We know the Global economy moves in regular cycles, from boom to bust and back again, always has, always will. Thankfully though, the booms last much longer than the busts and so stock markets make progress. With 2010 passing into history now would be a good time to assess where we are on this rollercoaster and therefore in what we should be investing, remembering cash and bonds are for busts and equities for booms.

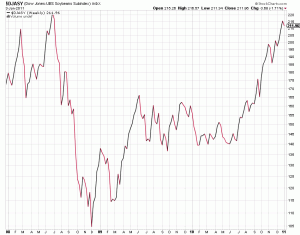

The Bear market ended in March 2009, 12 months before the economy turned, therefore in “normal” conditions we should have at least 3 to 5 years of growth before the dark clouds of recession start to appear again, so we should be reasonably safe to invest in equities for a few years yet. The recovery has been strong but also somewhat unusual; it is extremely rare for Bonds, Equities and Gold all to be going up at the same time. We have discussed in previous newsletters the reasons for this in particular QE supporting Bonds and a weak US Dollar supporting Gold. Will 2011 be the year when the “normal patterns” return and we see Bonds stagnate, Gold fall back and Equities accelerate?

What makes this difficult to predict is that Politicians are now trying to run the show instead of letting market forces and the natural laws of economics do the work. From Obama’s QE programmes, to European politicians trying to save face (and the Euro) and Chinese superpower currency posturing, more than at any time in the recent past markets will be hostage to a handful of individuals.

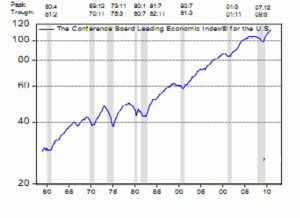

The “Normal” Cycle

It also shows the time gaps between the recessions since the 1960s quite clearly, we have seen several long periods of sustained growth generally though they have tended to fall into the 3-5 year timeframe.

On balance a positive background for Global Equities.

United Kingdom

At this stage of a normal cycle UK growth should be accelerating (never going to be particularly high in the UK it should be 3% to 4% first year out of recession) inflation should be 2% to 2.5% pointing towards Gilt yields and therefore interest rates at about 5.0%. What we have is growth at an annualised rate of 2.8% (bit low), CPI at 3.3% (bit high) and Gilt yields at 4.4% (about right). But the Base rate is at 0.5%. So looking at these numbers we are slightly behind the normal recovery trend and have a problem with inflation and Base rate is simply wrong at 0.5%. QE is supposed to be about stimulating the economy but in the UK it is more about keeping the banks alive, nobody can actually borrow at 0.5% unless of course you are a bank. Real lending rates are a minimum of 5.0% just about where they should be.

2011 will be a massive year for David Cameron he needs the economy to accelerate closer to 4.0% growth and in particular unemployment to go down. This would increase consumer confidence and also give the bankers confidence to start mortgage lending again. At the same time due to high inflation he needs to be ending QE, thus taking the banks off life support, without harming consumer demand. A set of circumstances that is fraught with obstacles. A tough year ahead for the UK economy but not for UK shares which will as always go with the US flow.

Europe

Europe is a mess and the biggest threat to the business cycle, the Euro is weak because of the issues with the PIIGS (Portugal, Ireland, Italy, Greece and Spain) but the biggest winner of all is Germany. A weak currency helps their export based economy just as the new Chinese and Indian middle classes queue up for BMWs and Mercedes. This makes their intransigent stance on bailing out the PIIGS a little hard to understand, and threats to leave the Euro are thus empty ones?

There is a fundamental structural problem with a single currency in Europe, unlike the US there is no Federal Government with a Federal fund raising process (US Treasury Bonds) just as Boston doesn’t want to bail out New York neither does Frankfurt want to bail out Madrid. Without a powerful referee like the US Federal Government with its own money forcing the issue it won’t happen.

What then will happen? There are two exit routes for this problem. Firstly, Europe moves closer to a Federal Structure with European Treasury Bonds and the Presidency and Commission having greater funding powers over say Defence etc. The alternative is that it moves further apart. The PIIGS drop out of the Euro (there are many EEC countries outside the Euro, Sweden for example.) Leaving a smaller, but much stronger core, this would bring back memories of Norman Lamont and UK’s exit from the ERM. This was painful in the short term but ultimately very good for the UK markets. Will this happen? Who knows it would mean trying to predict a politician which is a very dangerous game. It looks like very unpredictable period is ahead for Europe. But possibly a major ERM style opportunity if a split does occur.

Emerging Markets

The growth engine of the Global economy shows no sign of slowing down. The two key players amongst many are India and China. Both have large educated populations and a wealthy growing middle class. There are though subtle differences between the two new superpowers. China has concentrated on simply making cheap things for the west, whether it’s iPhones for Apple or clothes for Primark, China has used its low cost base and fixed currency to grow dramatically but ultimately is reliant on the Old World consumer.

India is further behind with its industrial revolution but started by being service led, not just the dreaded call centres but professional services such as IT and Accounting which are business not consumer dependent. However, Indian companies such as Tata are playing a cleverer game they are acquiring strong western brands such as Jaguar and Tetley Tea and combining our skills with a low cost base to create a new proposition. This could be a key theme for this year, more Indian takeovers and maybe the Chinese doing the same, buying established western brands rather than building them. SAIC of China has just bought a stake in GM.

The key threat to both these markets is inflation. The traditional policy response is to put up interest rates and both China and India are currently increasing them. The problem is that inflation in both these countries is dominated by food costs, costs which are dependent on the weather as much as the economy, so inflation may continue to rise regardless of the actions of central banks.

As we have written about before the Chinese have to manage an increase in the value of their currency (against their wishes) at the same time as moving their economy to being reliant on the Chinese consumer rather than the American. A tricky task, but one where progress is being made and it is a brave person to bet against their ultimate success.

Gold

With Global inflation higher than interest rates the only “real return” available according to investment theory is Gold. This coupled with a weak US Dollar (a deliberate US policy) plus the “carry traders” hedging their currency risk through selling Dollars and buying Gold has created a perfect storm for Gold. Until any of these variables change this should continue. What would cause them to change? Rising US interest rates would trigger the end of the “carry trade”, it would also by default strengthen the Dollar as the profit takers would bank their gains and sell Gold. QE2 and Chinese selling of US Treasuries (as a fit of pique against the US) has seen market rates of interest start to rise, so far this has not impacted on Gold but accelerating US growth and falling US unemployment will be the key to its future direction.

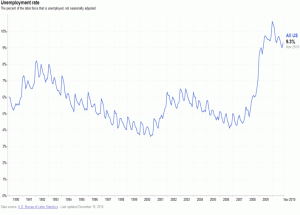

US Unemployment

High unemployment stops the US consumer from spending and also from buying houses; a full economic recovery cannot take place whilst the US consumer is in fear for his/her job and also their home.

QE1 and QE2 were supposed to bring this rate down too early yet to tell if it is working.

This is the key for 2011. If US unemployment does not come down then interest rates will remain lower for longer, talk will start of the US being the next Japan, with no growth QE3 would be needed. The Deflationists would come back out of the woodwork, and the strategy would be to buy Bonds and sell equities. This would however be at odds with the normal cycle and so is the outside bet.

Food

Food is turning out to be critical in the Investment world. Global growth depends on China and India and just as happened during our industrial revolution the population moved to work in the new factories in the cities. This increases demand for food and also types of food. The new Chinese middle classes want the beef that their parents couldn’t afford, bread rather than rice and more of it. Food has now gone beyond being a subsistence item in the emerging markets it is as much an aspirational consumer product as an iPhone or a BMW.

However, food is the major component of Indian and Chinese shopping baskets and therefore the inflation calculation. Food commodity prices are highly volatile as unlike oil or coal they are dependent upon the weather. In India the Monsoon is critical, the Australian wheat harvest has just been washed out and in the US the use of corn for alternative fuels has distorted the market.

China is buying land in Africa to feed its population, Brazil is a major exporter of food (not just coffee) and Canada and Australia are well placed to benefit. A bumper harvest is now a very significant market event as it will be good for global inflation and thus global growth.

Much will depend on the weather as to whether such rises are sustainable. It does seem strange that the EU is taking land out of agricultural production just as demand is rocketing.

Regulators are very aware that food is a political issue. In 2008 soft commodities became very fashionable as an “alternative asset class” and Hedge Funds were major buyers. US regulators became concerned that US traders were making money in a way which could lead possibly lead to starvation elsewhere in the world. Margin rates and rules were quickly updated to prevent international political fallout.

Cyber Terrorism

This is beginning to be a concern for the markets. Recently Wikileaks supporters managed to disrupt the websites of a range of companies including Amazon and Visa after they withdrew the ability of make a donation to Julian Assange fighting fund. Whilst Cyber-terrorism undoubtedly goes on it is below the radar and up until now has not been on the global stock market’s agenda. Governments are now getting wise as are major international companies. But 2011 could be the year when such attacks become commonplace and thus potentially have the ability to move the market. There is nothing we can do other than trust the various boffins to put in place measures to protect what is now an international finance system that is wholly reliant on telecommunications and the Internet to function effectively.

Investment Strategy

Essentially whilst there will be obstacles to the Bull market the cycle appears intact and we should manage money accordingly. Investment Strategy is essentially the allocation between Cash, Bonds and Equities; clearly equities are the place to be for now. However there is enough doubt around about the US economy that retaining an exposure to Bonds is both sensible and prudent, and will remain so until unemployment starts to fall. Markets do though anticipate such moves and the action post QE3 and with Chinese selling of US Treasury Bonds this maybe already starting to happen. It will be a tricky balancing act this year, particularly if the UK decouples from the US and remains moribund as the US grows.

Markets are unpredictable but the trade this year could be to take gains in Bond Funds and depending on risk profile a move to Absolute Return or Global Equities could be on the agenda. However, experience suggests that an investment year rarely pans out as expected and as such we will continue to monitor markets and act accordingly.

December 2010

This information is not intended to be personal financial advice and is for general information only.