There were times during 2012 when, if the media were to be believed, the investment world was about to end, but just like the Mayan calendar the doomsters were yet again proved wrong as equity markets delivered well above average gains.

We know the media is intrinsically pessimistic and there have been enough political crises in both Europe and the USA in 2012 to keep them busy but as long term investors we have to try and ignore all of this noise and look through to the key issues that actually impact on company profits.

In 2012 the reality was that this was a good year for businesses, particularly those that don’t rely on the consumer or on any single economy. The multi-national corporation cared little about Greek or Spanish government debt levels, it would however have been a bit twitchy about the US “Fiscal Cliff” negotiations, but as we said last month Obama played “hardball” and won.

So we start 2013 with some good news, undoubtedly there will be plenty more political crises to overcome this year but the key issues that drove the markets in 2012 haven’t changed either.

The Cycle

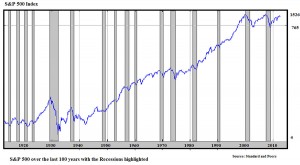

What we can see is that over the past 100 years despite World Wars, Depressions etc. it has gone up in roughly a straight line, and as long as the underlying companies continue to grow will continue to do so.

The grey bars represent recessions, and as the economy retracts so do company share prices. There are lots of wobbles along the way but as an investor the most expensive ones are when recessions happen. The good thing that this chart shows is that recessions don’t come along very often and when they do don’t last very long.

Doesn’t feel like this is the case when we are in one but that is what the facts tell us. We have talked before of a five year cycle that favours equities, it can be distorted but this one started in March 2009 so in theory there is still plenty of time left for equities to deliver further growth.

The key is that the central banks such as the Bank of England, Federal Reserve Bank, and ECB all remain accommodative i.e. keeping interest rates low and providing some form of Quantative Easing. When this changes we will need to be aware that the cycle might turn.

Good news for 2013 is there is no sign of that happening any time soon.

Gilts

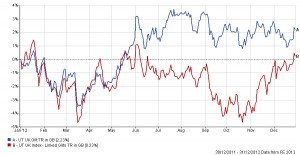

2012 saw Gilts again producing positive returns (just). As European debt was mired by political impasses, UK Government Debt was regarded as a safe haven. Furthermore, the Quantative Easing process has created an artificial buyer which keeps prices high.

This means that fundamentally Gilts are overvalued, but are still producing returns slightly higher than cash, though crucially less than the rate of inflation. It is just possible that the UK has entered a cycle of “Japan style” long term low growth in which case Gilts would simply stay roughly where they are, the probability of this happening however is low.

The UK remains financially in a mess, though under the surface there are some signs of improvement. Banks are starting to lend again and the number of new mortgages available has risen “significantly” according to the Bank of England.

The Funding for Lending Scheme seems to be having the desired effect. The housing market is the key to the UK economy and needs to be rising for the consumer to feel wealthy enough to spend again. This can’t happen without mortgages being available to all.

If the current trend continues there may be a silver lining to austerity after all. If there is, then QE ends, up go interest rates and down go Gilt prices.

Gilts and Index Linked Gilts

Corporate, International and High Yield Bonds

Bonds

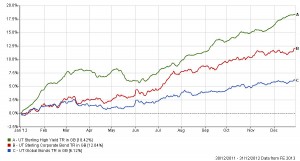

This sector covers a wide range of assets including overseas government debt and corporate bonds. Generally speaking bonds did very well in 2012 with defensive International sovereign bonds producing returns much higher than Gilts.

Corporate bonds (issued by companies rather than governments) did very well mirroring equities. Large multinational businesses are flush with cash and are perceived to be safer than many countries.

The more volatile High Yield Bond sector now includes much bank debt as well as lower rated industrial businesses. When the ECB introduced its LTRO programme, Bank debt rallied as the fear of European Credit Crunch dissipated.

This sector, which is not without risk, thus produced a stellar performance. As the cycle progresses Bonds will gradually move out of favour and we shouldn’t expect these sorts of returns to continue.

There are though some positive themes, as high yielding Far East and Emerging market sovereign and corporate bonds join the mainstream. For example, Indonesia will shortly overtake the UK as an economic power yet is not mired in debt and is growing faster, why should their bonds be rated below that of the UK?

Equities

UK Equities and Global Equities

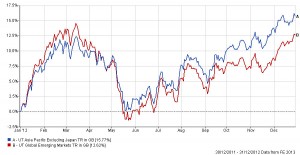

Far East and Emerging Market Equities

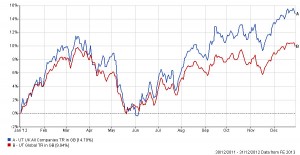

Equity markets produced well above average performances. This was despite a difficult period between March and May when the Euro debt crisis was in full flow.

Over the year the best performance came from the Far East and Emerging markets at up c 14% with the UK not far behind. In a way this shouldn’t be surprising with the heavy weighting of mining companies in the FTSE 100 index. However, if we drill down further it was the FTSE Mid cap index that has distorted the numbers. The big Blue Chips were up by only 6% whereas the medium sized companies were up by 24%.

The big global multinationals did better than the big UK companies. Whilst the numbers from the Emerging Markets and Far East are better than the old world the actual pattern of performance is yet again very similar. The equity investment world is gradually moving towards a single global market.

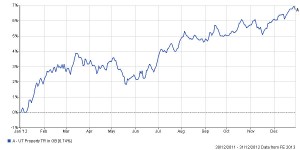

Property/Absolute Return

Property

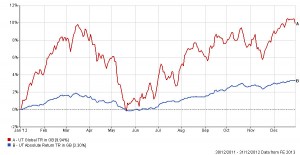

Absolute Return compared to Global Equities

Property continues to grind slowly upward. The market as a whole is seeing valuations rise but this is still from surveyor’s valuations rather than actual deal prices. London “trophy” properties continue to see cash investment from the super- rich moving money to a perceived safe haven. Elsewhere in the UK, commercial property market with the banks still not lending, activity is therefore limited.

The small but evolving Absolute Return sector did okay. There are a wide range of strategies used here and the sector numbers are not that representative.

Those funds that can “short” the market struggled whilst those that invest in currencies and commodities (Macro Funds) did well. These are all vehicles designed to diversify away risk within a balanced portfolio, the fact that in an excellent year for equities they still produced positive returns is actually good news.

What’s in your portfolio?

One of the key aspects of our portfolios at SRS is that we use unit trusts in order to diversify, i.e. spread the risk, as much as possible. This way, if an individual stock has a major crisis, e.g. Royal Bank of Scotland, then it has a minimal impact on your wealth.

It is often easy to forget that we are not actually investing in the unit trusts but in the underlying companies themselves. Within each SRS portfolio a client has an exposure to many hundreds of individual equities/bonds/hedge funds/currencies/commodities and properties.

The following table gives an example of some of the larger multinational equity holdings that are within the unit trusts that we use.

UK Equity Holdings

ANGLO AMERICAN

ASTRAZENECA

BG GROUP

BHP BILLITON

BP

CARNIVAL

CENTRICA

DAILY MAIL

GLAXOSMITHKLINE

HSBC HOLDINGS

LEGAL & GENERAL GROUP

PRUDENTIAL

RESTAURANT GROUP

RIO TINTO

ROLLS-ROYCE

ROYAL DUTCH SHELL

SPRAX-SARCO ENGINEERING

UNILEVER

VODAFONE GROUP

WHITBREAD

Overseas Equity Holdings

AMAZON

ANHEUSER-BUSCH INBEV

APPLE

AT&T

CHEVRON

EBAY

EXXON MOBILE

GENERAL ELECTRIC

GOOGLE

IBM

JOHNSON & JOHNSON

MASTERCARD

MICROSOFT

NESTLE

NOVARTIS

PROCTER & GAMBLE

ROCHE

SANOFI

SVENSKA HANDELSBANKEN

TOTAL

Far East / Emerging Equity Holdings

AMERICA MOVIL

AUSTRALIA & NEW ZEALAND BANKING

CHINA MOBILE

CNOOC

HON HAI PRECISION INDUSTRY

HUTCHISON WHAMPOA

HYUNDAI MOTOR CO

INDUSTRIAL & COMMERCIAL BK CHINA

ITAU UNIBANCO

NATIONAL AUSTRALIA BANK

OVERSEA-CHINESE BANKING CORP

PETROLEO BRASILEIRO SA PETROBRAS

QBE INSURANCE

SAMSUNG ELECTRONICS

SBERBANK OF RUSSIA

SINGAPORE TECH ENGINEERING

TAIWAN SEMICONDUCTOR

TATA MOTORS

VALE

Investment Strategy

So what are we looking for in 2013? The biggest risk to further progress in the equity markets is a slowdown in corporate earnings. The last set of quarterly numbers showed that the rate of growth was slowing and the results generally disappointed the markets.

This was a reflection of two sets of global circumstances. The first being sluggish growth in the USA, caused primarily by lack of consumer spending which in turn was due to high unemployment and fear or mortgage foreclosure. Secondly, China, India and Brazil had all tightened monetary policy in order to choke off rising inflation.

2013 begins with China, India and Brazil reversing this strategy and all are now stimulating growth again. Furthermore, in the USA we have QE3, this is targeted specifically at the housing market and thus getting the consumer spending again.

So the basis for continued growth is still positive but we may have a timing issue. This is because the first or even second quarter set of profits will not see much, if any, benefit from these measures.

So we must be prepared for what could look like a slowdown in growth which should be transitory. Markets should be able to look through this but sometimes they simply don’t want to!

Equity valuations remain cheap, central banks accommodative and yet there is still plenty of pessimism around which perversely is positive for the stock markets.

We still have Spain, Italy and Greece to deal with and the US Fiscal Cliff crisis will have a sequel in a few months’ time. All this means that the usual volatility will remain, but given that the cycle should stay in our favour we should sit tight, as the returns of 2012 show the rewards are worth having.

December 2012

Click Here for Printable Version