal Reserve Bank. China, Russia and various cryptocurrency advocates have all attempted to create alternatives to the US dollar/US Treasury Bond financial ecosystem. One day they may succeed, but not for a long time yet. Only the Federal Reserve has the power to both break and save financial markets. Remember, money does not technically exist, it is “fiat”. Its value derives entirely from public trust in the issuing authority and the stability of the economy. Central Bank actions create that “trust and confidence”; without it, money becomes worthless and hyperinflation destroys an economy, as seen in Zimbabwe, Argentina and 1920s Germany. Many names have been suggested for this crucial role, including several “Trump acolytes”. Although the Fed Chair has the casting vote and serves as the public voice of the institution, interest rates are set by a committee of “Fed Heads”. Simply appointing someone loyal to the President would not give the White House control over interest‑rate policy and the markets would punish the US for it. The dollar would weaken and long‑term interest rates would likely rise further. Trump’s team appears to recognise this crucial fact and has therefore proposed a known inflation “hawk” for the role, which came as a surprise. However, he is also a known Trump supporter and is connected through family to major Republican Party donors. This combination appears to give both the markets and the administration the best of both worlds. The dollar strengthened on the news, which in turn created turmoil in the gold market. Given Trump’s ongoing criticism of Jay Powell, who was, incidentally, appointed during Trump’s first term, selecting a politically “savvy” Chair with market credibility seems a sensible move by the administration.

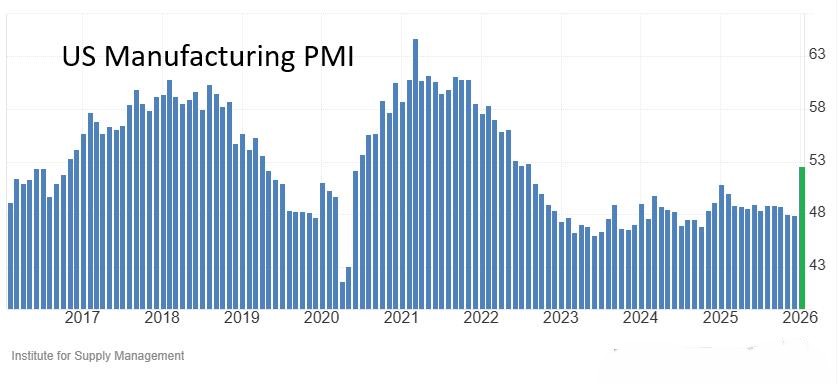

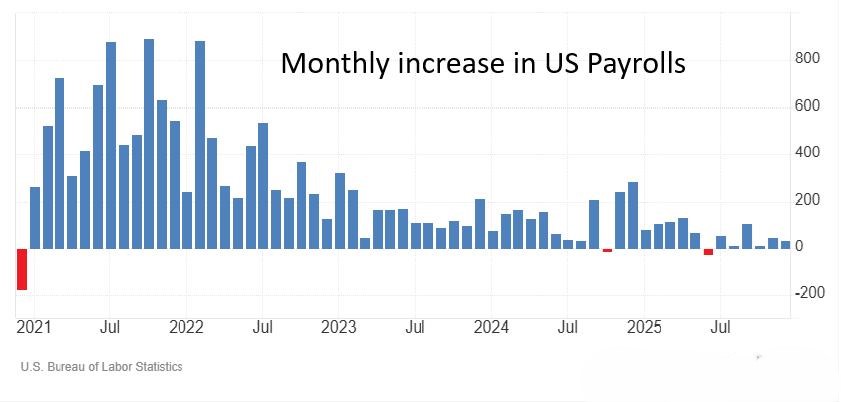

US Economic Activity

Since the war in Ukraine triggered global inflation, the US Purchasing Managers Index (a forward‑looking survey of manufacturing activity across various industries) had fallen into recession territory (below 50) and remained there for several years. In January, however, the survey rose well above 50, signalling renewed optimism about the outlook for US manufacturing. This is the first strong indication that the economic growth anticipated by the stock market is beginning to materialise. In contrast, the historical employment numbers appear to be stuck in recession territory. The challenge is that several US Government shutdowns have led to missing, distorted and likely-to-be‑revised data. Economists and central bankers, who depend heavily on reliable data, cannot trust the current figures. As a result, they are likely to remain cautious and avoid making decisions. This means interest rates are unlikely to move lower in the short term until the data becomes clearer and more reliable.

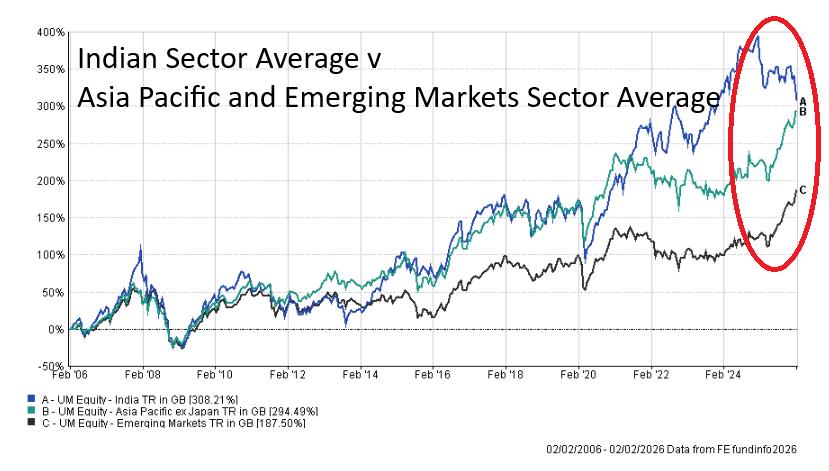

India

Five years ago, India overtook China as the fastest‑growing of the Far Eastern and Emerging Market economies. This led to steady outperformance by Indian equities. Over the past twelve months, however, there has been a period of significant underperformance, especially relative to China. The reason for this has been the lack of a trade agreement between India and the USA and the imposition of punitive tariffs due to India’s continued purchase of sanctioned Russian oil. What seemed unusual about this trade impasse was that India would be a logical ally for the USA in countering China. The Indians, however, appeared to be in no rush to reach a deal. Nevertheless, an agreement has now been concluded, under which US imports of Indian goods will be subject to an 18% tariff rather than the previous 50%. This follows new Indian trade deals with the UK and the EU. These agreements should support India’s already strong growth and help reverse the recent underperformance. The only potential challenge for Indian investments is that the large Indian IT services companies could be seen as major losers if the AI revolution develops as expected.

Markets

There are two themes dominating markets at present. Firstly, the dollar has been weak, this is both a deliberate Trump administration policy and part of the broader geopolitical “sell America” psychology. In addition, the return of inflation in Japan (finally, after decades of deflation) has caused Japanese bonds to fall and yields to rise. This has disrupted the yen/dollar carry trade and led to forced buying of gold (rather than dollars) to hedge yen exposure. The nomination of Kevin Warsh reversed this trade as the dollar rallied on the news. The dollar now appears to be trading sideways and global equity and bond markets are watching it closely; movements here will determine the direction of what have become quite “choppy” markets. The second theme remains AI. The announcement of a new AI legal service from Anthropotic hit leading software services companies such as RELX, Pearson and Walters Kluwer, a timely reminder of the disruptive power of AI. Tensions between Iran and the USA are rising again, yet oil and gas prices have barely moved despite the military buildup in the Gulf. The market assumption appears to be that the usual targeted airstrikes will occur, but little else. There is, however, a risk that events could unfold differently, forcing markets to react accordingly. January was not the blockbuster start to the year that many expected, the S&P 500 eked out a 100‑point gain. Nevertheless, despite the noise from the US President, nothing significantly changed during the month, yet economic fundamentals continued to improve.