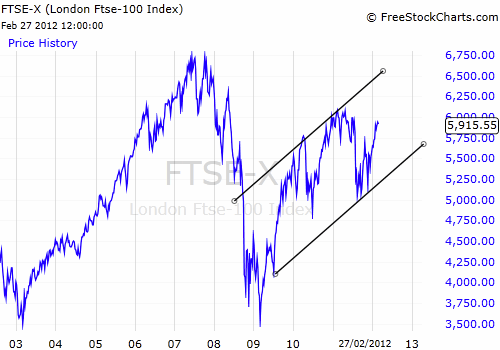

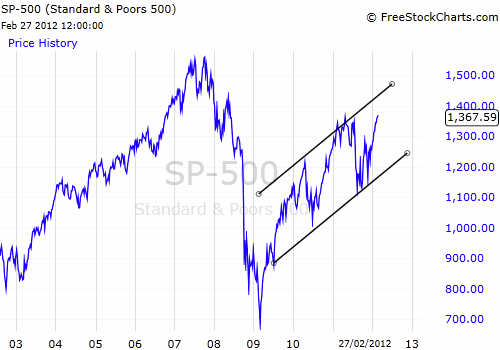

February has seen the Bull Run continue with equities led by Emerging Markets and the Far East producing healthy returns year to date. “So goes January so goes the rest of the year” appears to be working but these are still very early days. Since mid-December markets have gone up in virtually a straight line.

We must remember though that markets are volatile, it is in their nature and is necessary. This process allows new investors to get on board and for existing ones to hop off and bank their profits. This zigging and zagging is normal and healthy. What we have to resist is the temptation to bank short term gains, higher returns are only available to those that stick the course and ignore the daily gyrations that are intrinsic to investing particularly in equities.

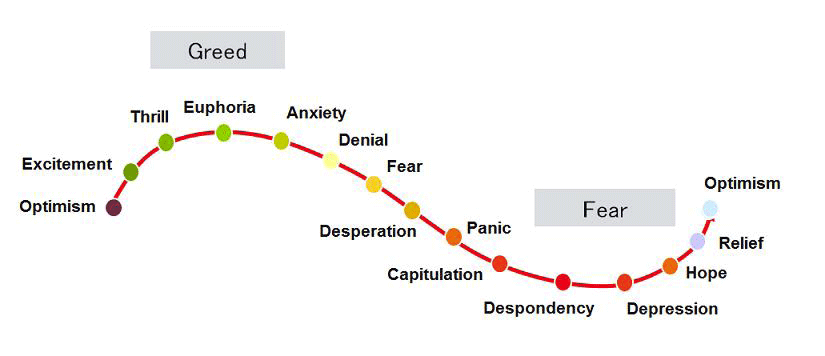

What is intriguing is that we are beginning to see a minor shift in sentiment amongst commentators with just a few positive press articles appearing. If this process continues then the fear of missing out could start to take hold?

FTSE 100 and S&P 500

Speculator or an Investor?

A speculator is someone who takes short term views on markets. They look to bank short term profits, sit in cash and wait to buy back at hopefully lower prices. An investor meanwhile accepts that markets are volatile and rides the cycles for as long as his/her time horizon allows before selling. We believe very strongly that investing not speculating is the best way to achieve the highest returns. Speculating or trading is a specific skill that requires intense monitoring of markets and the psychological ability to treat losses as an acceptable cost of doing business, just as a professional gambler would. Speculation historically was encouraged by stockbrokers who were remunerated by commission charged on both sales and purchases, more trades meant more income for them.

Statistics show that taking the long term view, reinvesting dividends and compounding returns whilst keeping costs to minimum is the way to achieve the best returns. Sometimes the markets can give us sleepless nights but as long as your portfolio matches your needs and time horizon history tells us to stick with it and not speculate, as more often than not you end up selling at the bottom and buying at the top!

The Budget

March sees the Chancellor of the Exchequer’s Budget speech. The UK economy is stagnant with consumers not spending due to falling disposable income, together with tight lending criteria from the banks leaving the critical property market equally moribund. Rising utility bills, fuel, transport costs mean for most of us we have less to spend.

The UK economy does not have a big manufacturing sector like Germany (though it is much bigger than most people think) nor does it have vast quantities of natural resources to export like Canada, Australia and Brazil. Our economy depends on the growth of existing wealth primarily through rising property prices and thus feeding into domestic consumption. We will not resume to trend levels of growth until the banks start lending and/or the amount of personal disposable income goes up.

QE is keeping the banks alive though it would appear that they are still short of capital, the news that RBS and Lloyds will use the ECB’s LTRO is a bit disconcerting but if someone is offering you cheap cash for dodgy euro denominated bonds why not take it? There is not much more HM Government can do for the banks other than a full recapitalization. Where they can help the economy is by boosting personal disposable income through tax cuts. But will they? This coalition government could in theory go on until May 2015 but probably 2014 is more likely for the next election. Is it too early for the Conservatives to declare their vote winning tax cuts? Do they start the process now in order to stimulate growth and cut again in 2013 when the national bank account should look a lot healthier?

Despite what the press say Osborne does have room for manoeuvre, the UK paid off £7.8billion of debts in January. The Budget was for the UK to borrow £127billion in the current tax year so far it has “only” borrowed £93.5billlion thus even if spending accelerates again in February and March (very unlikely) the Chancellor should have more than enough in the kitty to fund a significant increase in the Personal Allowance, but politically would it be wasted ammunition? Politics is becoming a big factor for markets with elections or leadership changes in the offing from USA, India, China, and Russia as well as across Europe. This creates uncertainty but also some degree of protection as no-one wants to rock the boat just in case it costs them their job.

Fear & Greed

Markets

Greece and Iran remain the two biggest immediate threats to the markets, we remain of the opinion though that the LTRO is far more important than Greece. It acts as a backstop for Spain and Italy and in theory Greece could leave the Euro and default but contagion should be limited. Iran remains a big unknown.

If markets continue to move higher speculators will be looking for an excuse to exit, negative news flow from either of these countries or if the good news from China and the US suddenly stops then this will be all that is needed for the short term hot money to flow out of the market. However, low valuations and strong underlying earnings growth still favour the long term investor and real institutional buyers will probably take advantage of any dip to increase their exposure to Global Equities.

February 2012

Click Here for Printable Version

cannot agree more with your views on property itnvsement vs stock itnvsement. Property itnvsement has an added problem of low liquidity (though the same goes for some stocks with low turnover). I am “stocking” up, just like you. And thanks for your sharing regarding having targets for your portfolio, I’ve just amended my retirement plan with a new sheet on buy-in targets.